Nigeria has one of the most competitive markets in Africa. With an estimated population of over 200 million people and a population growth rate of 2.6 percent per annum, Nigeria has the seventh-largest population in the world. The country also sits atop 70 percent of the effective West African market and it is the most competitive destination for the establishment of medium and large manufacturing industries.

Despite Nigeria’s competitive market, its economy is dominated by foreign investments. For example, as of November 2019, investment of Chinese companies in Nigeria was valued above $20 billion. Chinese manufacturing and cheap imports have also continued to dominate many sectors of Nigeria’s consumer goods market, often at the expense of local manufacturing. In fact, it is common to hear that the Chinese are taking over Nigeria’s economy.

Other countries have also taken advantage of Nigeria’s expansive markets. The United States, the United Kingdom, the Netherlands, and France are other countries that have invested in Nigeria’s markets. While local manufacturing companies have taken advantage of the market, they have not sufficiently maximized the full prospects of the expansive Nigerian market. Manufacturing contributed only 8.74 percent to the GDP in the last quarter of 2019.

Nigeria’s Uncompetitive Manufacturing Sector

Homegrown production and strategies is increasingly promoted in Nigeria. Close to this is the campaign on the need to purchase local products. As far back as 2016, the campaign, #BuyNaijaToGrowTheNaira was promoted in favour of the domestic market. However, Nigeria’s domestic market is not as competitive. Thus, the campaign to promote the purchase of indigenous products could not sufficiently achieve its aim.

Providing a context to the failure of the #BuyNaijaToGrowTheNaira campaign, an economic expert noted that the business environment is not driven by patriotism nor is it powered by loyalty. Rather, it is influenced by value and commodity prices. Purchases are made based on consumer’s perception of value and other competitive advantages such as price. When imported commodities are cheaper than local commodities, consumers go for the cheaper alternative.

Behind Nigeria’s poor level of competitiveness in its manufacturing sector is the series of policy inconsistencies and distractions attributable to the discovery of oil. Arguably, the Nigerian government has not committed as much resources and attention to its manufacturing sector as it has to its oil sector. Other challenges also contribute to the underperformance of the manufacturing sector in Nigeria.

A highly emphasized challenge with local production in Nigeria is the availability and cost of power. Due to problems with the availability of power, manufacturers often must rely on gas, diesel, and other alternative power sources. This increase production cost and impact on the competitiveness of local production. According to the Manufacturers Association of Nigeria, ₦93.1 billion was spent on alternative energy sources in 2018.

Illegal importation and smuggling also impact on the competitiveness of domestic production in Nigeria. Many foreign-made goods easily make way into the country due to border porosity. The actual amount of imported goods often far exceeds the total number of imports reported by appropriate agencies. The resultant is a price destabilization that in turn upturn the competitiveness of local products. Access to funding is another peculiar challenge that denies local manufacturers of expected competitiveness.

On a general note, Nigeria staggers with its ranking of ease of doing business. While it experienced a significant leap in ease of doing business last year, it still ranks 131 on World Bank’s Doing Business 2020 index. From the Doing Business Report, Nigeria scores low in access to electricity, ease of property registration, across border trade, resolving insolvency, and paying taxes. Poor infrastructural quality also contributes to a lack of competitiveness. Seemingly minute challenges such as traffic gridlock impact on the performance of domestic production in Nigeria.

Borrowing for Competitiveness

While Nigeria is enmeshed in the above listed challenges that impact on its competitiveness, there are indications that domestic investments do not operate on a level plain ground. A DATAPHYTE review of the monetary outlook for some of Nigeria’s top trading partners showed a huge disparity in credit lending structures.

For instance, whereas the interest rate is as low as negative 0.1 percent in Japan, Nigeria’s interest rate is 12.5 percent. Interest rate for USA, China, and India are 3.85 percent, 0.25 percent, and 4 percent, respectively. Of the five countries review, Nigeria also operates the highest Cash Reserve Ratio.

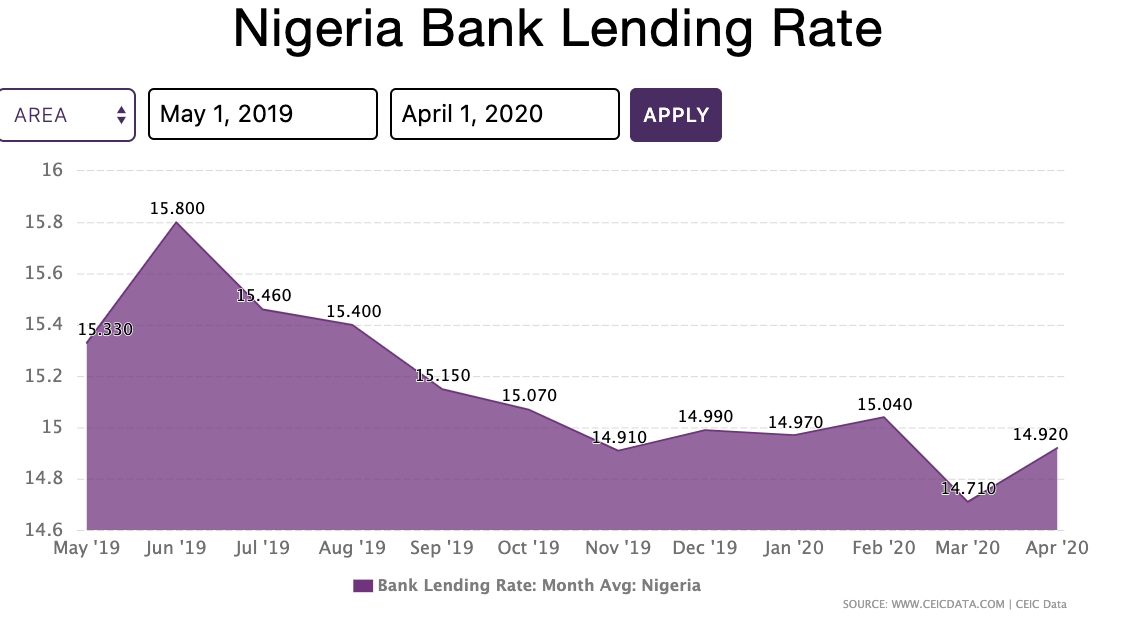

Nigeria’s lending rate stands at 14.92 percent whereas Japan’s lending rate is 1.475 percent, China’s is 4.35 percent, and USA’s is 5.28 percent. Only India has a relatively higher lending rate of 9 percent which is still almost six points lesser than Nigeria’s lending rate.

With these realities, it is practically impossible for Nigerian manufacturing ventures to compete with counterpart foreign ventures. Differentials in access to credit and interest rates can effectively absorb production cost and other surrounding logistics of operating in Nigeria. Due to the money lending structure, foreign investments have enough money to beat Nigeria’s businesses in a parallel race. In addition, many of these countries provide more credit for their businesses.

Outside the limitations of credit access for Nigerian businesses, there are indications that the manufacturing sector is overburdened by the government’s revenue drive. Of recent, pharmaceutical manufacturers in Nigeria expressed dissatisfaction over the introduction of a 7.5 percent VAT on packaging and essential raw materials. Among other things, this will increase production and possibly, limit the ability of the domestic market to compete with counterpart foreign ventures.

Summarily, relative to counterpart foreign ventures, borrowing in Nigeria is not sustainable. Huge interest rates, as well as the surrounding limitations in access to credit add to the woe of many businesses in the country. Lending realities for businesses in Nigeria show that domestic production may continue to be uncompetitive. It is thus important for the government to develop measures to improve its manufacturing sector.

Readjusting the Focus

While Nigerian Legislature was romancing the #BuyNaijaGrowTheNaira campaign some four years back, analysts recommended the urgent to shift focus to improving competitiveness among domestic enterprises. To achieve this, Nigeria should support natural advantages with the right interventions to spur growth. Changes should be made on infrastructure development and land ownership structures. Also, there is a need to improve the efficiency of power production and distribution. This will significantly reduce the cost of local production.

Expanded access to credit facilities is also necessary to improve the competitiveness of businesses. More funds should be provided at lower interest rates. Further, reliefs and exemptions should be provided for domestic enterprises. The burden of huge remittances should also be lifted. In addition, Nigeria needs less porous borders that aid illegal importation and smuggling. Ultimately, efforts should be made to further improve Nigeria’s ease of doing business. These should improve the competitiveness of local businesses in the country.