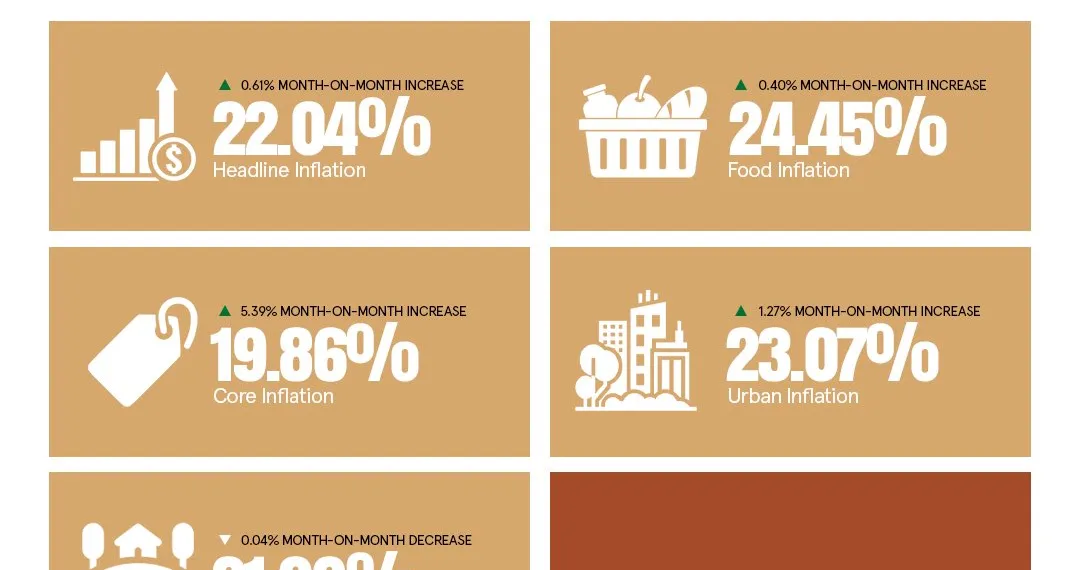

Nigeria’s inflation rate has increased for the third consecutive month since December 2022. Inflation rose from 21.91 percent in February to 22.04 percent in March 2023.

Inflation keeps a greater percentage of the masses under pressure, causing business owners to either raise their prices to stay afloat or take loans to remain relevant.

Price increases have taken a toll on the standard of living of citizens, with many jumping into poverty . Those mostly hit are the small businesses and households with fixed incomes.

Small businesses are the fulcrum of the Nigerian economy, accounting for 96 percent of businesses in the country and employing 84 percent of the population, according to the National Bureau of Statistics (NBS).

While the prices of goods and services continue to increase, fixed income earners feel the pinch. Workers’ salaries have stayed the same since 2019 when the minimum wage was increased from N19,000 to N30,000 monthly.

This has diminished consumers capacity to meet their needs as their real income and purchasing power decline rapidly.

The fluctuations in exchange rates have worsened the pressure on the fixed income earners. The naira has continued to weaken in relation to the dollar and other currencies, leading to further price increases, especially for imported products.

.png)

This is the case as the country imports over 90 percent of its products. The heavy reliance on imports has seen the country’s import bill rise to $10 billion to meet its food and agricultural production shortfall, amongst others, according to the International Trade Administration, a United States agency.

Households groan

An Abuja resident, Joyce Akombo, lamented the alarming price increases and uncertainties, wondering how families had been able to cope with the current state of galloping inflation.

Ms Akombo said she couldn’t work with a budget anymore as the prices were changing rapidly.

A resident of Cross River State, Emmanuel Ukpo, has had to forgo some of his projects because of rising prices.

“Before now, the cost of transportation from my residential apartment to my place of work was between N9,000 to N10,000 per month. But it’s over N16,000 (over 50 percent increase) now. This has made me put off many of the things I intended to do, especially as salaries do not increase with inflation,” he said.

A single mother, Janet Donald, said she and her daughter were facing hard times,

“I have to resort to taking loans from loans app to keep body and soul together,” she said.

Small businesses struggling to break even

Small business owners are mostly hit by the galloping inflation Some say they do business at a loss, while others admit they are trying to stay afloat.

A Lagos-based vendor who deals in perfume, Mary Daniels, said the price increases had made things difficult for her.

“I have to do a lot of convincing to be able to sell at new prices to my customers. Most of the time, I end up selling at a loss to my old customers as they are used to the old prices,” she said.

Ms Daniels noted that she just had to go on, not minding the losses, noting that she sometimes had to cover up for the loss while selling to a new customer.

A food vendor in Makurdi, Benue State, Victoria Ododo of Oooh’s Delight, said she bore the loss as a businessperson.

“Imagine making stew for someone a week before where a kilo of meat was N2500 and a bucket of tomatoes, N1500. A week later, the same person places an order, and this time, a kilo of meat has gone up to N3000 and a bucket of tomatoes is N2500. It feels absurd telling the customer that prices have increased by almost 50 percent, within the period,” Ms Ododo explained.

She said it was difficult to explain these changes to old customers, noting that new customers could easily cope with current market realities than old clients

The story is quite similar for a Lagos caterer, Queen Wando, who said inflation was hurting most businesses. Her concern was that the price fluctuations could drive away her reliable customers.

“If you give me an event to cater for, let’s say, in May, and I give you a cost price of items and my workmanship, if the event is postponed to November, the previous cost submitted will automatically be disregarded,” she said.

An Abuja trader, Olamide Sanni, has had to increase the prices of his items to be able to restock after sales. He has devised a means of making inflation allowance in his budget to cater for the frequent price increases.

“Now, I budget extra for whatever I am buying, and when I sell, I also increase my prices so that it won’t be an issue for me if I want to replace what I sold,” he said.

Policy makers making wrong decisions

An economics lecturer at the Benue State University, Dr Princewill Okwoche, said the current inflation trend could be attributed to supply-side factors.

“Topmost of these factors are conflict and terrorism, which affect production and disrupt the supply chain. Our dependence on imports is now taking its toll through currency depreciation and increases in production costs,” he said.

Dr Okwoche said the government was responding to inflation as though the issues had been caused by demand-side factors, noting that the use of interest rates to curtail inflation would yield little results.

This was also the position of the former Director-General of the Lagos Chamber of Commerce and Industry, Dr Muda Yusuf, who said the central bank’s use of interest rates to rein in inflation would come to nothing.

He explained that the fiscal side of the economy must come in to resolve supply-side issues to reduce the rate of inflation.

A business analyst, Dr Abdulsallam Yusuf, said business survival in the face of inflation depended on whether changes were sustainable or transient.

Dr Yusuf said service-oriented businesses such as hair salons, laundry services, among others, faced “sustained effect,” noting that it was better to temporarily endure a reduction in profit margin to retain the customer base.

.png)