Parent companies enjoy profits in the form of dividends from their subsidiaries; think of it like royalties or tribute to a Queen. The Nigerian Petroleum Development Company Ltd (NPDC), however, denied her parent company, Nigerian National Petroleum Corporation (NNPC) any such tribute in 2018. NPDC made ₦179 billion profit-after-tax, yet declared no dividends to NNPC.

NPDC is one of eleven (11) subsidiaries of the Nigerian National Petroleum Corporation (NNPC) that shortchanged the Nigerian Government in dividend payments running into multi-billion naira, Dataphyte’s findings show. This fiscal negligence speaks voluminously about various inadequacies and opacity in the operation of Nigeria’s state-owned oil firm. The undeclared dividends are mainly from the 2018 financial statements of the 20 subsidiaries released recently by the Corporation.

According to the financial reports, only 4 out of the [16] subsidiaries that made profits for the year paid a dividend to the parent company – NNPC. They are Duke Oil Company Inc, Duke Global Energy Investment Ltd, Integrated Data Services Limited, and N-Gas Limited. These subsidiaries paid the sum of ₦579.73million to the purse of NNPC as a dividend for the 2018 accounting year.

Why Dividend is Important

A dividend payment provides certainty about the company’s financial well-being, and consistent paying means the company is in stable condition. Findings by Dataphyte further showed that although dividend payments mean profitability, it is usually at the discretion of the Board of Directors. So, the Directors of the twelve (12) subsidiaries essentially denied its parent company billions of naira.

Just think, if four subsidiaries of NNPC paid ₦579.73million for making a little profit in the 2018 financial year, how much would the ‘high earning entities’ such as NPDC have made?

“The Nigerian Government should explain why one subsidiary pays, and the other one is not paying– it is a dent on accountability, and the country needs a working framework on governance for its oil firms,” Mr Atiku Samuel, a policy expert said.

The NNPC has over 20 subsidiaries operating as joint ventures or wholly owned companies. It holds shares for the government in those companies with concessions in production sharing contracts and manages service contracts. It has long argued for its subsidiaries just paying taxes on what they earn and pay dividends to the Group. The remaining subsidiaries made profits but decided not to pay a dividend. They include:

National Petroleum Investment Management Services (NAPIMS);

National Engineering and Technical Company Limited (NETCO);

Nigerian Gas Company Limited, NIDAS Marine Limited;

NIDAS Shipping;

NIDAS Shipping Services Limited;

NIDAS Shipping Service Agency UK;

NPDC;

NNPC Retail;

Petroleum Product Marketing Company (PPMC);

Wheel Insurance Limited, and

Duke Oil Services UK.

s/n | NNPC Subsidiaries | Dividend | Income | |

1 | Petroleum Product Marketing Company (PPMC) | Nil | ₦11.12 billion | Profit |

2 | Wheel Insurance Limited | Nil | $18.1 million | Profit |

3 | National Petroleum Investment Management Services (NAPIMS) | Nil | ₦1.06 billion | Profit |

4 | National Engineering and Technical Company Limited (NETCO) | Nil | ₦4. 6 billion | Profit |

5 | Nigerian Gas Company Limited | Nil | ₦16.62 billion | Profit |

6 | Nigerian Gas Marketing Limited | Nil | ₦19.99 billion | Profit |

7 | NIDAS Marine Limited | Nil | ₦761 million | Profit |

8 | NIDAS Shipping Services Limited | Nil | $1.43 million | Profit |

9 | NIDAS Shipping Service Agency UK | Nil | £74,794 | Profit |

10 | NNPC Retail | Nil | ₦2.28 billion | Profit |

11 | NPDC | Nil | ₦179.14 billion | Profit |

12 | Duke Oil Services, UK | Nil | £174, 118 | Profit |

| Total | | | |

Huge income, no dividend payout

Recall how we speculated earlier on how much NNPC’s “high earners” made? Turns out, we need not speculate as Datphyte’s analysis of the 20 financial statements showed that some subsidiaries made high profits in 2018, declaring no dividends to the NNPC. This omission means less will end up in government coffers.

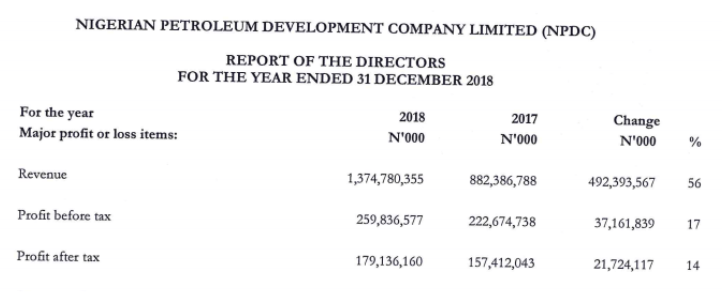

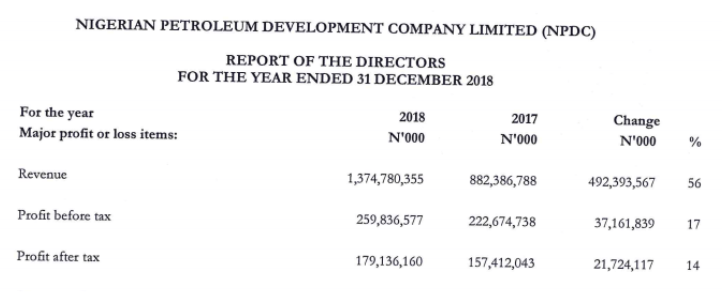

For instance, the Nigerian Petroleum Development Company Ltd (NPDC) reported large revenues (₦1.37 trillion) and income (after-tax profits) of ₦179 billion but paid NNPC no dividends for the year. The company had N195 billion in its bank accounts (“Cash on hand”) at the end of the year. A 2018 audit report of the oil and gas Nigerian Extractive Industries Transparency Initiative (NEITI) identified recurring issues from NPDC such as legacy liabilities, operation and management of Cash-calls, remittances of domestic crude sales proceeds, and liabilities of royalty and taxes by E&P companies.

NPDC financial statement, 2018.

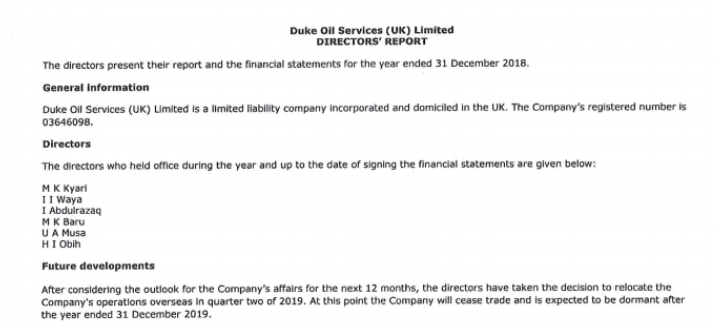

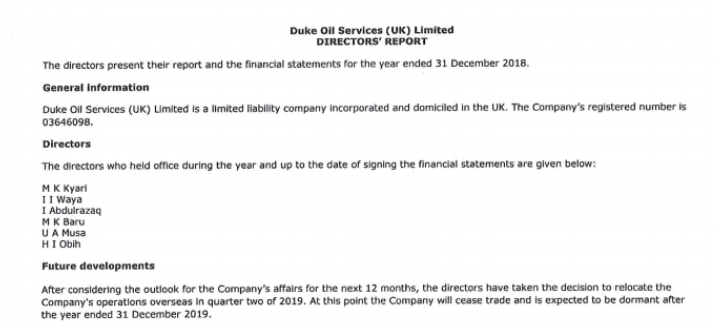

Like NPDC, Duke Oil Service UK paid no dividend despite racking ₦69.64.million (£174, 118) profit for the year. The company had since the second quarter of 2019 shut down in the UK and moved operations. The details of its new location as at the time of filing this report are unknown.

Screenshot of Duke UK financial statement, 2018. (NNPC)

“After considering the outlook for the company’s affairs for the next 12 months, the Directors have taken the decision to relocate the company’s operations overseas in quarter two of 2019. At this point, the company will cease trade and is expected to be dormant by 31 December 2019,” a statement from the Directors read.

The relocation was reportedly linked to the ongoing $9.6 billion judgment claim between the Nigerian government and Process and Industrial Development, P&ID Limited.

Other big earners like the Nigerian Gas Marketing Limited and Nigerian Gas Company Limited also paid no tributes to the NNPC.

Huge Profit, Minimal Dividend

For 2018, Duke UK paid NNPC a dividend of only $40,419 (₦12.37 million), despite making a pre-tax profit of $61.03 million (₦18.68 billion). Speaking with Financial Times, the Group Managing Director of NNPC, Mr Mele Kyari said Duke UK reinvested profit back into the business. He, however, did not state the details of the investment but acknowledged its profit and dividends rose in 2019. The 2019 financial statements are due for publication.

As for Duke Nigeria, they paid NNPC a ₦100 million dividend even though it only booked ₦135.6 million in revenue and a ₦41.6 million operating profit. In contrast, N-Gas Limited posted a profit of $6.38 million (₦1.95 billion), paying only $6,000 (₦1.87 million).

Efforts to reach Dr Kennie Obateru, the new spokesperson of the Corporation, for clarification were unsuccessful.

No Clear Cut Framework For NNPC Operations

Mr Samuel believes there is a need for a clear-cut framework for the NNPC. “We have a systemic problem. The complexity of government is huge, and there is a need for better coordination. As a nation, we need to solve governance issues, in terms of directors, roles, and responsibilities of NNPC and its subsidiaries. This is where the discussion about transparency and accountability in the operations of the NNPC comes in.”

Mr Samuel said the Auditor-General reports have also raised queries on financial transparency for years. But some Ministry, Departments, and Agencies of government see themselves as powerful and untouchable.

“The NEITI report and Auditor General’s report have extensively identified issues with the NNPC and subsidiaries. But they have become untouchable and failed to remit certain benefits to the government. Most of the issues raised by the reports litter around without attention.”

Mr Henry Adigun, a team lead at Facility for Oil Sector Transparency and Reform (FOSTER) in Nigeria, described the operations of the NNPC as one that lacks direction.

He said that is why Nigerians are clamouring for a Petroleum Industry Bill (PIB).

“Organisations like ours can do very little. That’s why we urge Nigerians and civil societies to work together to ensure the passage of the PIB.”

Mr Adigun believes the passage of the PIB will solve some fiscal transparency issues in the NNPC and result in the establishment of a governance structure for the corporation.

NEITI and Auditor-General’s reports on Oil and Gas

Various stakeholders and reports have itemised the opacity in the operations of the NNPC. Two key bodies – NEITI and the Auditor General – have highlighted the fiscal operations and non-disclosures of the NNPC books for years. Reminiscent of this is the $10 billion in NLNG dividends cumulatively kept by NNPC- still fresh in Nigerians’ memory.

Despite breaking the record recently with the accounts of the subsidiaries, the management of the NNPC led by Mr Mele Kyari decided not to release the details of the Group. The NPDC, for instance, has long-standing years of non-remittance of dividends, taxes, and royalty to the government. Between January 2012 and July 2013, the NPDC denied the NNPC, and ultimately the Federation accounts the sum of ₦1.48 billion in dividend, according to a forensic audit conducted by PricewaterhouseCoopers Limited (PwC).

Despite citing inaccessibility to NPDC’s full accounts and records, PwC considered the fund as a dividend payment by NPDC to NNPC.

In its report, “Inside NNPC Oil Sales: A Case for Reform in Nigeria,” the Natural Resource Governance Initiative (NGRI) called for the creation of an explicit rule for how NNPC should fund its operations. Similarly, NGRI calls for an amendment to the NNPC Act by spelling out which funds NNPC can keep in greater detail than the current provision, including the structure of tax or dividend payments by the corporation and its subsidiaries.

To become commercial-viable entities, experts and stakeholders have called for a clear-cut framework for the notorious National Oil Firm that will ensure adequate transparency and accountability for every one Naira spent.