The Commercial Banks in Nigeria hold the largest value of customers’ deposits among other banking institutions, which include merchant banks, micro-finance banks, and others. Their time and savings deposits made up 97% of all deposits in the banking sector between May and December 2018, showing their gigantic capacity to create money in the economy through credits.

However, recent data from the National Bureau of Statistics (NBS) on the borrowing pattern from Nigeria’s deposit banks between 2015 and 2017 reveals that while these banks gave loans to all categories of persons and business entities, there was a marked and consistent discrimination against micro, small and medium business groups, that resulted in the lopsided distribution of these credits.

For instance, a total of 13.192 trillion naira was awarded as loans to a group of customers that could each borrow over a billion Naira from Nigeria’s deposit money banks in 2017 alone. Conversely, a paltry sum of 122 billion naira was given as loans to the group of customers whose credit ceiling was 1 million naira in that same period (see chart above).

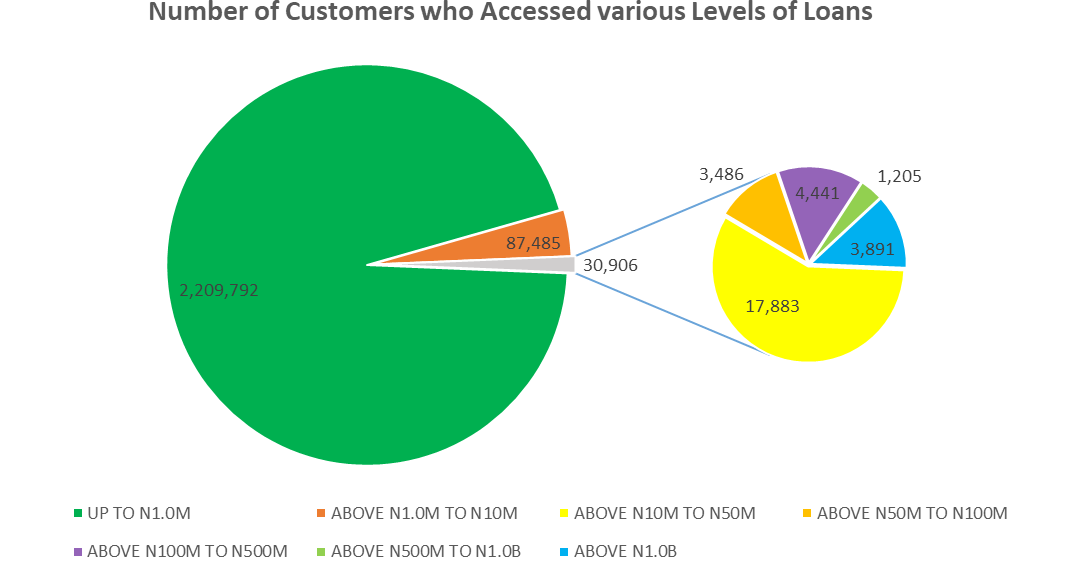

However, this group, made up of individuals and firms that cannot each access more than 1 million naira loans, make up 95% of all customers that borrowed from these banks (see chart below). Yet, these group received less than 1% of the total bank credit finance, which amounts to 122 billion naira only, the least amount among the 7 categories of borrowers.

While this most populated group has over 2.2 million persons or business entities (2,209,792), the group that received the highest loan have below 4 thousand customers in number (3,891). The latter group with very few persons and firms, however, got the highest share of 83% of the total credit finance from Nigerian deposit money banks, that amounted to 13.2 trillion naira (see first chart above).

These figures show that 83% of the credit money available for the seven categories of borrowers was loaned to only 0.2% of those customers (see chart below). This means 83% of total loan money available is not accessible to 499 out of 500 customers in critical need of loans to finance their business plans. In a twist of fate, an insignificant 1% of total loan money available was hoarded to 95% of all who accessed credit finance (see chart below).

Going by the Bank of Industry’s (BOI) classification of Micro, Small and Medium Enterprises (MSMEs), with regards to the range of loans each group could receive (see table below), it follows then that all the Micro, Small and Medium Enterprises shared 3%, 3%, and 6% respectively, of all loans commercial banks disbursed in 2017. While the Large enterprises and Big Corporates secured 5% and 83% of all loans disbursed that same year.

Though the Central Bank of Nigeria (CBN) acknowledges that adequate financing of MSMEs helps in “stimulating economic growth, developing local technology and generating employment”, yet, “compared to other emerging markets, Nigeria has historically shown lack of commitment to building a strong SME sector”, opines Professor Banji, Oyelaran-Oyeyinka, Director Monitoring &Research Division (UN-HABITAT).

This explains why only 12% of the total loan amount from all commercial banks was shared to MSMEs who make up 99.8% of all borrowers, and why according to the Enhancing Financial Innovation and Access (EFIA) report, about half of Nigerian adults still lack access to basic financial services.

MSMEs, the world over, remain the “vehicles for rapid industrialisation, sustainable economic development, poverty alleviation and employment generation”, admits the CBN, but it needs to work with the Federal Government to further incentivise Commercial Banks to create substantial funds to finance Nigeria’s potentials for industrialisation.