The Central Bank of Nigeria (CBN) says that one of the many reasons for naira redesign is to mop up excess liquidity in the Nigerian economy.

At a press conference in December 2022, Central Bank of Nigeria Governor, Godwin Emefiele, said that many Nigerians, especially the rich, were hoarding the local currency.

“There is no reason why currency in circulation will grow from N1.4 trillion to N3.23 trillion in seven years. People are hoarding it. People are keeping vaults in their homes,” he said.

“We cannot allow them to be banks in their homes. They don’t have the license to build bank vaults in their homes. They should release that money back to CBN because what they are doing is undermining monetary policy. They are keeping those monies to speculate against our currency and it is making our work difficult in CBN.,” he had noted.

In the past four years, the CBN has blamed Nigeria’s inflationary pressure on excess liquidity in the system. In its Moneetary Policy Committee meeting held on November 23 and 24, 2020, Emefiele had said, “The Bank is expected to continue its aggressive mop up of excess liquidity with the CRR policy and other means to curtail inflation.”

In January 2021, the apex bank debited N600 billion from accounts of deposit money banks in order to mop up excess liquidity in the interbank money market.

The current central bank has ramped up cash withdrawals in the economy with a view to reining in on inflation and putting cash into productive use.

Naira redesign policy

This explains why the CBN announced the naira redesign in October 2022. During the announcement, Emefiele had said that the amount of money to be withdrawn from the counter would be drastically reduced.

This, he said, would ensure a steady transition into a cashless economy. According to the CBN governor, this was geared towards controlling the currency in circulation and curbing counterfeit currency as well as ransom payment to kidnappers and terrorists.

However, politicians of the ruling party have opposed the timing of the policy, saying that it is targeted at achieving certain selfish ends. Nigeria’s ruling party, the All Progressives Congress, believes it is meant to kick them out of power.

Excess liquiidty defined

The European Central Bank defines excess liqudiity as “all liquidity available in the banking system that exceeds the needs of banks.” Economists define it as idle money sitting in the banks outside of their needs. However, Nigeria’s excess cash/ liquidity exists outside the banking system – in homes or holes- rather than banks, says the CBN. Whether it is in the banks or outside of them, the apex bank believes there is excess cash in the economy.

Nigeria lags peers on cash circulation

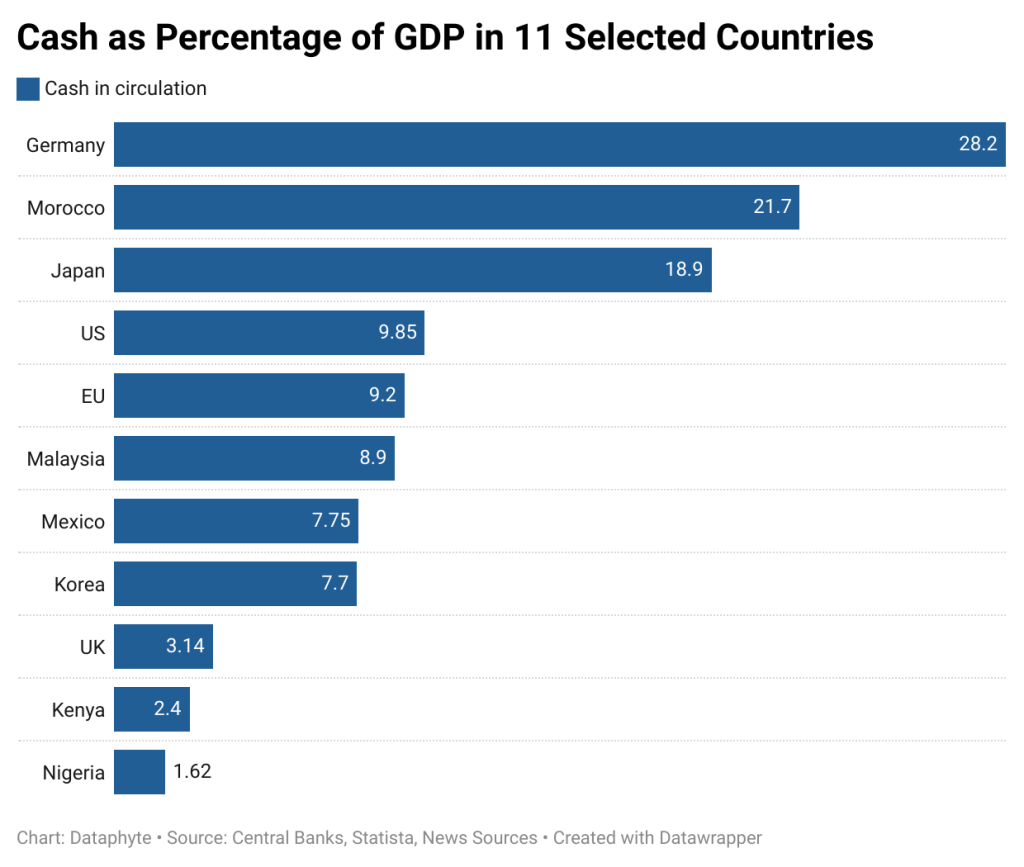

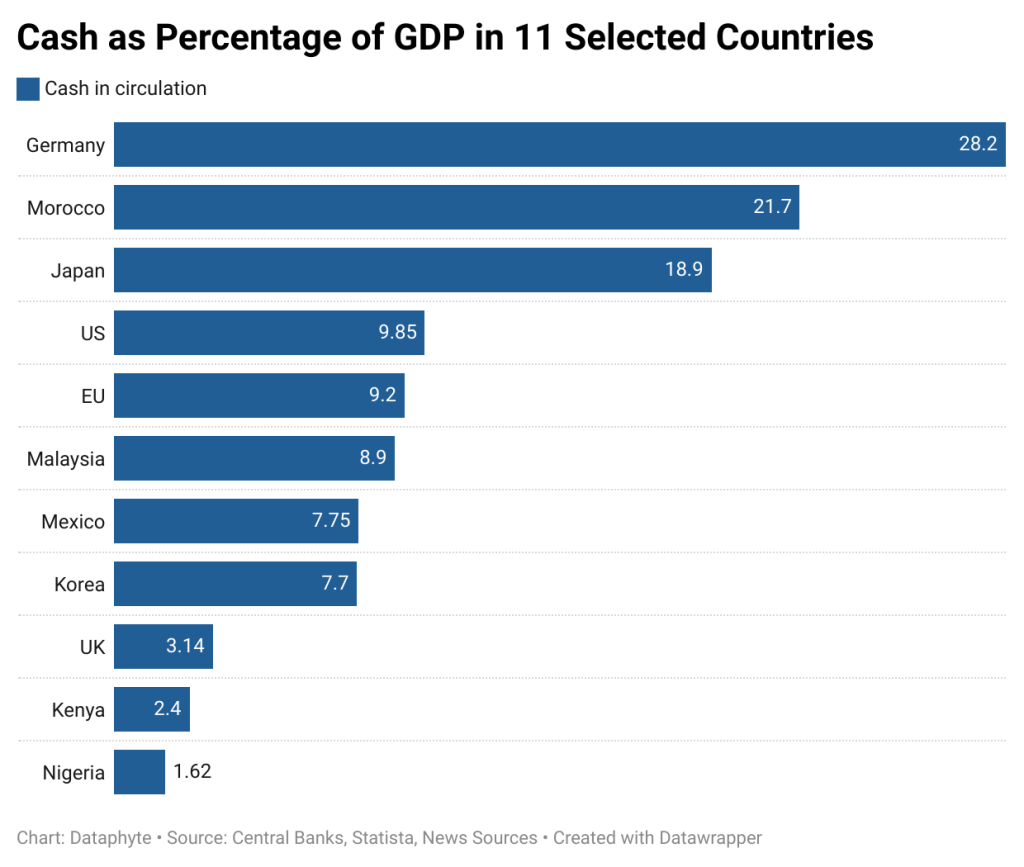

But this claim is hardly supported by data. Dataphyte research shows that money circulating in the Nigerian economy is only a drop in the pan. Analysis shows that the N3.23 trillion cash circulating in the Nigerian economy is only 1.52 percent of Nigeria’s Gross Domestic Product (GDP). Other developed and emerging economies are worse. The European Union’s cash-to-GDP ratio was 9.27 percent in December 2022. Also, cash-to-GDP ratio was 9.85 percent in December 2022 in the United States and 3.14 percent in the United Kingdom by January 2023. In South Korea, another developed country, cash is also king. Cash-to-GDP ratio in the Asian nation is 7.70 percent while Germany’s is 28.2 percent. Japan’s is 18.9 percent whereas Malaysia is 8.9 percent.

Based on available data, cash-to-GDP ratio was 7.75 percent in Mexico by the end of 2021. Nigeria is better than some emerging market peers in Africa such as Kenya (2.4 percent) and Morocco (21.7 percent).

All the cash in circulation in 11 countries examined were converted to dollars. Cash-to-GDP ratio was obtained by dividing the amount of cash circulating in the economies by their GDPs. This is considered a better metric for determining excess liquidity by economists.

CBN policy not properly thought-out

Economists and analysts believe the CBN’s cash withdrawal policy was not properly articulated.

Chief Executive Officer of Centre for the Promotion of Private Enterprises, Dr Muda Yusuf, said: “The implication of a comparative analysis is that Nigeria is already well ahead of even many advanced economies as far as cashless environment is concerned. To the credit of our financial system, it is also an indication that our payment system is one of the best globally.”

Yusuf was worried that the CBN was committing huge resources to fixing what was not broken. According to him, the cost of the naira crisis to the

economy would be enormous.

“Of course, our cashless performance can be better, but it should not be presented as the most urgent matter confronting the Nigerian economy. There are more critical macroeconomicissues demanding the attention of the country’s economic managers and policy makers,” he added.

On his part. President of the Manufacturers Association of Nigeria (MAN), Otunba Francis Meshioye, said manufacturers were hard hit by the cash withdrawal policy, urging the apex bank to release sufficient funds to drive the economy and businesses.

“If CBN releases enough funds in circulation, they need to have effective monetary scheme or system to ensure that it circulates. If this is done, there will be no hoarding. If funds are released, they should be monitored effectively,” he said at a press conference on Tuesday in Lagos.

A market analyst, Ike Ibeabuchi, noted that even if there was excess liquidity, the CBN should be held responsible.

“The CBN has lent over N23 trillion to the government through ways and means. So, why would you think that there is too much money circulating when you have lent more than the size of Nigeria’s 2023 budget to the government, which is even planning to restructure it?” he asked.

“As I have said many times, the major driver of inflation in the economy is high production costs fuelled by foreign exchange, energy prices, insecurity and the rest – it is not liquidity,” he noted.