Our findings show that the Federal Government of Nigeria incurred 350 billion Naira debt through Sukuk Bond on three different offerings since 2017. Yet, the most shocking detail is what’s being done or what isn’t.

In truth, the Sukuk Bond interest rates can be best described as “tempting”, a Dataphyte analysis found, further explaining the willingness of investors to invest. But, underneath all that “sukukness” what lies?

Since interest rates on treasury bills have crashed below double-digit, investors have turned to other forms of investment. These include FGN Saving Bond and the Sukuk. In the last three years, the FG Sukuk issues witnessed over-subscription. So far, the government has offered ₦350 billion from Sukuk programmes.

What Type of Bond is Sukuk?

Before delving into matters, what is Sukuk? It is an additional source of borrowing for ethical concerns since Islam prohibits collection of interest from loans. It indicates ownership of an asset, aligns with certain principles, and clearly states the details of the asset investments. Furthermore, these assets are to be compliant with Shariah. In other words, such assets adhere to the Islamic prohibitions on gambling, alcohol, tobacco, narcotics, and adult entertainment products and services.

In addition and perhaps most noteworthy, Sukuk notes pay a fixed percentage return as a profit-sharing percentage of the underlying assets’ revenues. This distinction separates it from other Bonds which are interest-based. Sukuk is also tax-free.

While the government premised the utilisation of these bonds for the construction and rehabilitation of roads across the six geopolitical zones of the country, challenges of transparency and accountability plague an otherwise “good sentiment”.

More so, the details of all the 97 road construction projects are not available on the website of any government agency at the time of this reporting. This omission speaks further contradicts the transparency and accountability mantra of the Buhari administration.

Mr. Tope Fasuwa, an economist and ex-Presidential candidate of ANRP (Abundant Nigerian Renewal Party), noted that only a few things are transparent in Nigeria and urged citizens to continue to speak on the opacity of government. “Very few things are transparent in Nigeria. The concept of Sukuk is not a bad idea. It came on board when the world started looking at Islamic banking from a different perspective. Governments look for investments from ethical investors.

“We shouldn’t write Sukuk off entirely, but the issue around transparency should be delved into squarely. People need to continue to talk to put the government on its toes on transparency and accountability.”

Nigeria’s Multi-billion Naira Sukuk Borrowings

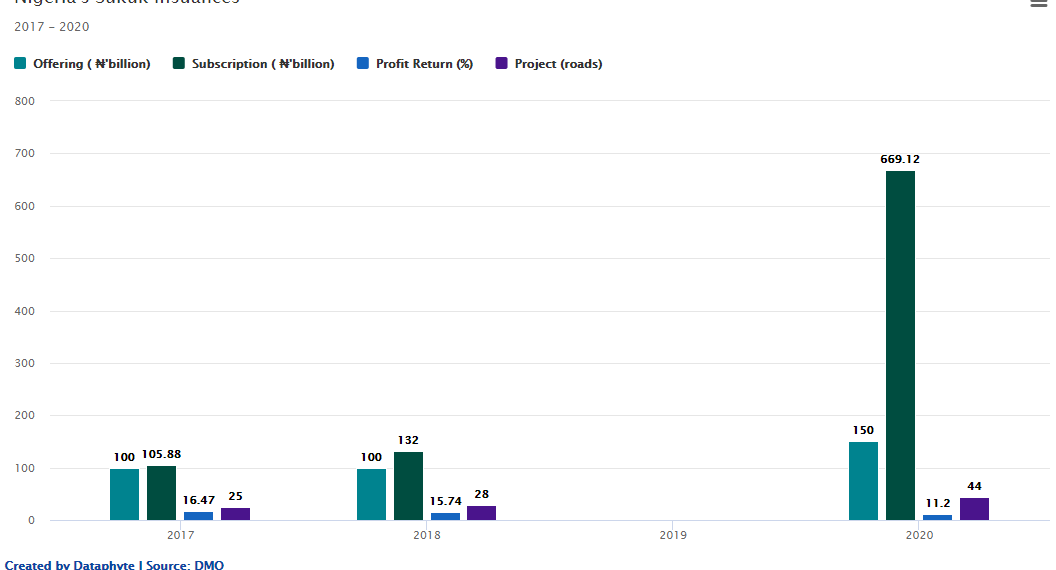

In June 2020, the Debt Management Office (DMO) reported that investors oversubscribed to Nigeria’s third Sovereign Sukuk at ₦669.124 billion. It represented a 446 per cent increase from the initial offer of N150 billion. According to the DMO, investors that participated in the Sukuk include Ethical Funds, Insurance Companies, Fund Managers, and Retail Investors, among others. The Debt Office said the participation is in line with the objectives of diversifying investors for FG securities.

The first issue in 2017, at ₦100 billion, attracted a total subscription of ₦105.88 billion. The issuance, according to DMO, was for the construction and rehabilitation of 25 roads selected by the Federal Ministry of Works. Some of these roads were the reconstruction of Bida-Lambtata road in Niger state, rehabilitation of Gworza – Damboa – Goniri – Ngamdu Road in Yobe/Borno states, and construction of Ikom Bridge in Cross River State. Others are Ibadan-Ilorin Rd, Kolo-Otuoke-Bayelsa-Palm Rd, Enugu-P/Harcourt Rd, Kaduna Eastern By-Pass, Kano-Maiduguri road, and Loko-Oweto Bridge over River Benue.

In 2018, the second Sukuk for N100 billion, a 7-year tenor at 15.74 per cent received subscriptions of over N132 billion. The last offer was ₦150 billion with a total subscription of ₦669.12 billion, representing a subscription level of 446 per cent.

The DMO said it allotted ₦162.56 billion to investors in the third Sovereign Sukuk. The proceeds will also be used to finance 44 critical road projects.

Year | Offering ( ₦’billion) | Subscription ( ₦’ billion) | Period | Profit Return | Projects |

2017 | 100 | 105.88 | 7 years | 16.47% | 25 Roads |

2018 | 100 | 132 | 7 years | 15.743% | 28 Roads |

2020 | 150 | 669.124 | 7 years | 11.2% | 44 Roads |

Source: DMO

The Minister of State for Works and Housing, Abubakar Aliyu, had said part of the latest Sukuk would fund expansion, reconstruction, and rehabilitation of Lagos-Ibadan road, Construction of Second Niger Bridge and the Rehabilitation of Abuja-Kaduna-Kano Dual Carriageway.

No Adequate Details on Sukuk Financing

Despite the enormous advantage of Islamic financing for human capital and infrastructural development of nations, there is a transparency gap in Nigeria’s Sukuk programme. Although the essence of the programme is for road infrastructure in the country, the full list is not known to the public. Transparency is key in government finances for stakeholders to scrutinise and follow through on the usage of the loan.

Section 44 of the Fiscal Responsibility Act (2017) mandates the Debt Management Office (DMO) to maintain a comprehensive, reliable, and current electronic database of internal and external public debts, guaranteeing public access to the information. But this is not the case in Sukuk instruments.

Several calls made to the official line of the DMO dropped. Email correspondences sent to the official email for comment were unattended to. Efforts to reach the Ministry of Works and Housing also proved abortive. The handler of the Ministry’s account on Twitter also refused to respond to this reporter’s message.

Stakeholders Want More Transparency, Question Interest Return on Sukuk

With less than 4 years to the full repayment of the first Sukuk issuance at 16.47 per cent, stakeholders believe the FG’s Sukuk has many questions begging for answers. They queried the high-interest rate and how an ethical instrument can fund non-business or profit-making activities such as non-tolled roads.

Barr. Eze Onyekpere, Lead Director at the Abuja-based Centre for Social Justice (CSJ), faulted the FGs claim on Sukuk, saying it is quite different from an Islamic perspective type of Sukuk.

“How do those roads generate income that would be distributed among investors at the end of the year? And we were made to believe those roads will not have toll gates,” he quizzes.

Barr. Onyekpere said the Sukuk programmes did not follow the letter and spirit of the Fiscal Responsibility Act.

“They have not been done in the letter and spirit of the Fiscal Responsibility Act. To ensure this, you must have done a cost-benefit analysis and ensure they come in low-interest rates.”

“If a loan has an interest rate, are they still Sukuk? Do we need to ask our Islamic scholars? “So, where is the Sukukness of the Sukuk Bond.”

“It is purely an opaque system of government, and they (government) keep doing it.”

Atiku Samuel, a policy analyst, said there is a need for the government to make open details of the Sukuk programme. “Nigerian citizens need to know what the memorandum is all about, the investors, and all the project

“We need to know the cost implication of those projects and ensure it is not just to satisfy some ethical concerns.”

Mr Damen Ilevbaoje, Head, Tracka (a subsidiary of BudgIT), told Dataphyte that there are a lot of underlying transparency issues on the road projects embarked upon with the Sukuk bond.

“Transparency is a big issue in Nigeria, and there are a lot of underlying factors, some questionable projects, and on work execution so far.

“If they are transparent, we should be able to know how much they have spent or budgeted for those road projects,” he explained.

Mr Ilevbaoje said the execution of road projects around the Kano and Katsina axis has been satisfactory so far. But he condemned the slow pace of work at Enugu, Port Harcourt axis while unsatisfied with the Ibadan – Oyo – Ogbomoso as well as Edo axis of the road projects.

Nigeria needs to follow the Asian example. In Asia, Islamic bond (Sukuk) remains one of the debt instruments used in funding public or private infrastructure (or combined public-private) projects. For instance, Sukuk has been successful in Malaysia because of the openness of the government. The adoption of best practices and transparent processes in Sukuk issuance will boost investors’ and citizens’ confidence and thus eliminating trust deficit issues in the market. Also, to achieve overall development, the Nigerian government must open up its fiscal books inline with the Fiscal Responsibility Act. The Act provides for prudent management of the nation’s resources, ensures long- term Macroeconomic stability of the National Economy, secure greater accountability and transparency in fiscal operations. Where there is transparency, taxpayers would be able to track and monitor the benefits of Sukuk issuances.