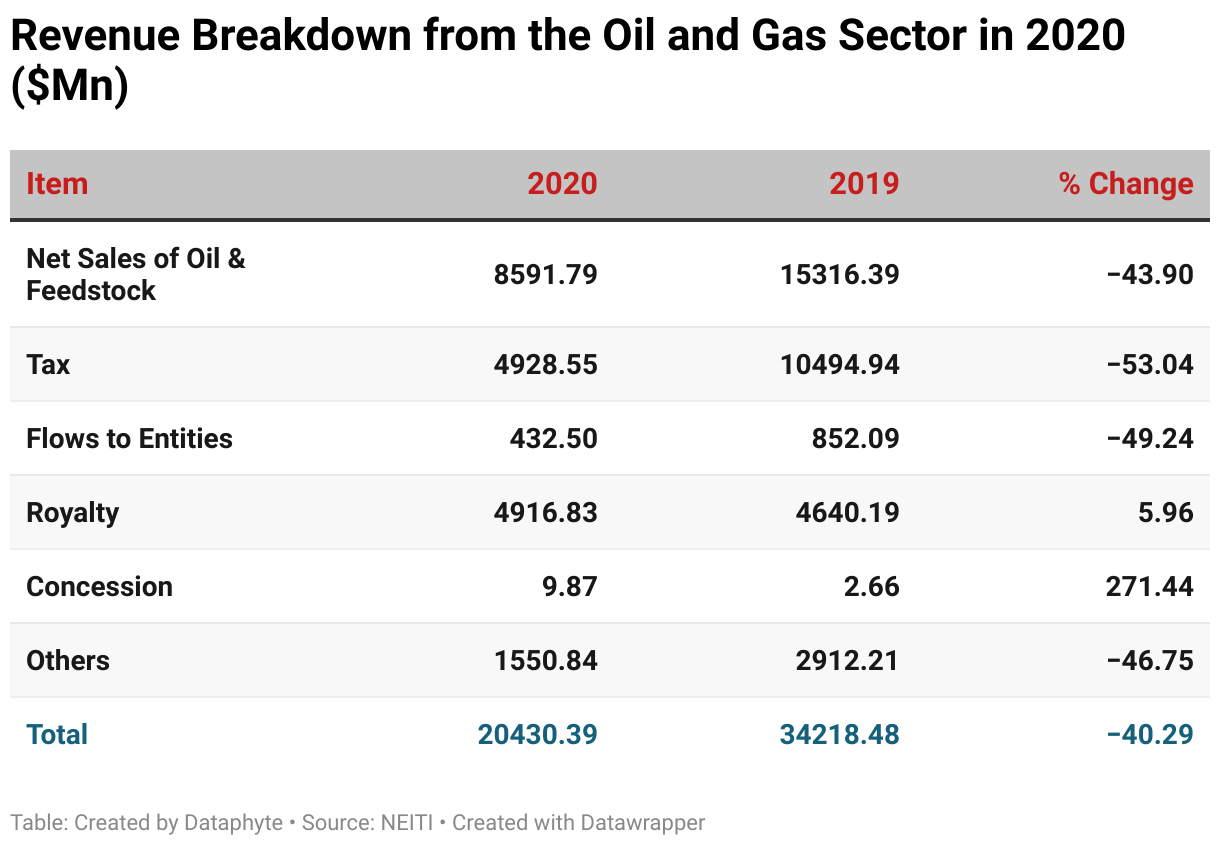

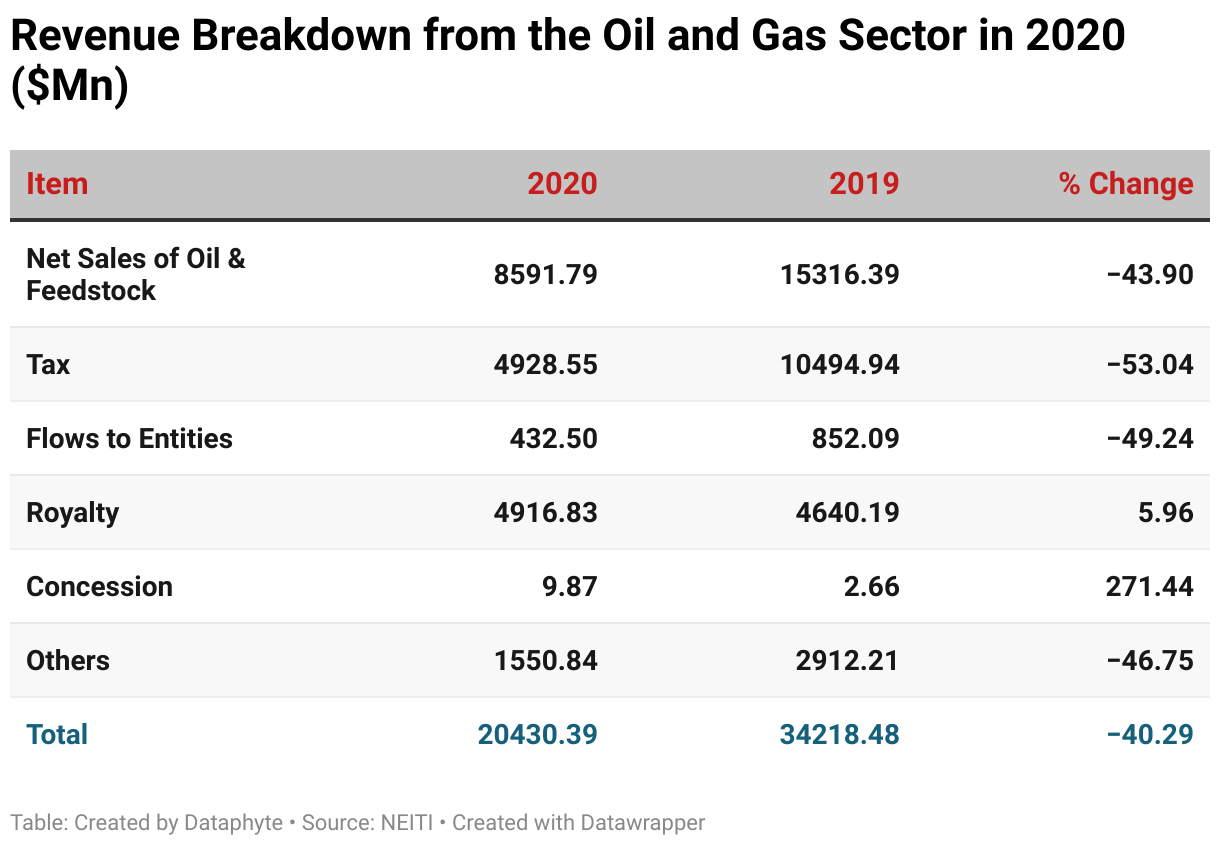

According to the recently published Nigeria Extractive Industries Transparency Initiative (NEITI) report, the total revenue generated from Nigeria’s oil and gas operations in 2020 was $20.43 billion.

This revenue represents a 40% decrease in revenue from the $34.22 billion generated in 2019.

Like other sectors, the oil and gas sector in Nigeria was greatly impacted by the outbreak of coronavirus. Furthermore, the Saudi-Russia trade wars had a double effect on the revenue from the sector, all contributing to the drop in revenue in 2020.

Across all revenue categories, there was a drop in revenue generated save for two – royalties payment and concession rentals. Royalties on oil and gas increased from $4.64 billion in 2019 to $4.92 billion in 2020, a 5.9% increase. Concession rentals increased by 271.4%, from $2.66 million to $9.87 million.

A total of $10.78 billion of the sum generated in 2020 was from crude oil, gas, and feedstock sales. Thus, this component accounted for 52.78% of the total revenue generated in the year.

However, $2.19 billion was deducted as tax and royalties from the $10.78 billion. The taxes were the Petroleum Profit Tax (PPT) on Product Sharing Contracts (PSCs) and Modified Carried Agreement (MCAs). Others are Education Tax (EDT) and royalties and rentals charged.

Thus actual remittance to the government account was $8,591.79 billion from the sales of crude oil, gas, and feedstock.

Revenue flow to government entities within the year include the 3% levy to Niger Delta Development Commission (NDDC), Nigerian Content Development and Monitoring Board (NCDMB) levy, and NESS fee. These entities collectively received $432.5 million in 2020 as against the 852.09 million they received in 2019. This represents a drop in revenue to these agencies by 49.2%.

The government generated taxes from the operations of companies within the industry within the year. These include VAT, CIT. PAYE, WHT, Capital Gain Tax, and Bank to Excess Dividend Tax (EDT). The total amount generated from these sources summed up to $4.93 billion in 2020. This figure is a 53.04% drop from the $10.49 billion generated in 2019.

Other sources of revenue generated are miscellaneous income, transportation revenue, signature bonus & licence renewal, and dividend from NLNG. Revenue from these sources dropped from $2.91 billion in 2019 to $1.55 billion in 2020. Thus, there was a 46.75% decrease in revenue from these sources.