Credit is essential for economic development. Bank credits in Nigeria are loans granted by financial institutions solely to the private sector such as businesses and households by providing capital for new investments and enabling people to buy commodities.

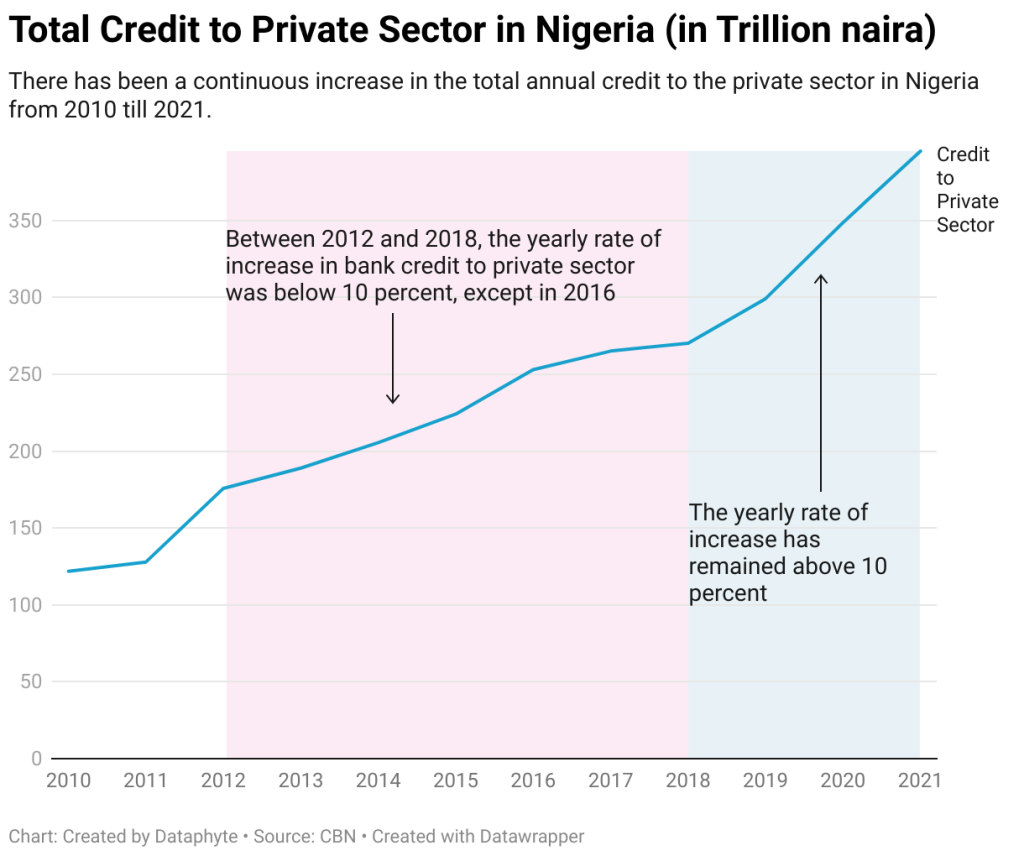

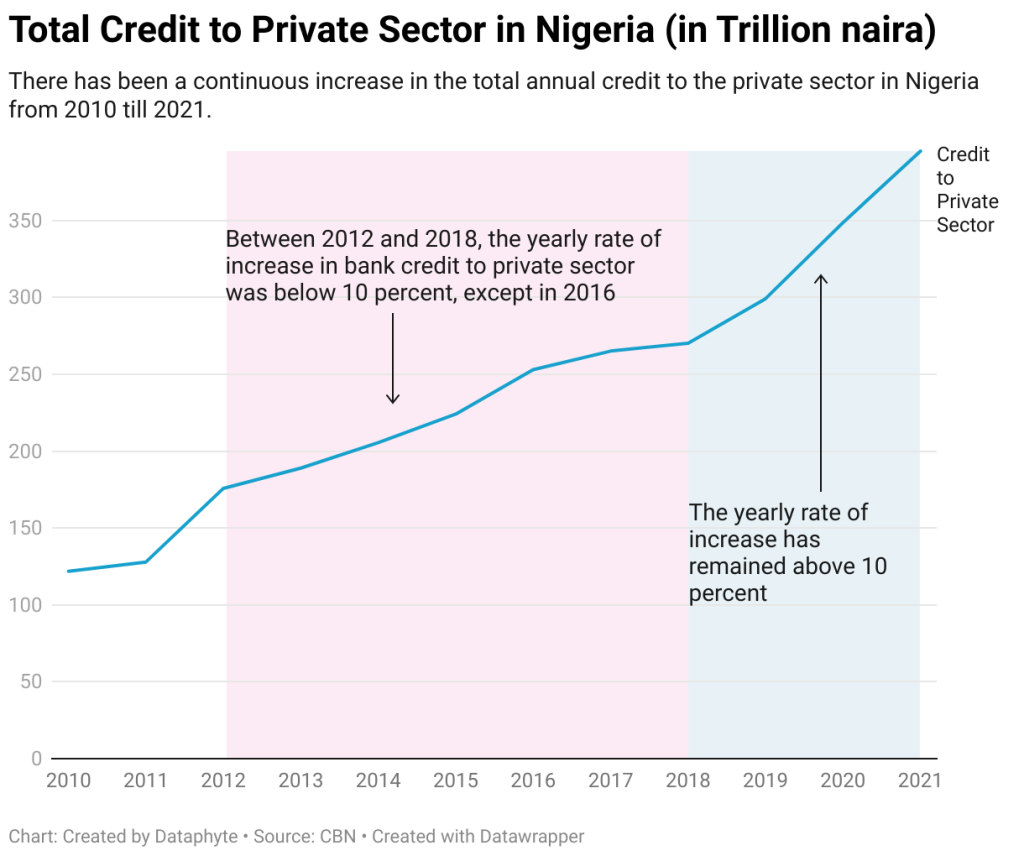

The total credit given to the private sector has steadily increased in the last decade. However, while the increase was steady from 2012 to 2018, there was a significant jump from 2019 to 2021.

Between 2012 and 2018, the yearly rate of increase in bank credit to private sector was below 10 percent, except in 2016.

The CBN’s Loan to Deposit Ratio (LDR) policy may be the incentive for banks to lend more to the private sector.

For instance, the yearly rate of increase from 2012 to 2018 was below 10%, save for the 12% increase in 2016. However, total credit increased by 10.7% in 2019, 16.5% in 2020 and 13.4% in 2021.

In 2021, credit to the private sector increased from N348.62 trillion in 2020 to N395.21 in 2021, representing a 13.4% increase.

Over the last 12 years, the total credit to the private sector has increased by 224% growing from N121.88 trillion in 2010 to N395.21 trillion in 2021.

.webp)