The federal government is currently rethinking the 2020 budget to respond to the shocks stemming from ongoing global oil price crisis. The 2020 budget bench-marked crude oil price at $57/b but, as of now, the price is $38, could slide further. The crisis is triggered by the COVID-19 outbreak, which has affected demand from the world’s second-largest economy, China, and, of course, the associated price war by Saudi Arabia and Russia.

While Nigeria has been running on a deficit budget in the last couple of years, it continues to subsidize Petroleum Motor Spirit (PMS) which is a mere consumption product. In 2019 alone, Nigeria spent about ₦1tn, which is about 10 per cent of its budget, on petroleum subsidy. For the same year, the appropriation bill indicated that Nigeria had a budget deficit of ₦1.92tn. This implies that over 52 per cent of the 2019 budget deficit was accrued because of the petroleum subsidy. Compounded, about ₦10tn was spent on fuel subsidy between 2006 and 2018.

Experts often describe Nigeria’s oil pricing framework as problematic and insufficient in addressing the country’s real needs. Specifically, on petrol subsidy, experts often argue that while the scheme could have been designed with good intentions, a sort of social approach in the context of a largely poor economy, it is a waste of rare economic resources. This argument is often based on the view that consumption products should not be subsidized. Subsidizing production is preferred. Thus, the subsidy on petrol is questioned because the product is not an investment item.

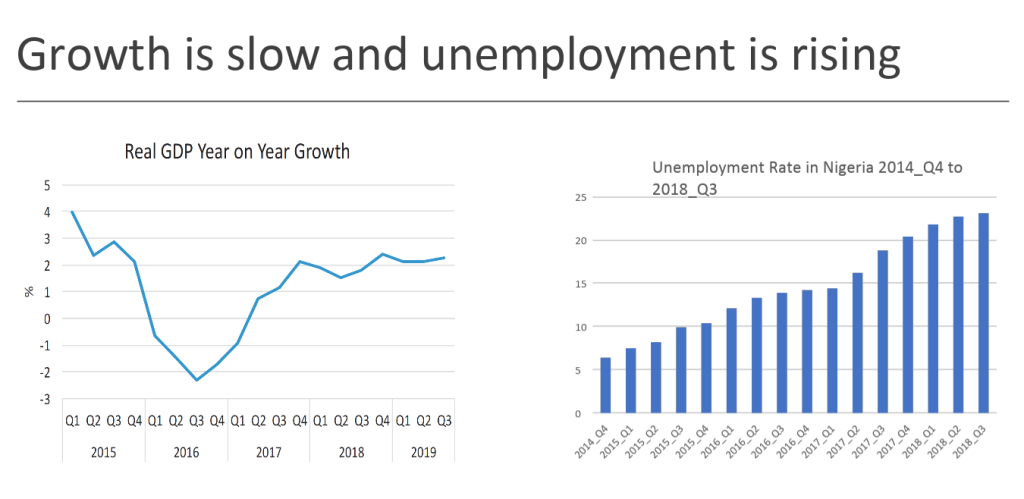

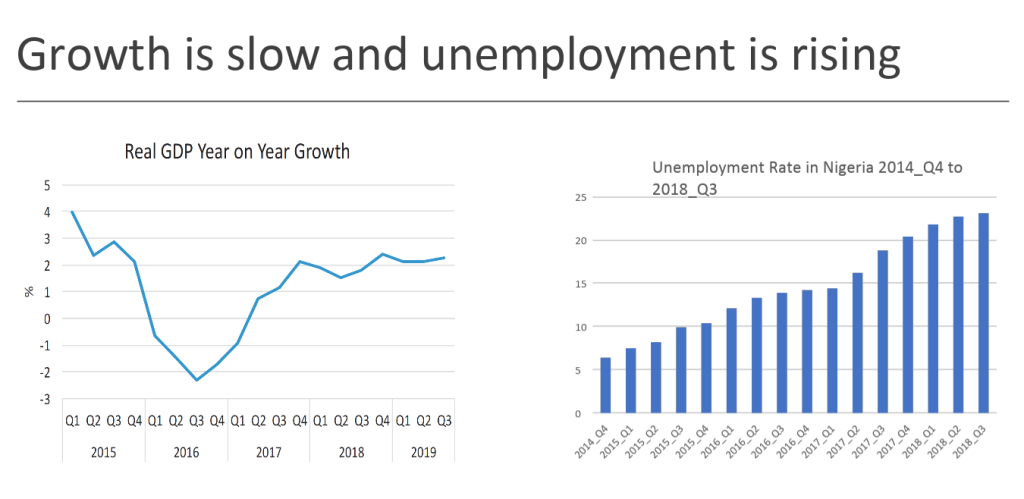

Research also suggests that the huge economic investment in providing subsidy is not sustainable amidst Nigeria’s economic outlook. Asides the growing debts, the fast depleting foreign reserves and the persistent budget deficit, Nigeria has a high inflation rate, high growth of poverty and unemployment, and huge fiscal crises in many of its states. All these require freeing up funds for investments in economic infrastructure that can engender jobs-generating production across sectors. The external account is also under severe pressure and the country has been battling to stabilize its currency. In addition, the current subsidy regime is posed with serious accountability challenges that limit its performance.

Beyond these challenges, is the reality that the poorest are barely impacted by the financial draining scheme even though the government makes a series of claims suggesting that the subsidy is a pro-poor initiative. Multiple pieces of evidence show that most of the beneficiaries of the subsidy arrangement are above the poverty line and can afford to pay the true price of the oil product. A World Bank report in 2013 showed that about 57% of the gain from subsidies goes to the top 20% while only 3.8% goes to the bottom 20%.

While the government continues to pump a significant portion of its funds into the petrol subsidy scheme, the scheme is fraught with several challenges. For example, the current subsidy regime has not sufficiently reduced the problem of price hikes, black-market trade, and the difficulty with obtaining the product. In some states, residents still queue up to purchase petrol. The current PMS mechanism is also characterized by price freezing and ad hoc increases. These challenges frustrate the intention of the subsidy scheme and signal the need to redefine the PMS mechanism.

Extant literature shows that completely overhauling the current subsidy system is good for the GDP and the trade balance. While a total removal of petrol subsidy could cause significant increases in fuel prices, the long-run impact on inflation is envisaged to be minimal. Particularly, the impact on food price increases is negative for the poor. Overall, complete removal of the subsidy is good for the economy.

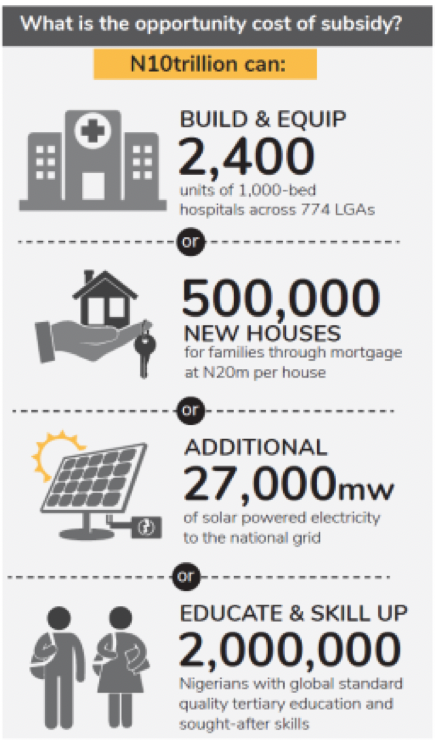

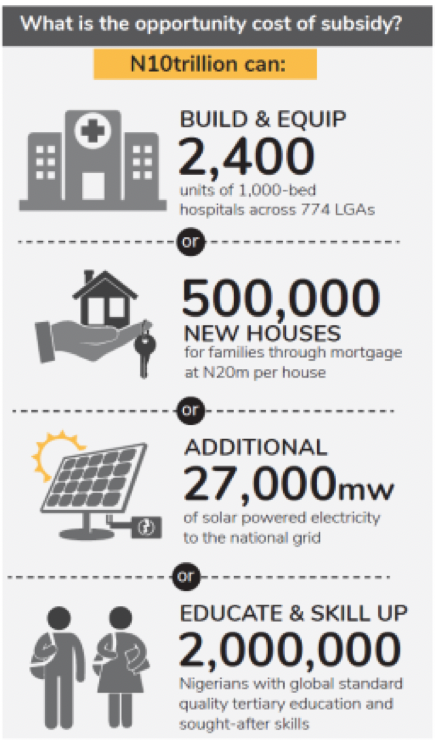

Analysis by Akin Iwayemi Neil McCulloch Hamzat Lawal submitted that the total spending on petrol subsidy could have funded Nigeria’s public education system (including the construction costs). It could have also funded about 1.5 million community health centres to resolve some of the proliferate health crises in the country. Also, the ₦10tn subsidy investment could build and equip 2,400 units of 1,000-bed hospitals across Nigeria’s 774 Local Government Areas. it could have added 500,000 new housing units at ₦20m per unit. An additional 27,000MW of solar-powered electricity could have also been added to the national grid with the fund. The funds can also significantly offset Nigeria’s budget deficit.

Credit: Akin Iwayemi et al

However, while the country will be tremendously impacted by subsidy removal, research suggests that the attempt may create significant public disarray and social unrest if it is not carefully implemented. This is because of the trend of public perception and opinion on subsidy removal. Generally, research shows that Nigerians have a poor understanding of the subsidy scheme as well as its implications. In fact, some Nigerians still believe that the sales of PMS accrue some wealth to the government. Most serious is the problem of lack of trust in the government. Many Nigerians believe that the government acts only in its interest and that if the current subsidy regime is overhauled, the funds may not be justly reallocated. Closely related to this are fears about the compensation initiatives that should accompany the subsidy removal.

Ultimately, experts advise that Nigeria should consider diverting the petrol subsidy into cash transfers in support of basic education, universal health coverage, and youth employment, and skills acquisition program. it is also recommended that the subsidy should be progressively removed to reduce the social outrage that may accompany it. The reform should address the specific needs of the poor to garner public support for the process. It should emphasize that the purpose of the reform is to reallocate and redistribute the fund while eliminating corruption in the process PMS pricing mechanism. However, beyond all of these is the need to tackle the fundamental lack of trust in government. Transparency and accountability should be ensured during the reform.