For weeks (in some places for months), there has been a scarcity of petrol across the country. The scarcity has heralded long queues at filling stations, and many stations are selling at prices that are way higher than the official pump price per litre. In many parts of the country, petrol is sold for as high as N250 per litre as opposed to the official rate of N165.

This report looks at why the scarcity has lingered despite promises of increased supply by the government.

Moribund Refineries

Nigeria imports refined petroleum products due to moribund refineries. This leaves the country that consumes 465,000 barrels of petroleum daily at the mercy of international market forces.

All the country’s refineries are broken down thus it cannot refine crude locally and completely relies on the importation for its supply of refined products such as petrol and diesel.

Between January and July 2022, Nigeria spent a sum of N54 billion on refinery rehabilitation; the country also announced that it would spend another sum of N100 billion in 2021.

In March 2021, the federal executive council approved $1.5 billion for the Port Harcourt refinery upgrade. In August of the same year, $1.48 billion was approved for Warri, and Kaduna refineries upgrade.

In March 2021, a dollar averaged N378, meaning the sum agreed for the Port Harcourt refinery equalled N567 billion. In August, at an average dollar rate of N411, the amount approved for Warri and Kaduna refineries equated to N608.28 billion.

Despite these investments, Nigeria’s refineries have remained non-functional, making refined petroleum costlier and leaving a burden of petroleum availability on the country.

Growth in Global Crude Oil Price above Government’s Projection for Subsidy Payment

The government introduced a subsidy scheme in the 1970s to put petroleum prices per litre at an official rate; the PPPRA Act of 2003 also empowers the regulation of petroleum prices in the country.

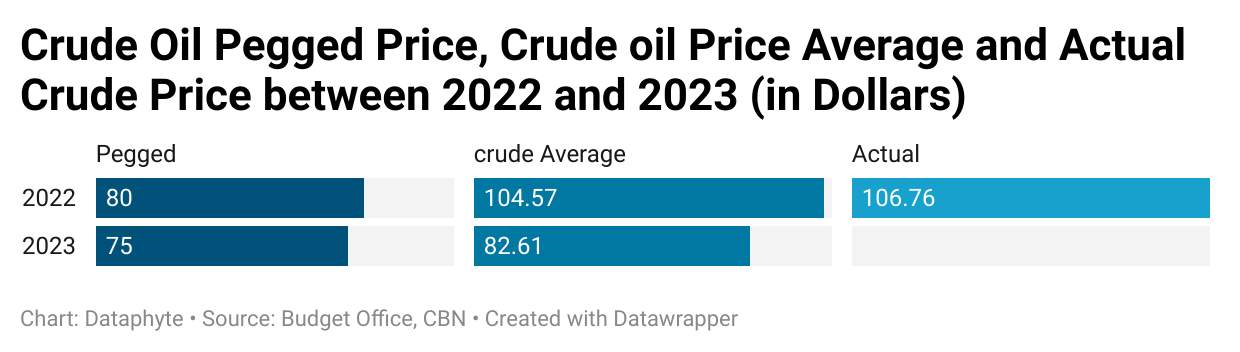

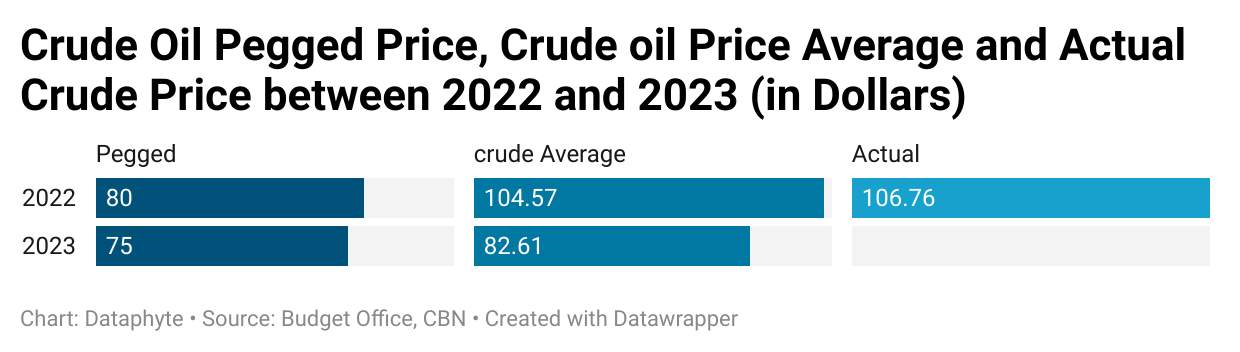

When the country’s finance Minister, Zainab Ahmed, tried to justify the N3 trillion subsidy bill pushed forward for 2022, she noted that crude oil price as of then was pegged at $80 per litre; thus, the need for an N3 trillion subsidy bill.

The subsidy is paid from the revenue made by NNPC Limited and recorded as under-recovery.

A check on the daily official crude oil prices published by the Central Bank of Nigeria shows that in 2022, crude oil prices averaged $104.57 per litre, going above the country’s projection of $80 per litre for subsidy payment. This is a 30.7% increase from the earlier projected figure, meaning that the country will need more money for the fuel subsidy if it meets its obligations on subsidy payments.

The Budget performance document for 2022 published by the Ministry of Budget and National Planning shows that the actual crude oil price per litre stood at $106.76.

The 2023 approved budget also pegs Crude Oil price at $75 per litre.

The average price per barrel of crude oii as at the time of filing this report stands at $82.615, meaning that the country needs more money than it budgeted for subsidy payment, considering the difference between the pegged amount ($75) and the actual average crude oil price ($82.615).

Dollar-to-Naira Exchange Rate Volatility Increasing Subsidy Bill

Another factor that increases the landing cost of refined petroleum and the subsidy bill is the dollar-to-naira exchange rate.

In 2022, the exchange rate used by the government to set its expenditure, including subsidy payments, was N410.15 to one dollar; however, the actual average exchange rate at the end of the year stood at N444.08 to a dollar, representing an 8.27% increase over initial projections.

The increase in the price of crude oil and the increase in the dollar value against the naira means that the country needs more money to subsidise Premium Motor Spirit (PMS) beyond what it planned.

NNPC Limited Financial Statement Concern

While the financial statements of NNPC limited for 2022 have yet to be fully published, ideally, the company should make enough money, more than the subsidy figure for a year, to cover the subsidy cost adequately. In simpler terms, if the subsidy expenditure for 2022 is N10, NNPC limited should make more than N10 as revenue to cover its running costs and subsidy, which is recorded as under-recovery in its books.

A review of the January to July NNPC limited FAAC reports, however, offers little hope. In the seven-month period of January to July, NNPC limited posted gross revenue of N2.836 trillion (gross revenue is the money made by an organisation before the deduction of expenses); the company, however, used 72% of its gross revenue to cover subsidy (under-recovery).

This means that it made no profit after other deductions, which may question the ability of NNPC limited to sustain subsidy payments bearing in its own operational cost and may explain financial issues that come with subsidy payment.

Put simply, the higher the crude oil price and dollar-to-naira rate, the higher the landing cost of refined petroleum per litre. The country subsidises the price of petrol to cushion the impact of such landing costs and to ensure that every Nigerian pays a uniform amount for a litre of petrol.

These factors on subsidy bills and dollar-to-naira variations play a massive role in Nigeria’s ability to sell petroleum at an official rate and the ability of the government to meet its obligation to petroleum marketers.

Already, the Major Oil Marketers Association of Nigeria has been quoted as stating that “The major cause is the shortage and high (US Dollar) costs of daughter’s vessels for ferrying product from mother vessels to depots along the coast,” MOMAN said.

The marketers said the fuel queues are caused by exceptionally high demand and bottlenecks in the fuel distribution chain.