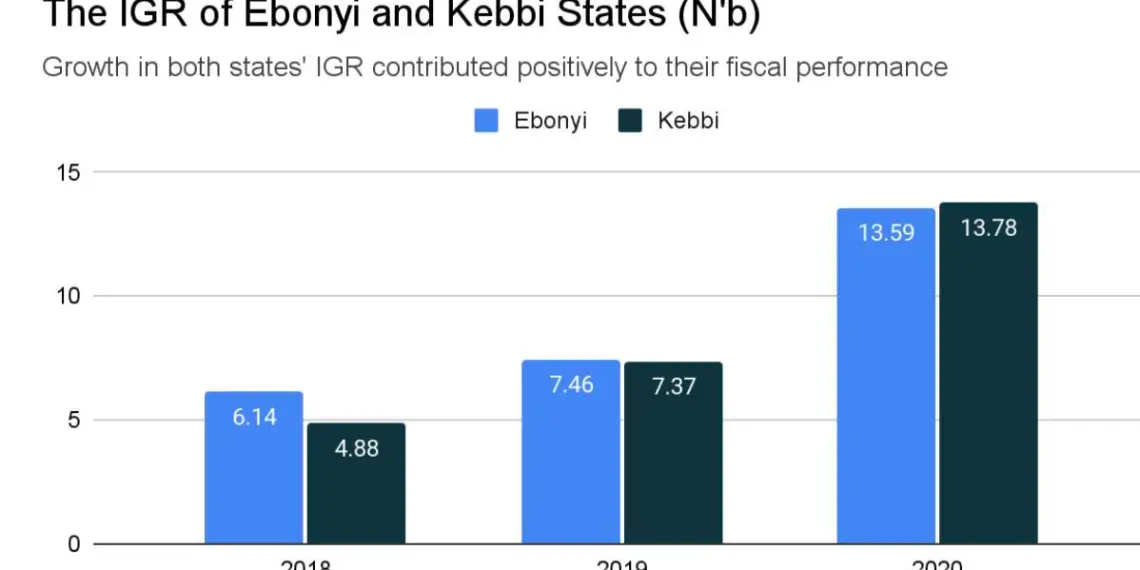

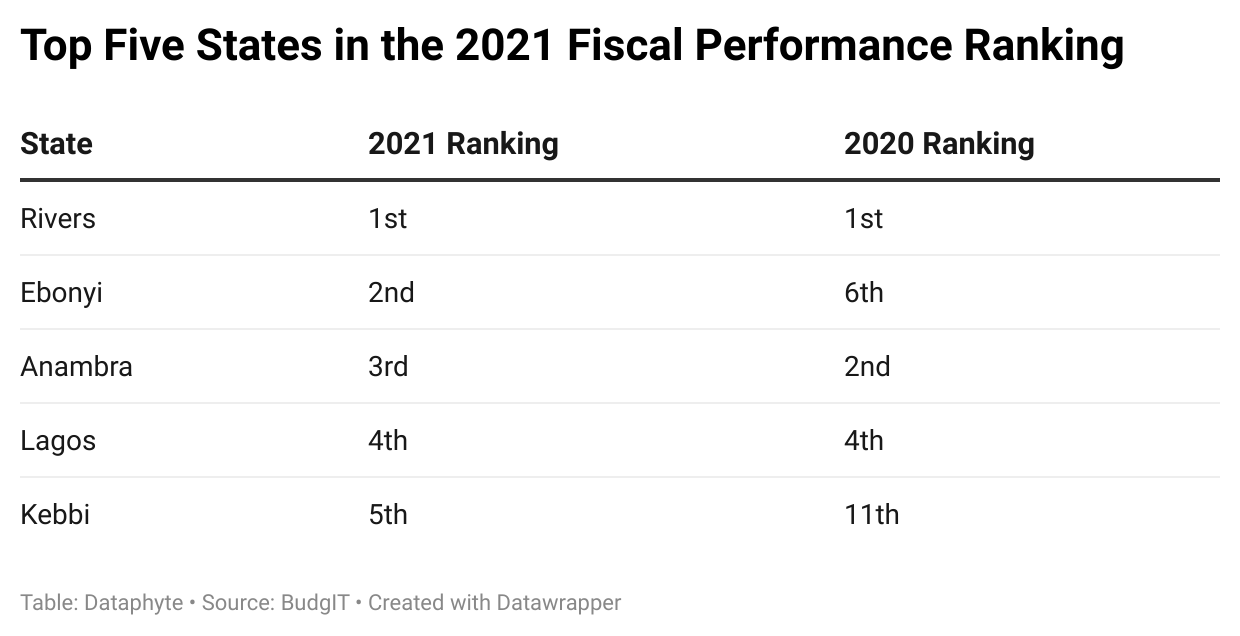

Ebonyi and Kebbi states emerged as outlier states in the 2021 edition of the State of States report by the BudgIT foundation.

The State of States report is an annual publication of BudgIT which describes the fiscal policy of the 36 states of the federation and ranks them according to the fiscal activities for the year. The 2021 edition of the report revealed that Ebonyi and Kebbi states improved their fiscal performance. Thus, debuting in the top five states in this year’s fiscal performance ranking.

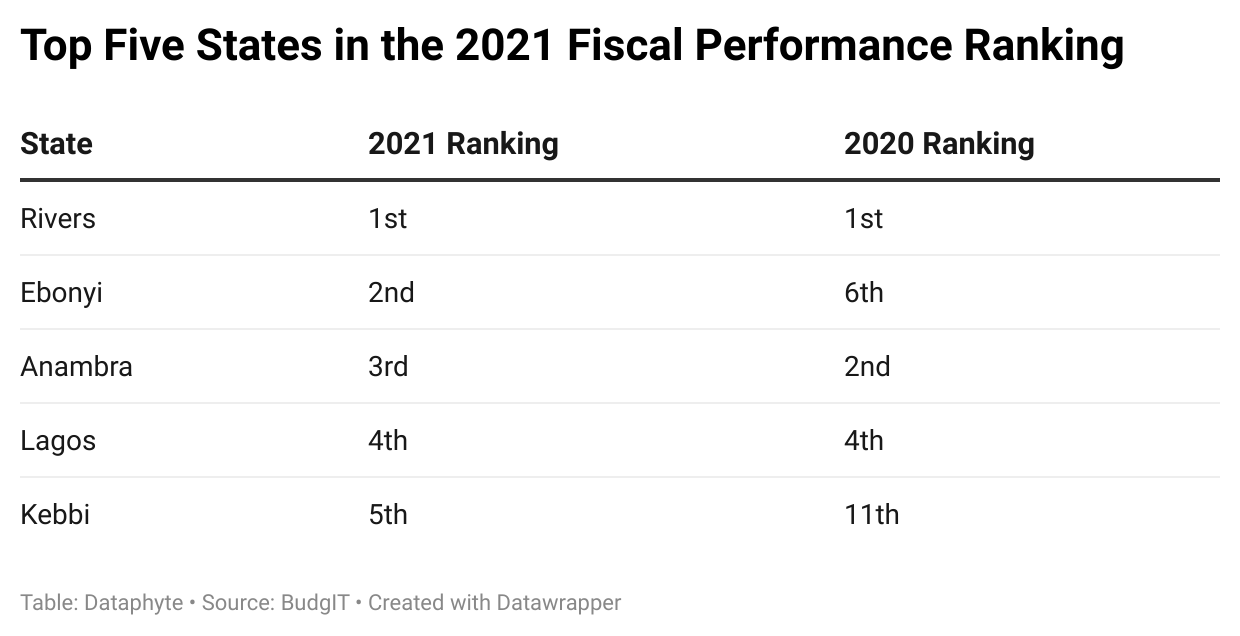

Ebonyi moved up to 2nd position from its 6th place in the previous ranking, while Kebbi emerged 5th position moving from its 11th position in the 2020 ranking. The performance of the two states is connected to the growth in their internally generated revenue (IGR) which was noted in a report by Dataphyte in April. The report spoke to the growth in the fiscal sustainability of Ebonyi and Kebbi states with respect to the IGR recorded between 2018-2020.

In the report, Dataphyte noted that even with the impact coronavirus had on economic activities of the states, the IGR of Ebonyi and Kebbi increased by 82% and 87% respectively. In 2019, the IGR of Ebonyi stood at N7.46 billion and by 2020, it was N13.59 billion. Kebbi also increased its revenue from N7.37 billion to N13.59 billion within the same period.

-1708892855.png)

The increase seen in both states’ IGRs were largely attributed to their tax policy, amongst others. Dataphyte noted that between 2018-2020, Ebonyi state recorded an increase in their Pay As You Earn (PAYE), Direct Assessment, Road taxes, MDAs revenue and other taxes.

Another performance driver that was attributed to Ebonyi state’s emergence as one of the top five states in this year’s fiscal performance ranking was its emphasis on infrastructural investment. BudgIT noted that 72.02% of the state’s spendings in 2020 were capital expenditures, while operating expenses was 27.98%

Although Kebbi state spent more on operating expenditure than capital expenditure, its IGR growth is attributable to the increase in its MDAs revenue and other tax components of the IGR. Thus, strengthening its fiscal performance.

IGR, as explained by Olayinka and Phebe in their research, serves as a major tool for infrastructural development in a state.

They further noted that as the state government raises more revenue internally, it leads to more commissioned projects, more money in circulation, more job and business opportunities as well as improvement in the standard of living of the people in the state.

The growth in the IGR of Ebonyi and Kebbi states in recent times should ideally result in infrastructural development, create more job opportunities and improve the standards of living of the residents of the states further strengthening its fiscal sustainability.

Ebonyi state ticks four index fiscal performance ranking in BudgIT’s report

Four indexes were used in ranking the 36 states’ fiscal performance.

The first index focused on the ability of states to meet their operating expenses and carries the highest score of 45 points. The second index with 35 points is on the ability of the states to cover their total operating expenses and loan repayment without having to borrow. The next index which carries 10 points is on the fiscal power of the state to borrow more given its low debt burden and how much it generates in a year. The final index is on how much priority a state placed on capital expenditure over recurrent expenditures. This also carried 10 points.

Of the 36 states, Ebony is the only state that ticked all four indexes. It ranked 4th in the first index category behind Anambra, Rivers and Lagos with a score of 0.70. In the second index, the state took the lead with a score of 0.47. For the third index it received a score of 0.38, taking the 4th position. In the final index, it also came 1st with a total score of 0.39.

With only a few weeks until the end of 2021, state governors have begun presenting their 2022 budget to their respective houses of assembly, President Buhari also did the same recently. For states to improve their fiscal sustainability in the coming year, they may need to pay more attention to the high level of unemployment and underemployment in their states and also improve their IGR.

It can only be hoped that states have paid attention to reports such as state of the states and placed emphasis on the right fiscal sustainability markers.

-1708892855.png)