In the last couple of years, the Nigerian government has described its budget in manners that suggest high aspirations for growth and development. In 2016 for instance, the budget carried a theme of change. Similarly, the 2018 budget was described as a budget of consolidation.

Reading the 2019 budget speech, President Buhari noted that “the 2019 Budget Proposal is intended to further place the economy on the path of inclusive, diversified and sustainable growth in order to continue to lift significant numbers of our citizens out of poverty”. The 2020 budget has been described as a budget of sustaining growth and job creation.

Globally, rises in per capita income and income distribution, as well as improvements in access to education, healthcare, communication, transportation, housing, production technology and the quality of life, are indicative of economic development. While development can be predicated on several factors, budgetary patterns, as well as expenditure structure, can suggest the extent of commitment to development aspirations.

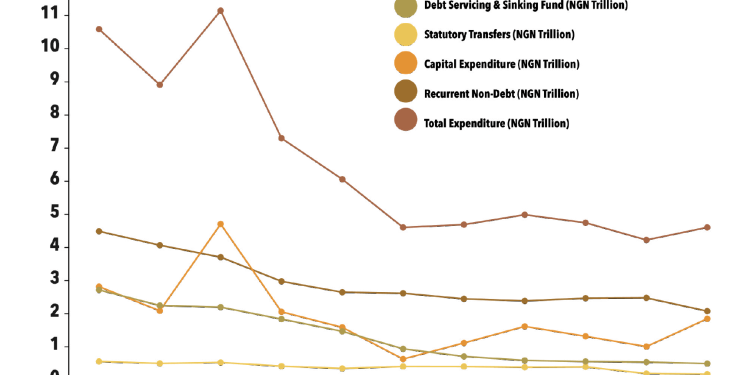

A review of Nigeria’s budget reveals that the country has four main items of expenditure. They are capital expenditure, debt servicing and sinking fund, recurrent expenditure, and statutory transfer. In the last five years, Nigeria’s expenditure has been reportedly burdened with provisions for debt servicing. On average, debt servicing accounted for 24.02 percent of the total budget share between 2016 and 2020.

Statutory transfers which include an allocation to the National Judicial Council, Niger Delta Development Commission, Universal Basic Education, National Assembly, Public Complaint Commission, the Independent National Electoral Commission, and the National Human Rights Commission occupy a significant portion of Nigeria’s budget. In a recent DATAPHYTE occasional paper, it was revealed that since 2015, an average of 6 percent of the total budget size has been earmarked to statutory transfer.

Most of Nigeria’s funds goes into recurrent expenditure items. These items which include salaries and pensions, fuel for cars, and purchase of consumables take as much as 58.66 percent of the total budget share. In the last five years, budgetary provision for recurrent expenditure averaged at 41.18 percent of the total budget share. Over 42 percent of the total 2020 budget has been allocated to recurrent expenditure in 2020.

Expenditure Items as Percentage of Total Budget

Year | Debt Service & Sinking Fund (%) | Statutory Transfer (%) | Capital Expenditure (%) | Recurrent (Non-Debt) (%) |

2020 | 25.68 | 5.29 | 26.63 | 42.40 |

2019 | 25.25 | 5.63 | 23.45 | 45.67 |

2018 | 19.73 | 4.75 | 42.24 | 33.27 |

2017 | 25.21 | 5.74 | 28.22 | 40.83 |

2016 | 24.25 | 5.79 | 26.23 | 43.72 |

2015 | 20.47 | 8.92 | 13.74 | 56.87 |

A Meagre Share on Capital Expenditure

Capital expenditure items, which are often considered as the main drivers of economic growth and development receive a relatively minimal allocation in Nigeria’s budget. For instance, provision for capital expenditure was as low as 13.74 percent of the total budget in 2015. In the same year, budgetary allocation to debt servicing was 20.47 percent of the total budget while the allocation for recurrent expenditure was 56.87 percent of the total budget size. In 2020, only 26.63 percent of the total budget has been earmarked for capital expenditure, a figure slightly above the provision for debt servicing.

Amidst minimal investment in capital expenditure are the underlining challenges in the use of allocated capital expenditure funds in the country. Underutilization of appropriated funds for capital expenditure is still very common. In addition, the inflated cost for capital projects due to the fragility of the revenue management framework in the country continues to dent many of Nigeria’s hope on development. Poor project delivery also constrains development in the country. But these challenges do not erode the reality of underinvestment in the capital items that can in turn spur development.

In addition, despite the government’s claim on its development aspirations, budget share to capital expenditure has not improved significantly in the last couple of years. While the total expenditure size rose from ₦7.3 trillion in 2017 to ₦10.59 trillion in 2020, budgetary allocation to capital expenditure was ₦2.06 trillion in 2017 and ₦2.82 trillion in 2020. Proportionally, budgetary allocation to capital spending increased only by 36.9 percent between 2017 and 2020 while total budget size increased by over 45 percent over the same period. This raises question on the ‘developmental magic’ the government intends to perform without increased investment in capital expenditure items.

Looking forward, to match the ambitious claims of the government with commensurate development, there is need for a rethink of the commitment to capital spending. To spur development, an increased budgetary provision to capital items might be required. This will ensure the provision of infrastructure that can spur development and in turn improve on the staggering human development index of the country. Accountability in the utilization of funds is also paramount. Side by side with this is the need to plug leakages and prudently administer the country’s limited resources.