The Nationa Bureau of Stattistics’ (NBS) Telecoms data for the fourth quarter of 2019 has revealed that a total of 184,699,409 subscribers were active on voice calls in Nigeria. Also, 126,078,999 subscribers were active on internet during the period under review. According to the report, Nigeria recorded an increase of 3.08 percent and 2.37 percent on voice and internet subscription respectively between the fourth quarter of 2018 and the fourth quarter of 2019.

Currently, Nigeria’s population figure stands around 205 million. By implication, about 90 percent and 61.5 percent of the population subscribed to voice and internet telecommunication services, respectively. Despite the high level of technical compliance in the telecoms sector, financial exclusion is still high in Nigeria.

Only 39.7 percent of Nigeria’s 99.6 million adult population were banked as at 2018. This means that about 60.7 million Nigerian adults are outside the reach of financial and banking services. According to a report, only one in every five adults and 38 percent of households have a formal Bank account. This includes both commercial banks and other financial institutions such as microfinance institutions (MFI), cooperative societies, and savings associations.

Financial exclusion of individuals and households in Nigeria has been strongly connected to poverty and poor living standards. Excluded people have limited access to credit facilities that can aid their productivity. During this period of COVID 19 pandemic, exclusion of poor households has generated discussion on the reach of government’s palliatives and other series of concerns on accountability. Connected to this are the concerns on cash disbursement rather than through back accounts.

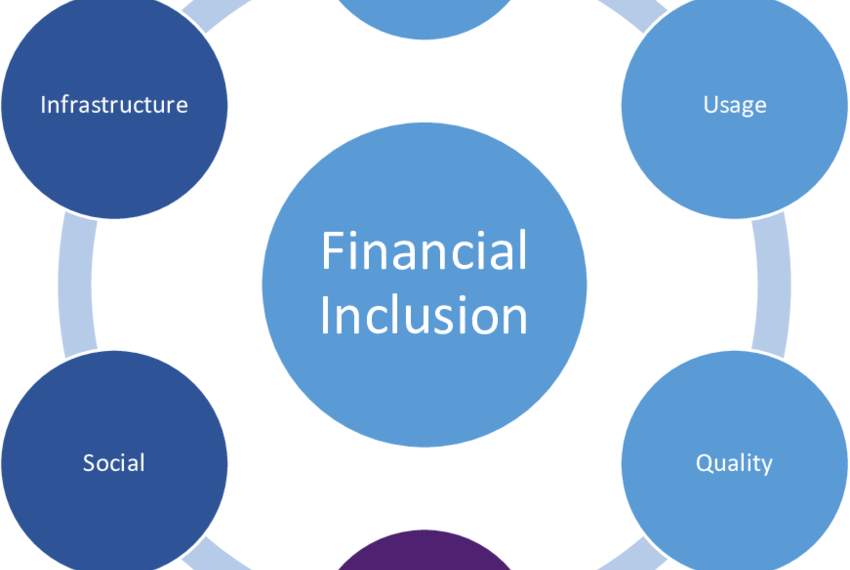

Challenges of Financial Inclusion in Nigeria

But the extent of telecommunication penetrations in Nigeria suggest that a more financially inclusive Nigeria is possible. For instance, in the North-East that has the highest poverty rate, over 17 million people were on active subscription to voice telecommunication services. A total of 11.6 million people were active subscribers to internet services as at 2018. Thus, financial inclusion is achievable across the country.

However, while the Nigerian regulatory environment may be partly responsible for the financial exclusion challenge, there are indications that poor perception and ignorance have also contributed to the exclusion challenge. Perception tending towards high bank charges and time-consuming queues at banks have discouraged some Nigerians from formal banking services.

Way out

To solve some of the deficit on financial inclusion, existing subscription to telecommunications services can provide a leverage. Through Fintech, telecoms companies can collaborate with financial institutions to expand financial coverage in the country. the government can also step in to facilitate the arrangement. Reduced requirements for account registration can also expand the scope of financial services.

In addition, citizens need exposure to financial literacy programs. This will disabuse many of the erroneous perceptions held against financial institutions and services. Mobile agents can help break the distance barrier in many communities and take banking closer to the people. At the same time, banking institutions should improve the operational efficiency. This should attract more Nigerians and improve their experience.