Dataphyte’s policy brief discusses Nigeria’s position in the African Continental Free Trade Area (AfCFTA) and its relationship with China in the context of the agreement. The AfCFTA aims to increase intra-African trade by liberalizing tariffs on up to 97% of goods produced within the continent.

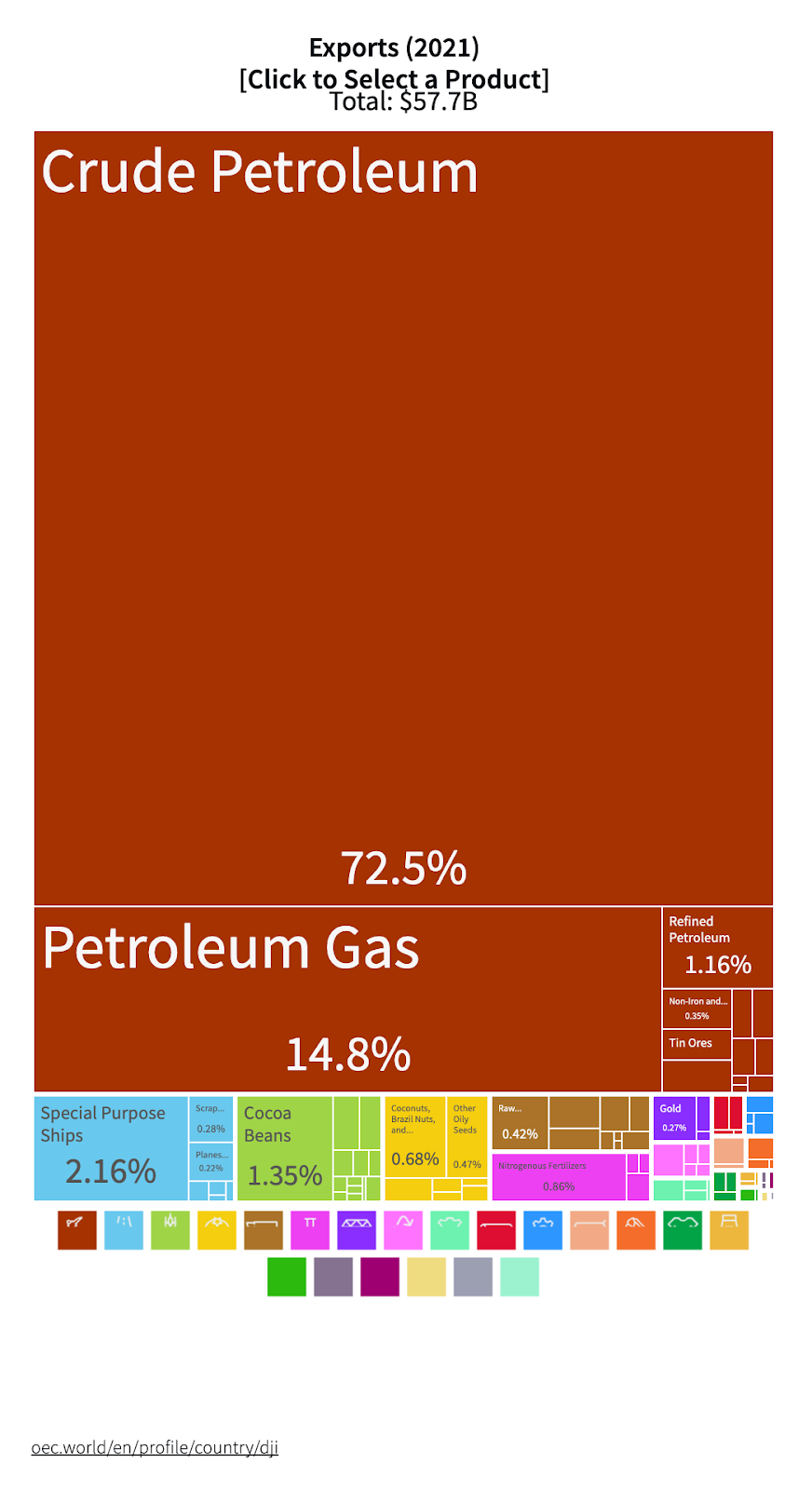

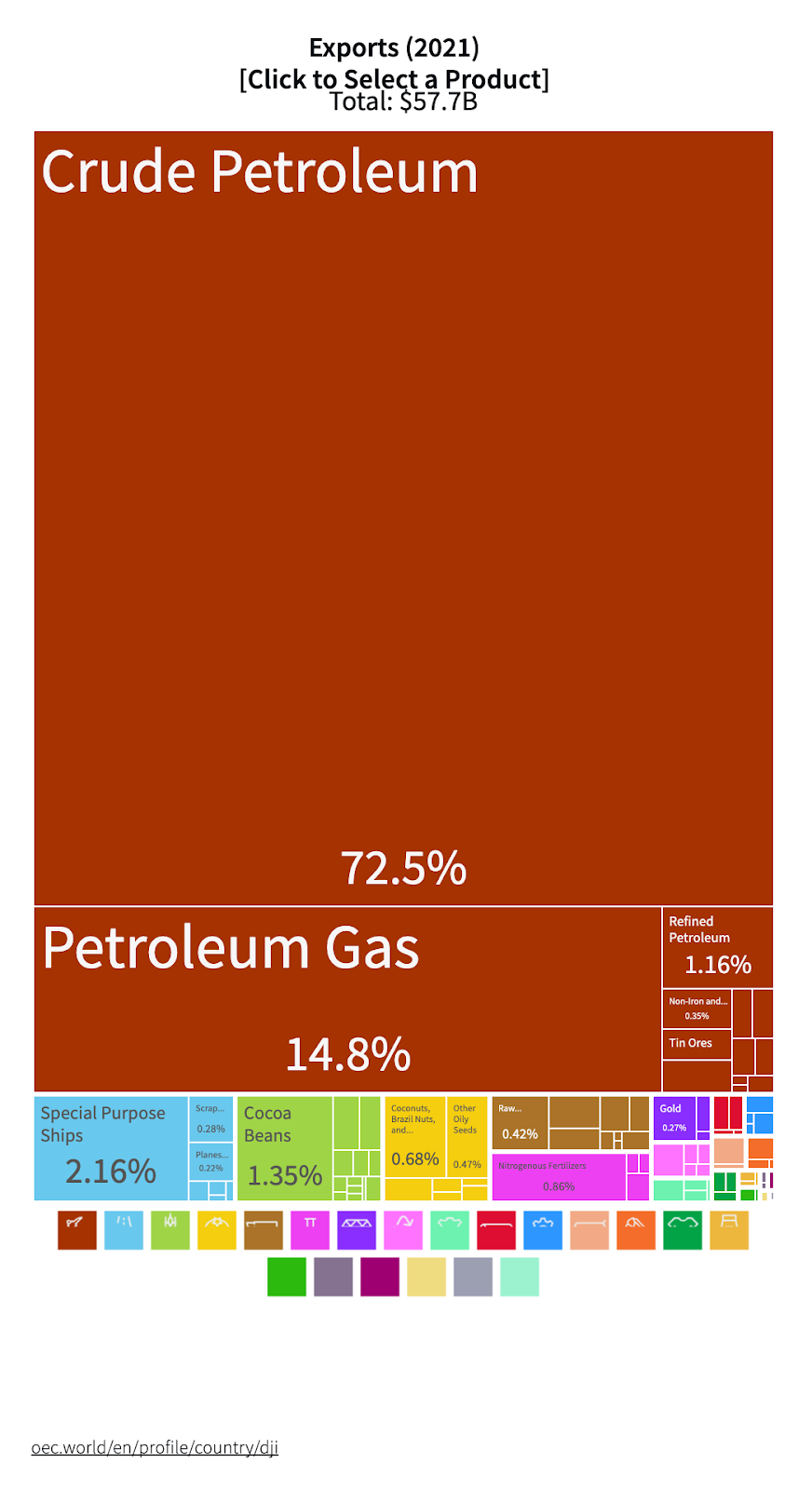

However, Nigeria’s reliance on oil and gas exports and its low productive capacity reduce its competitiveness in the free trade area. To strengthen its position, Nigeria needs to better leverage its partnership with China, which has its own investment and trade interests to protect.

The agreement has benefitted from high political will, with 54 African Union (AU) Member States signing and 46 ratifying it. Nigeria has signed and ratified the AfCFTA agreement, but it has faced resistance within the country due to its dependence on oil and gas exports and poor manufacturing competitiveness.

Nigeria is entering the AfCFTA primarily as a major importer with limited productive capacity to meet the demands of the continent. China, on the other hand, is argued to be one of Africa’s major trading partners and is well-positioned to benefit from the AfCFTA due to Africa’s dependence on its exports, capital, and expertise.

Teniola Tayo and Muhammed Badamasi, project that “if President Bola Tinubu’s new government accepts the task of providing leadership in Africa-China affairs, this could launch a new era in Nigeria’s external relations.”

Nigeria: Beyond Protectionism

Nigeria was initially reluctant to sign the AfCFTA agreement in line with its protectionist approach to trade, but eventually signed it on July 7, 2019. The country’s reliance on oil and gas exports and import of manufactured goods reduce its competitiveness in the free trade area. Additionally, Nigeria faces various business environment challenges and low productive capacity, which further reduce its overall competitiveness.

Figure 1: Petroleum Oil and Gas made up 88.5% of Nigeria’s Export Basket, 2021

.png)

Source: TradeMap (Accessed May 2023)

Source: oec.world (Accessed April 2023)

The industrial development disparity between Nigeria and South Africa may affect their gain from the AfCFTA. South Africa is far ahead of Nigeria in terms of industrial development, with manufacturing value added per capita at US$596 in 2021, compared to Nigeria’s US$213. A study predicted that South Africa would gain US$1.46 billion from the agreement, while Nigeria would gain US$146.12 million.

This has led to Nigeria focusing on services trade under the AfCFTA, but to fully leverage it, Nigeria needs to invest in improving the business and export environment, attract foreign and domestic capital, and strengthen its manufacturing sector.

China’s Proactiveness Before AfCFTA

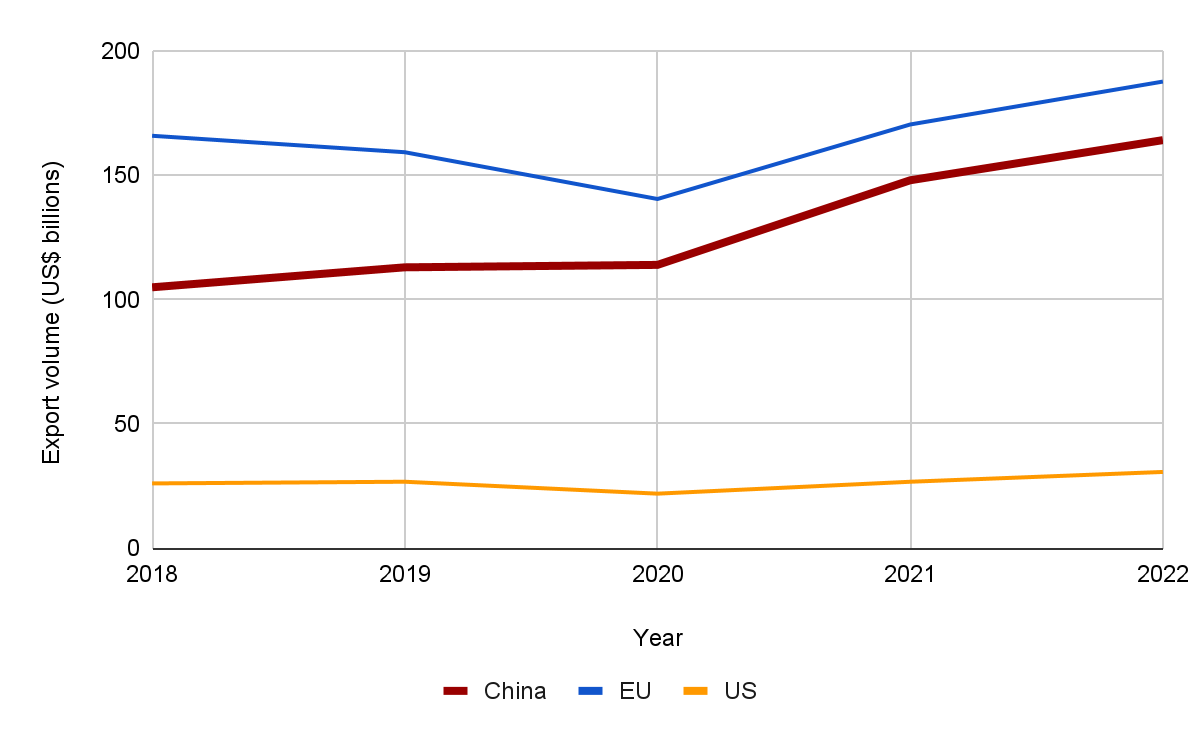

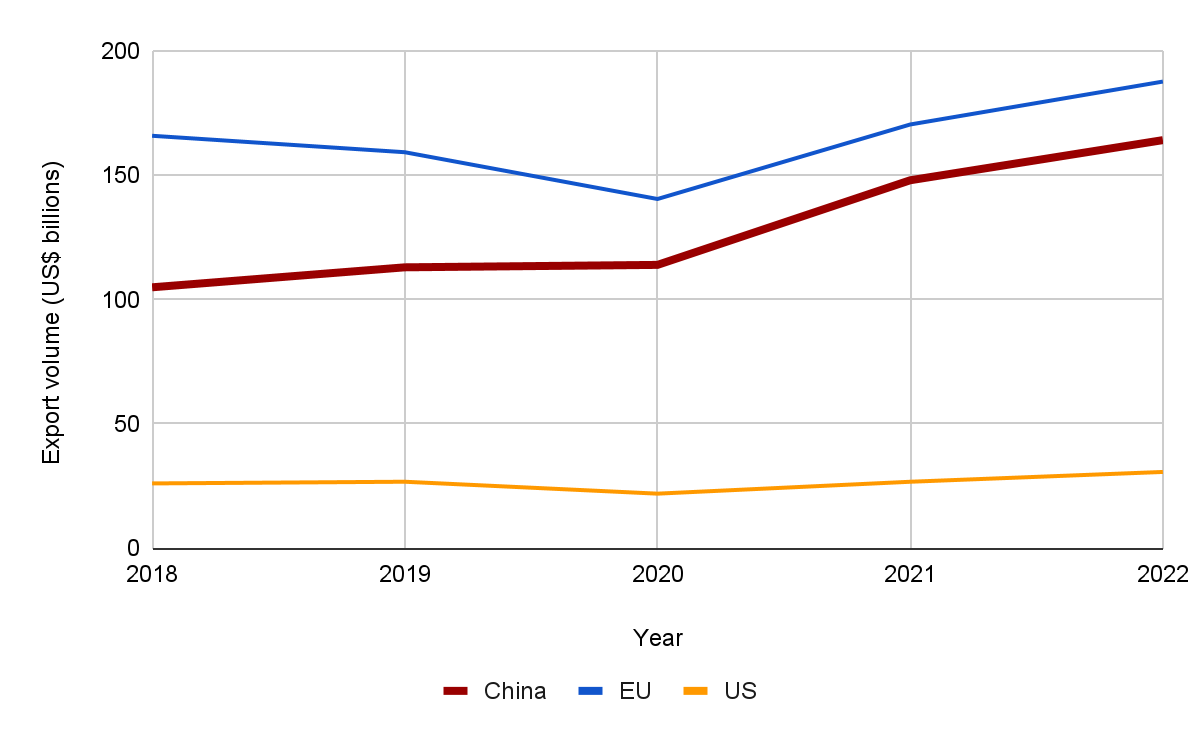

China has emerged as the top trading partner for many African countries, with a US$ 37.9 billion and US$46.98 billion trade surplus with Africa in 2021 and 2022, respectively, and the highest among Africa’s major partners. While increased intra-Africa trade is expected to result in a diversion of trade from China, it may take some time for African-made goods to compete favorably with Chinese imports.

Figure 3: Africa’s imports from major partners – China, the EU and the US (2018 – 2022)

Source: TradeMap (Accessed May 2023)

Depending on the final Rules of Origin requirements for the different goods and services to be traded under the AfCFTA, China is in a position to be the preferred source country for manufacturing inputs. Chinese infrastructure investment and development also strengthen its position within the AfCFTA.

Figure 4: Africa’s share of Chinese exports (2018-2022)

.png)

Source: TradeMap (Accessed May 2023)

However, the full implementation of the AfCFTA could eventually lead to a diversion of trade from China to proactive countries on the continent. More important is the potential for African industrialization, which may make raw material and commodity imports less available for China.

African countries need to be more tactical in their engagement with China in light of the AfCFTA, and Nigeria, in particular, can either be one of the biggest winners or losers under the agreement.

Continue reading

.png)

.png)