Every month, there is an increase in the price of every item you purchased the previous month. The reason for this is not far-fetched — unabating inflation.

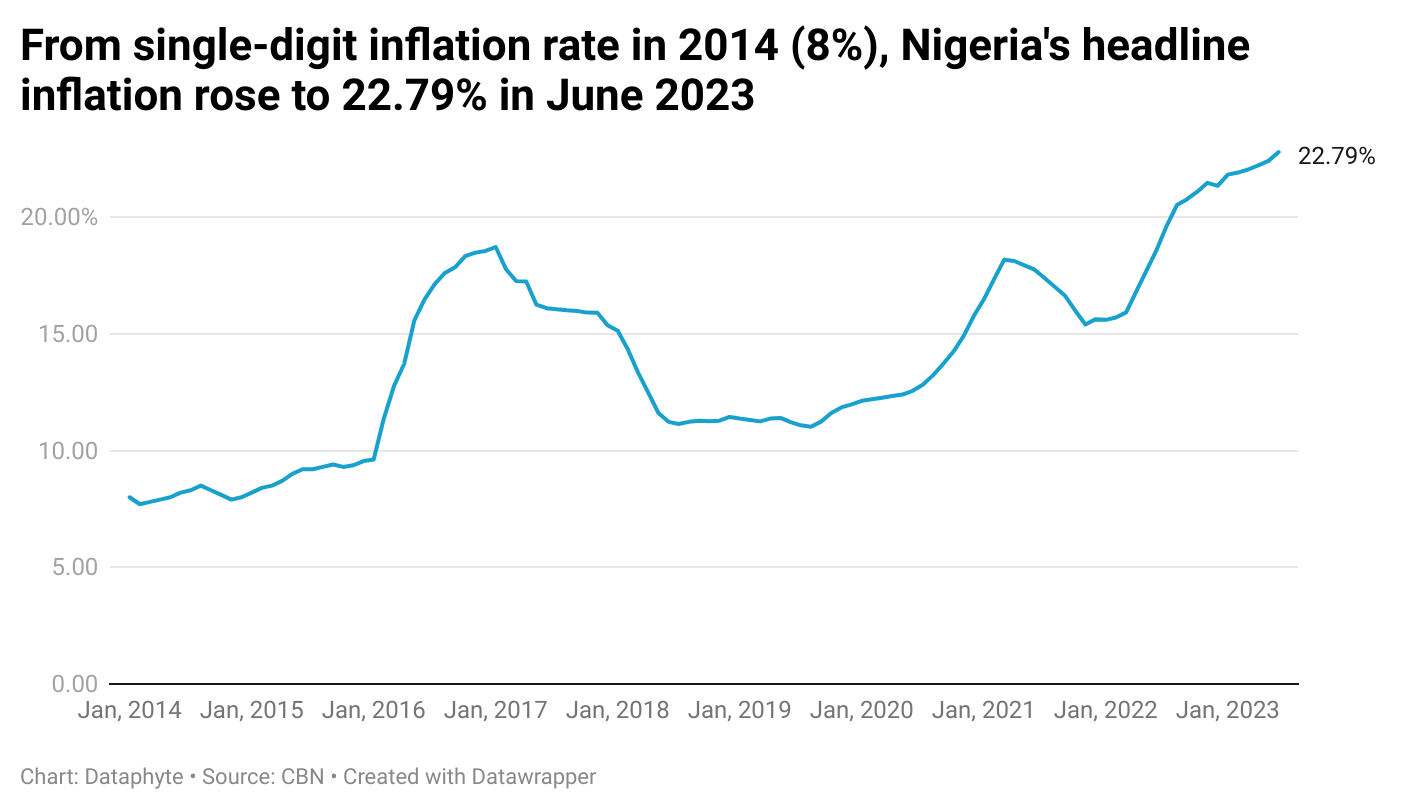

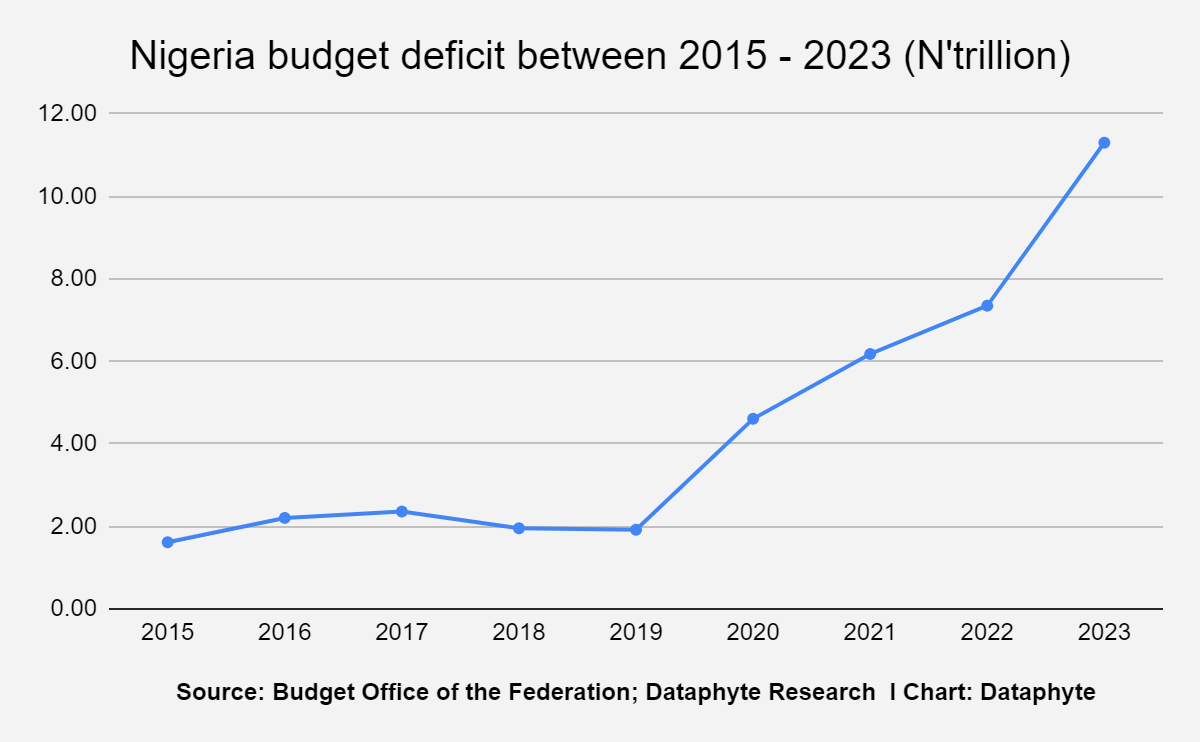

According to the data from the National Bureau of Statistics (NBS), Nigeria’s headline inflation rate climbed to 22.79% in June, the 6th consecutive rise this year.

.png)

That is, since 2023 started, there has been a consistent rise in the inflation rate, driving up the cost of goods and services month on month. The increase did not start this year. Nigeria’s inflation rate has been on the rise for a long time now.

In particular, since 2017, there has been a rise in the country’s headline inflation which has become worse in recent times.

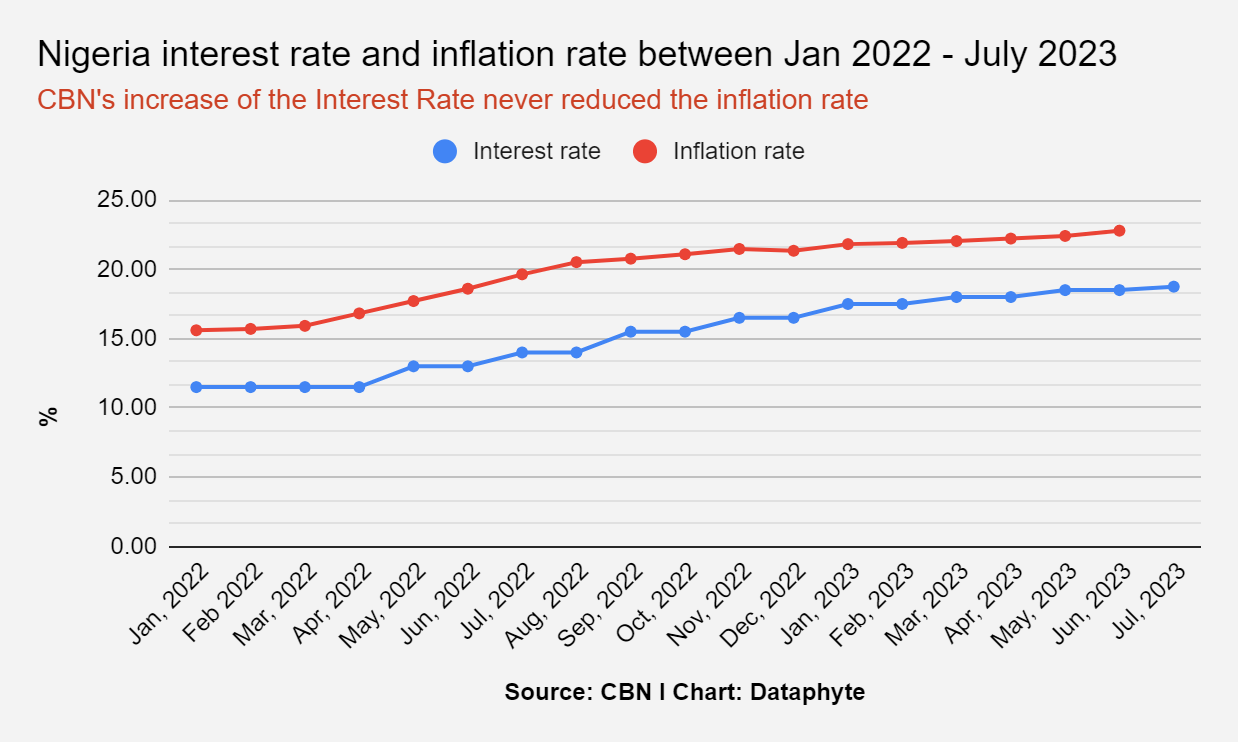

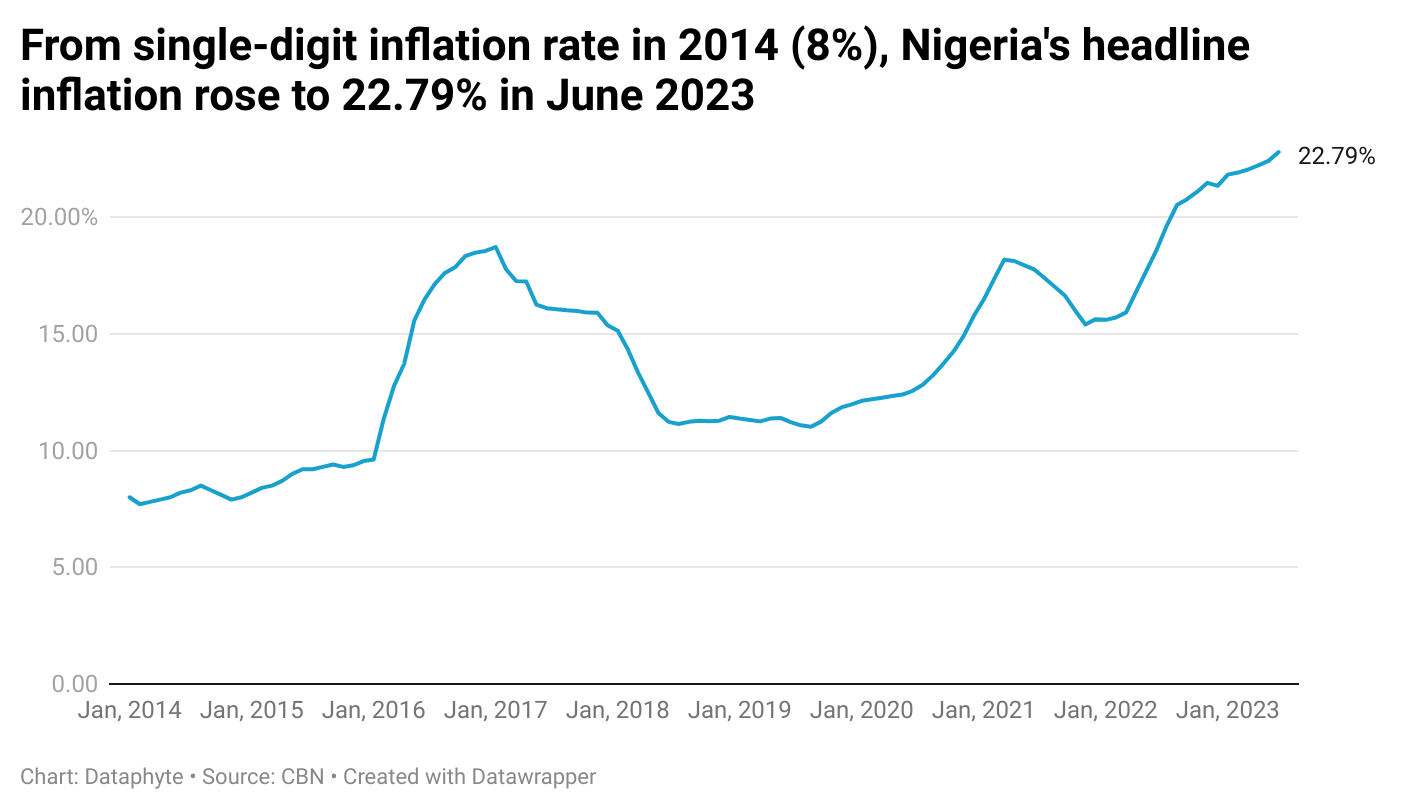

So far, one key measure the Central Bank of Nigeria (CBN) has adopted in addressing the inflation challenge in Nigeria is by raising its interest rate/Monetary Policy Rate (MPR).

MPR is a monetary tool used by Central Banks in different countries to manage the flow of money to address inflation.

It refers to the rate at which the CBN lends money to commercial banks or other financial institutions.

The idea behind this is that by increasing the benchmark interest rates, borrowing becomes more expensive, which, in turn, discourages consumer spending. This also reduces money supply, thus, curbing inflationary pressures.

This has been one of the policy stances of the CBN in taming inflation in Nigeria.

However, it has not yielded the intended result as inflation has continued to soar high.

Inflation never abated anytime the CBN increased its MPR. This reaffirms the view of economic experts that the CBN interest rate increase approach is ineffective in tackling the current inflation, which has pushed millions of Nigerians into poverty.

What else works?

To control the current spiralling inflation rate, the government cannot limit itself to demand-side tweaks. A typical example of the demand-side approach to tackling inflations, like reducing demand for credits through increased price of money (interest rate), has not worked.

The government may then combine supply-side adjustments with the CBN’s demand-side adjustments (increasing the monetary policy rate). Yet, there is still need for caution as the supply-side tweaks are not without side effects, just like the demand-side.

On the supply side, the approach is to tackle supply-side scarcities which drive up prices. One of the key drivers of inflation in Nigeria is supply chain disruptions. This include disruptions in the supply of raw materials for manufacturing and in the supply of food to consumers.

As noted in a report by BusinessDay, the food chain in Nigeria involves farming, transportation, processing, and retailing. Sadly, due to security challenges and poor infrastructure (roads, rails, etc.), the food chain supply is now disrupted. While insecurity on its part, especially in the different zones in the Northern region, has continued to threaten farmers, thus, obstructing farming activities and deterring agricultural investments in major crop-growing states, poor infrastructure, such as bad roads, makes the transportation of food items from producers to retailers, then consumers difficult.

The report further noted that, as a result of the poor road network in Nigeria, transportation of food items from where they are produced to retailers takes a long time. In some cases, these food items become bad before they get to the buyers. This is exacerbated by a lack of modern facilities to preserve these items. Thus, driving up the prices of available wholesome food.

In addition, the Russia-Ukraine war contributes to this. Both countries contribute over 25% of total global wheat exports, on which many least-developed countries, including Nigeria, rely. Both countries are also major exporters of edible oil. As a result of the war, there has been a disruption in the supply of these commodities, therefore, causing inflation even globally.

The government then needs to address the security challenges and fix its infrastructure to enable farmers to return to the farm fully and also transport their goods to buyers easily. This appears as a long-term plan.

In the short term, allowing food import may be an approach to consider. Aja Kalu, a financial analyst, shares this view.

While allowing import of essential commodities may temporarily increase food supply and help stabilize prices, it has its side effects too.

Heavy reliance on food imports could discourage domestic farmers and producers. This leads to reduced investments in the agriculture sector and negatively impacts rural livelihoods. This, erodes the gains that have been made in this regard in the country.

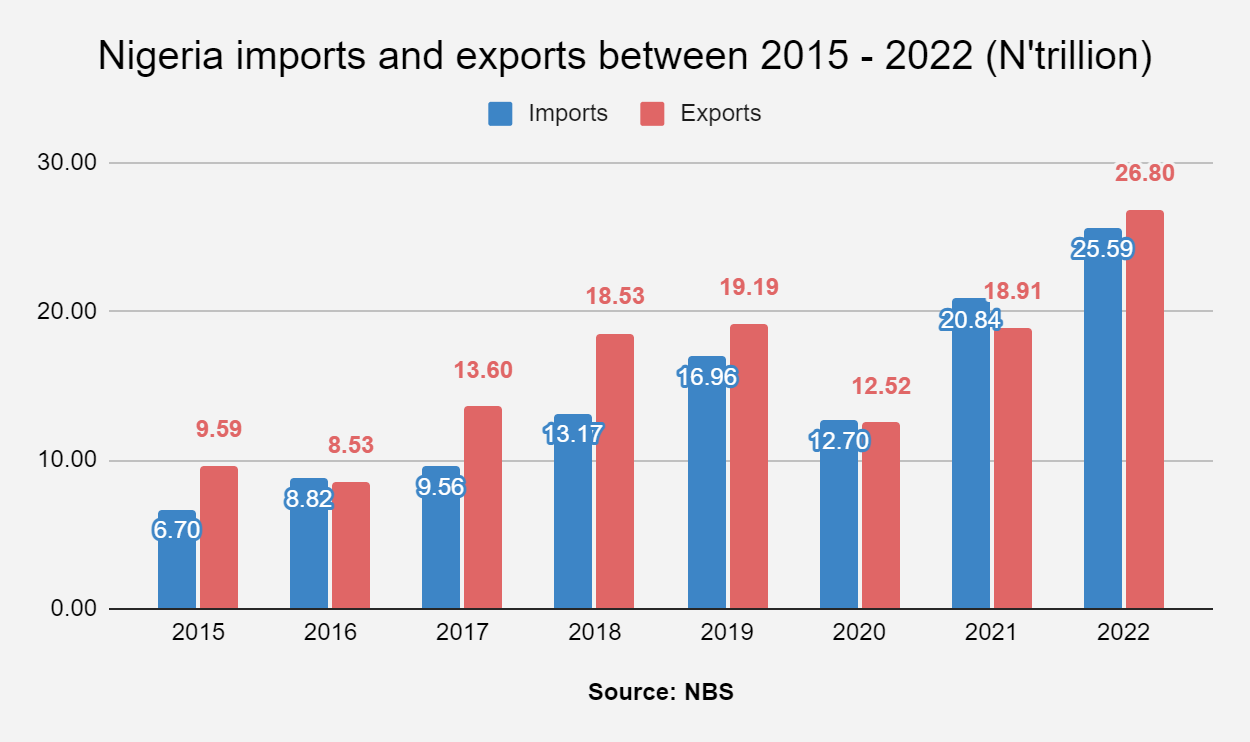

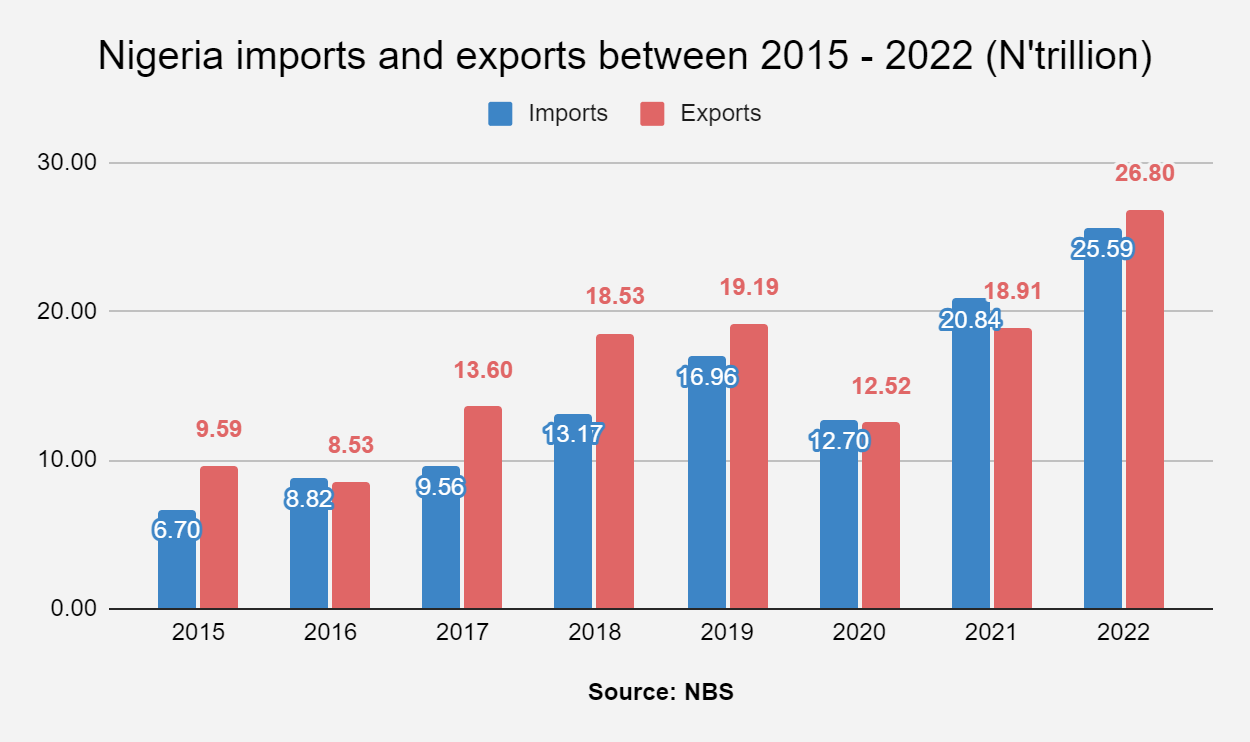

In addition, sustained reliance on imports could worsen Nigeria’s trade balance as imports exceed exports.

Nevertheless, this may be applicable as a short-term measure to curb the high inflation rate. In 2011, Egypt adopted this measure to tackle its inflation challenge.

Related to the above measure is the option of reducing/adjusting the import duties. Import duties are also known as tariffs. They are taxes levied by a government on goods and services imported into a country. These duties are typically imposed at the border when the goods cross into the importing country.

In an interview with Nigeria Info, the Chief Executive Officer of the Centre for Promotion of Private Enterprise, Dr Muda Yusuf, submitted that the Nigerian government can adopt the approach of adjusting its import duties on key areas of importation, especially those that affect the masses. This, he believed, would, to some extent, help control the high inflation rate.

“The government must identify sensitive areas of importation that affect the masses, alleviate the import duties on these items, and give them concessions to boost food production in the country,” Yusuf noted.

Adebayo Ahmed, an economic expert with Agora Policy, shared the same view. According to him, if tariffs are cut on imported food, it will reduce food prices and, by extension, general inflation.

The Indian government is reported to have adopted this measure in also tackling its inflation rate. According to a report, the government reduced the import duty on critical raw materials for production and inputs for the steel and plastic industry.

This reduced the cost of production, causing some stability in the prices of the final goods. In addition, the government also allowed duty-free imports of crude sunflower oil for the next two years to also help control the inflation in the country.

While this seems like an approach the Nigerian government may consider, it also has its own negative impacts.

One of the downsides to this is that it could expose domestic industries to greater competition from imported goods. If domestic industries are not competitive enough, they may struggle to compete with cheaper foreign alternatives, leading to potential job losses and reduced production.

An instance would be the usual preference for foreign rice over local and foreign rice among consumers citing the difference in the quality of both rice.

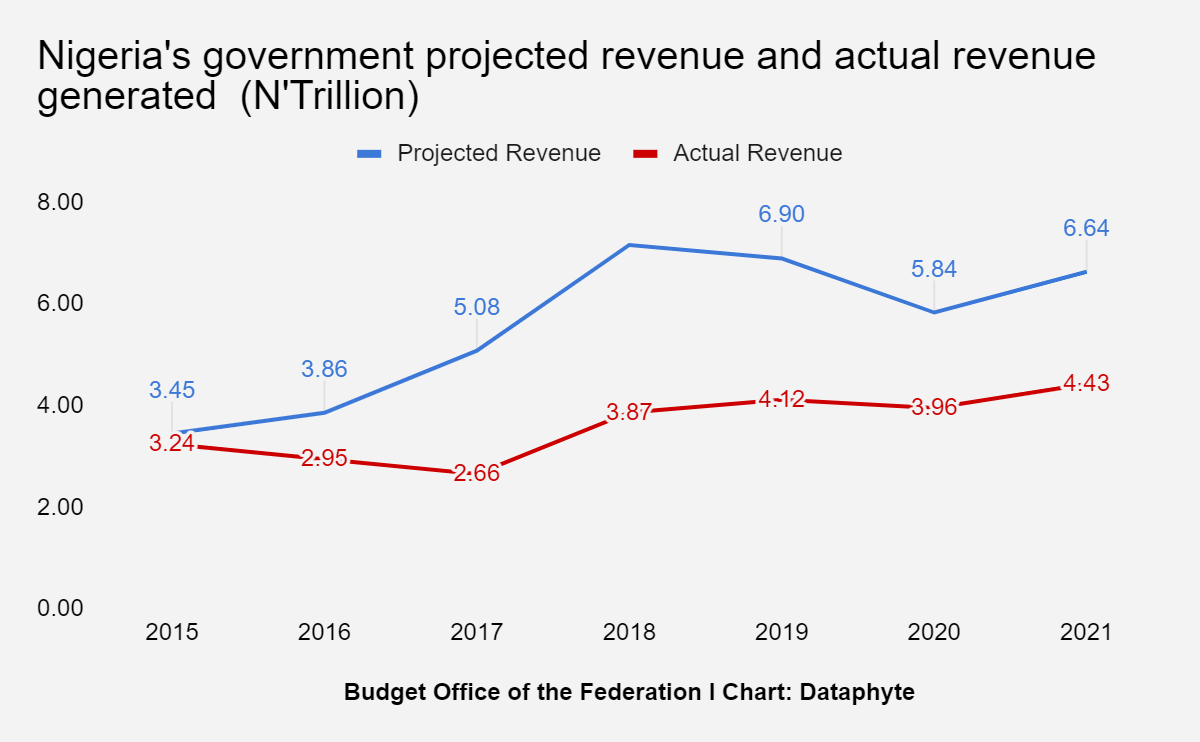

Another side effect of lowering import duties is that it may lead to a drop in the government’s revenue. According to a report, tax and import duties are the second most important revenue sources for the government after oil.

This means that if the government reduces or cuts off import duties on certain items to help moderate the inflation rate, there is likely to be a decline in the government’s revenue which may impact its funding of public services and infrastructure.

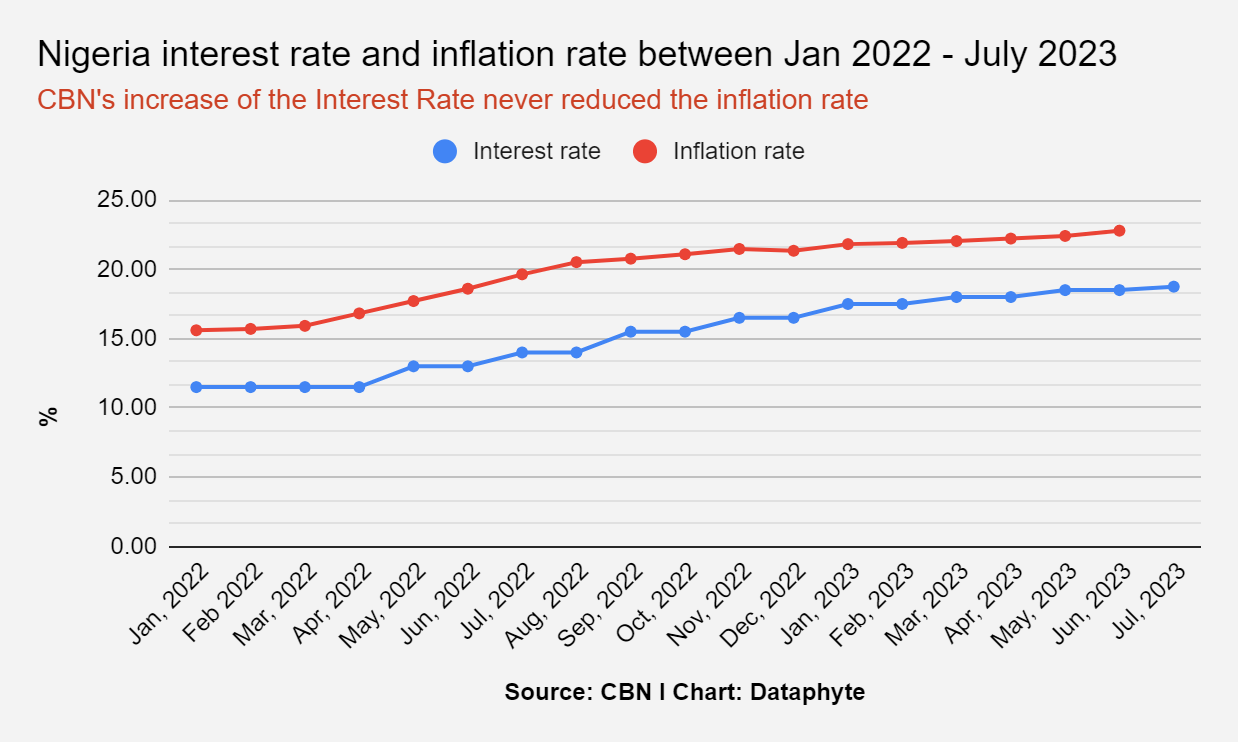

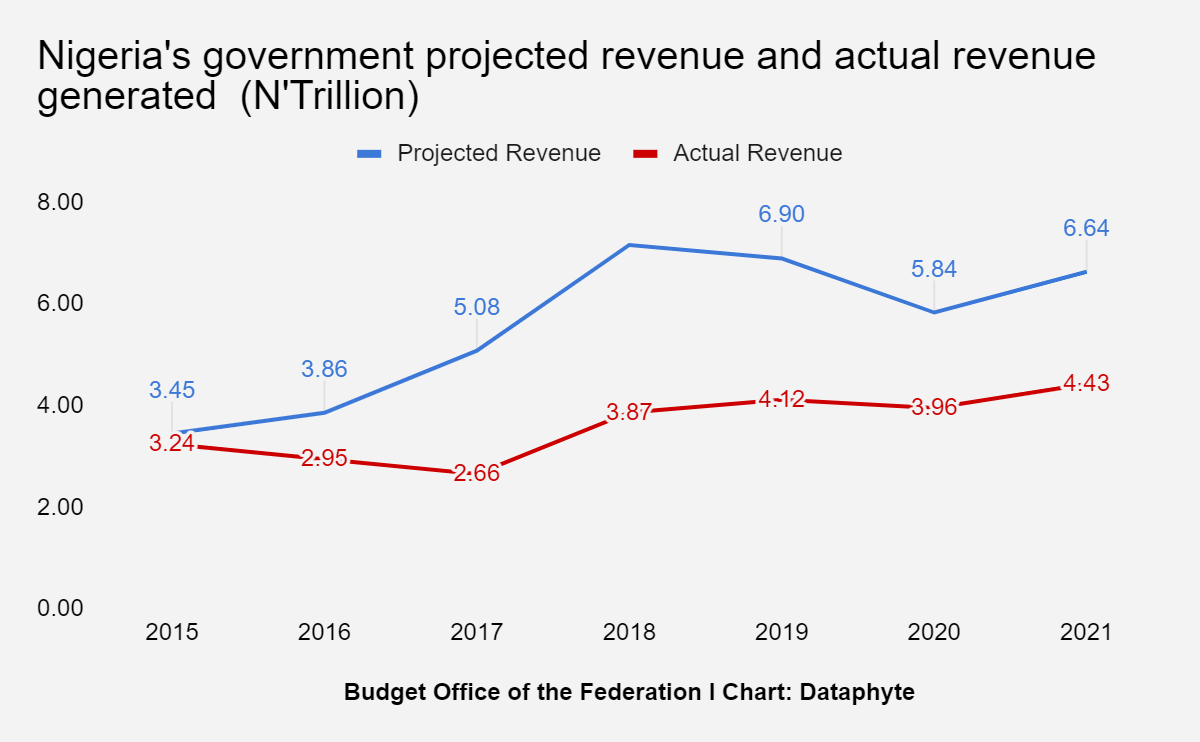

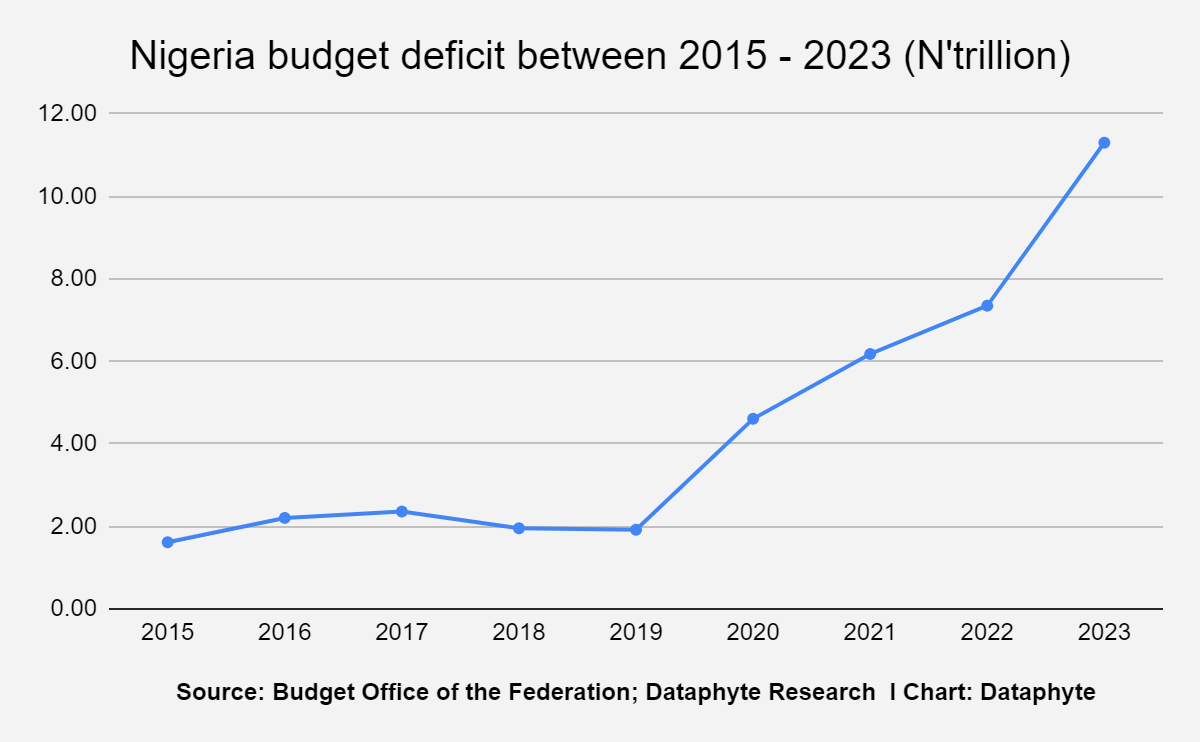

Moreover, the Nigerian government, in recent years, has been suffering from revenue issues which have resulted in budget deficit and ultimately increasing borrowing.

In addition to the two measures previously mentioned, promoting agriculture and local production is also a way the government can go about taming inflation. This could lead to increased availability of goods and enhance food security.

Interestingly, last month, President Bola Tinubu declared an immediate State of Emergency on food insecurity to tackle the increase in food prices. While the declaration appears to be a step in the right direction, and the various strategies the government outlined that it would take, it is important to match words with actions as this may also help address the increasing inflation rate.

.png)