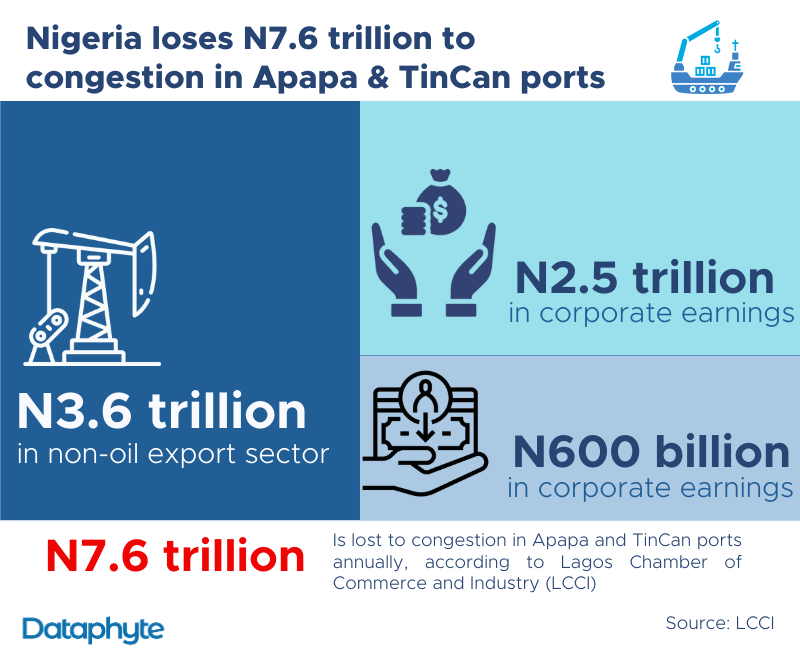

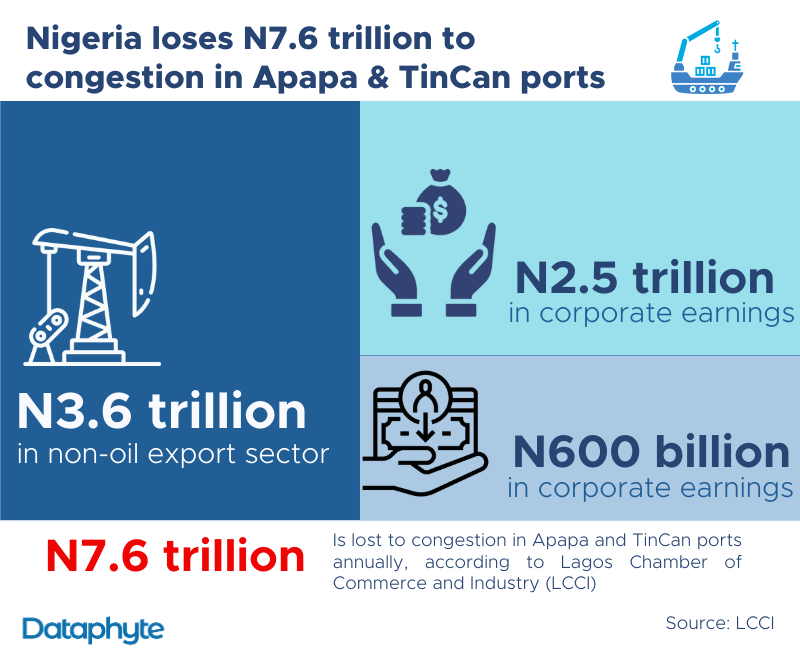

Nigeria loses N7.6 trillion annually to congestions in Apapa and TinCan ports in Lagos, according to a recent report by the Lagos Chamber of Commerce and Industry (LCCI).

By way of breakdown, Africa’s most populous nation loses N600 billion in customs revenue, $10 billion (N3.6trn) in the non-oil export sector, and N2.5 trillion in corporate earnings across various sectors annually due to the state of Nigerian ports, said the report.

This is one major problem confronting Nigeria’s President-Elect, Chief Bola Tinubu, who must find a practicable solution to this challenge and save the country from such humongous losses.

The two ports handle about 70 percent of the country’s international trade, but they face logistic and administrative bottlenecks.

Apapa and TinCan ports activities in Lagos account for the country’s second-largest source of revenue.

Apapa Quays, Nigeria’s first port, established in 1923, has been and remains the country’s main seaport. Due to its increasing activities, an extension in sort of new port was established seven kilometers northwest of Apapa Quays. The TinCan Port is the second largest after Apapa Quays.

Built to accommodate a maximum of 1,500 trucks daily, Apapa Quays and TinCan are currently over-congested with a daily truckload of 5,000 trucks, more than three times its capacity. This makes it difficult for trucks to clear their goods for import and exxport on time, leading to loss of time and perishable goods.

For instance, a report noted that 25 percent of cashew exported in 2017 went bad due to delays. Only 10 percent of cargoes are cleared within the 48 hours stipulated time frame, resulting in about 90 percent being delayed to five to twenty days.

Access to Apapa Quays and TinCan Port has remained through the road. The one mode of transportation has made it difficult to access the ports efficiently.

Insufficient scanners

Africa’s largest economy has just two scanners to cater for thousands of containers daily. According to the Nigeria Customs Service, the scanners, purchased at $120 million in 2022, could handle only 400 containers daily. Chief Executive Officer of LWL Concept, Mr Lawal Wasiu, told The Punch that there was a need to install more scanners in the country’s seaports and border stations to drive cargo clearance and reduce gridlocks at the ports.

There are more than 1,000 containers inspected daily, according to clearing agents, but most of the inspections are done manually, increasing the level of gridlocks and loss of man-hours there.

Where is the N20bn revenue?

Apapa alone is said to generate N20 billion daily for the Nigeria Customs Service (NCS), the Nigerian Ports Authority, and other regulators, according to a report. The revenues come from tariffs paid on imported goods, raw materials, and petrol. However, the government has failed to link rails being constructed to the ports, thereby increasing pressure on the roads and diminishing the economic importance of Apapa. Most of the businesses in Apapa have relocated, with the latest being a national newspaper, BusinessDay, which moved from Point Road in Apapa to Lagos Island.

Most of the properties in Apapa have lost significant values, with several of the buildings put up for sale. A report said property value fell by 30 percent in 2019 due to the gridlock. This is a major challenge Tinubu will contend with as significant revenue comes from seaports.

Other seaports

Importers have argued that there is a need to develop and rehabilitate eastern seaports to decongest Lagos ports. The LCCI report said that the Federal Government should improve the security situation along and within the Warri port in order to ward off militants and touts, urging the authorities to approve and publicise a bouquet of incentives to importers and exports patronising ports outside Lagos.

Many importers are worried that more attention is focused on Lagos ports and less on other ports across the country. However, the Nigerian Port Authority’s Managing Director, Mr. Mohammed Bello-Koko, said in 2022 that it was not deliberate.

In his August 2022 interview at a stakeholders’ fora in Port Harcourt, Rivers State, Bello-Koko said, “We are interested in decongesting the Lagos ports. If we have two deep sea ports in the East, it will help the decongestion initiative and change the narrative. So, the Federal Government is interested in seeing the eastern ports’ work. However, the consignee or shipper decides where he or she receives the cargo. It is not a function of NPA or a policy by the government.

“The Calabar port has the longest channel, with over 108 kilometers from the fairway buoy to the port; Rivers port is over 69 kilometers, so the cost of dredging those channels is expensive, but we are dredging them. Some of the ports are very old. Rivers Port is over one hundred years old, and the engineering designs used in constructing some of them are obsolete. The Warri Port breakwaters have problems, and the siltation is high, and it also has security problems because of the length of the channel.”

However, the problem is not insourmountable.

Corruption reigns

Corruption is also fingered as a major problem facing Tinubu at the ports. Several stakeholders in Apapa particularly accuse security agencies, especially the police, of collecting bribes to distort the call-up system.

A report by BusinessDay in 2020 cited a process known as “fast-track,” where truck drivers paying N250,000 and N350,000 as bribes entered the ports before others in the queue.

An exporter to the United States via Apapa, Mr Jon Tudy Kachikwu, said he incurred losses at Apapa due to corruption and delays at Apapa ports.

Togo, Benin ports eating Nigeria’s lunch

One major challenge facing Tinubu is how to stop the diversion of Nigeria-bound containers to Togo, Benin and other neighbouring countries. Nigerian containers are diverted to other countries due to issues such as manual inspections, shallow port draft, congestion and other problems. Importers also claim that charges on Nigeria’s seaports are high, prompting them to seel alternatives. Hence the incoming administration has a role to play in ensuring that these countries do not continue to eat Nigeria’s lunch.

Experts speak

Development economist and lecturer at Benue State University, Dr Princewill Okwoche, said that a country that was serious about development would not rely on a single mode of transport. He said with Lagos ports catering to most of the country’s imports and exports, multiple access routes would lead to efficiency.

“Most leading countries with heavy port activities have rail networks that link to the ports. This eases the pressure of relying on the road and leads to efficiency. If a rail system connects to the ports in Lagos, revenue losses will be averted,” he said.

A private sector institutions strategic analyst and investment banker, Mr Robert Anande, said the permanent solution would be the decongestion of the port by opening up full activities in other ports.

“Lagos port has been congested for over 50 years, and the idea behind the Calabar, Warri and other ports is to decongest the Lagos ports. But the government has been playing lip service to the idea,” he noted.

He said Tin Can was an inland port, and other inland ports were identified with the purpose of decongesting the Lagos port. Citing an instance, he said dredging the River Benue and creating an inland port in Makurdi would divert some vessels to the port that would handle about 2000 trucks daily. This would bring the goods closer to the north and save the country billions annually, he further said.

He concluded that it was still a mystery to him why the Nigerian Ports Authority (NPA) chose to maintain activities at the Lagos ports despite its challenges, stressing that inland ports in Makurdi, Calabar, and Warri could clear vessels in 48 hours, boost economic activities in these areas and create employment opportunities for the people.