+Why Commuters Fare Better Now

Dear Esteemed Reader,

It’s a pleasure to introduce to you the next newsletter from Dataphyte’s Insight Team. We’re so inspired by your acceptance of Marina and Maitama, our Thursday Newsletter. And here’s the next: Pocket Science!

Pocket Science offers tips to individuals and families on navigating tough economic waves in the country and the Diaspora – for staying afloat during inflation or positive during economic downturns, finding opportunities in adversity or building wealth and buffer savings for seasons of austerity.

We’ll expose the invisible hands that fuel pocket crises, explore turning hobbies into profitable ventures or starting a successful side hustle, explain DIY home repairs or thrift shopping, and all the networking you need to thrive in a gruelling economic climate.

It all begins with a personal Budget!

Most Nigerians spend over 50% of their income on food, one of the highest proportions of personal income spent on food around the world.

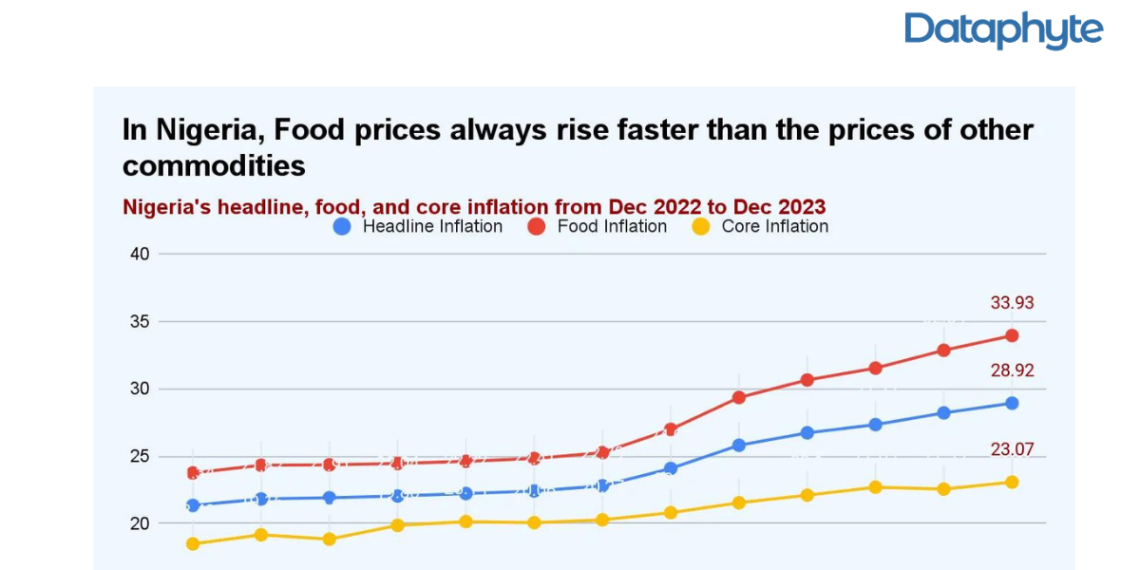

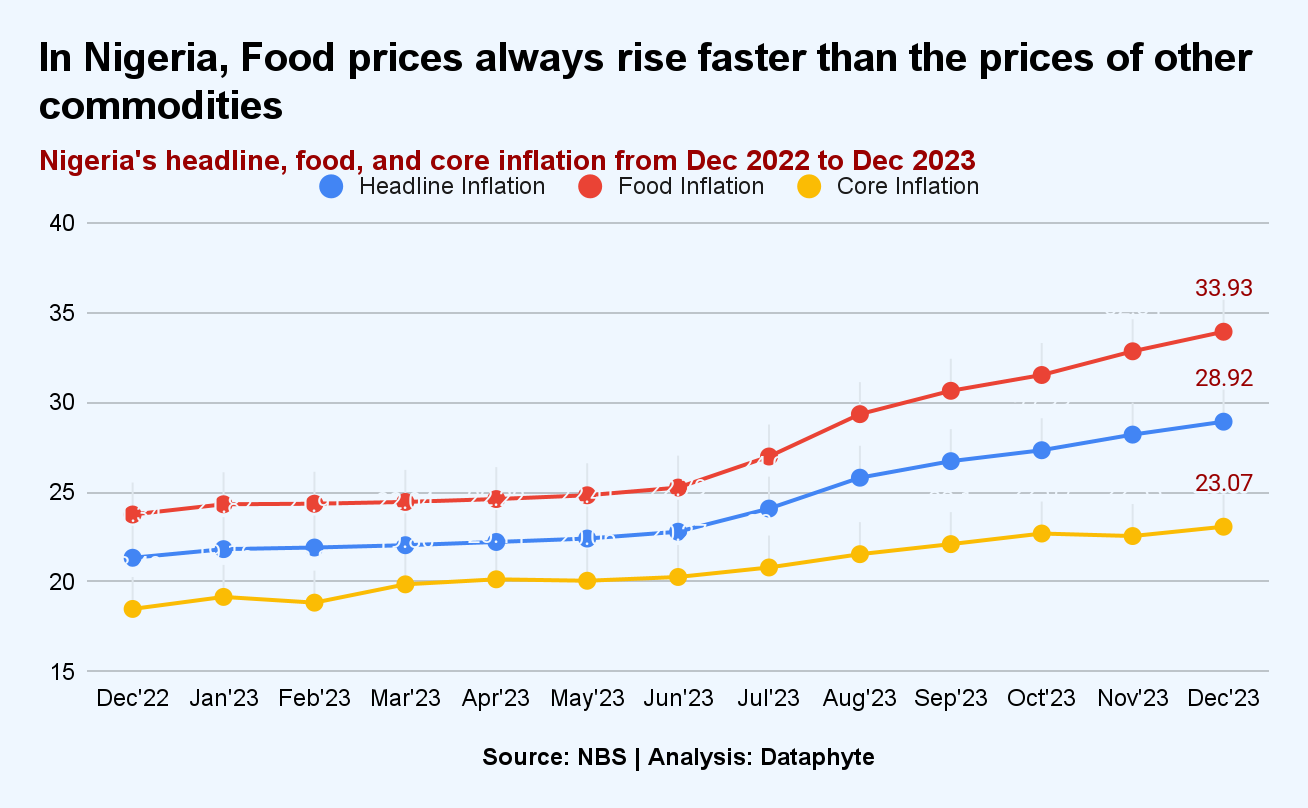

On the one hand, this is largely due to relatively high prices of agricultural products and skyrocketing food inflation month on month and year on year.

Food consumption is inevitable. So, people can’t evade the high costs of food purchases.

Huge Food Budgets

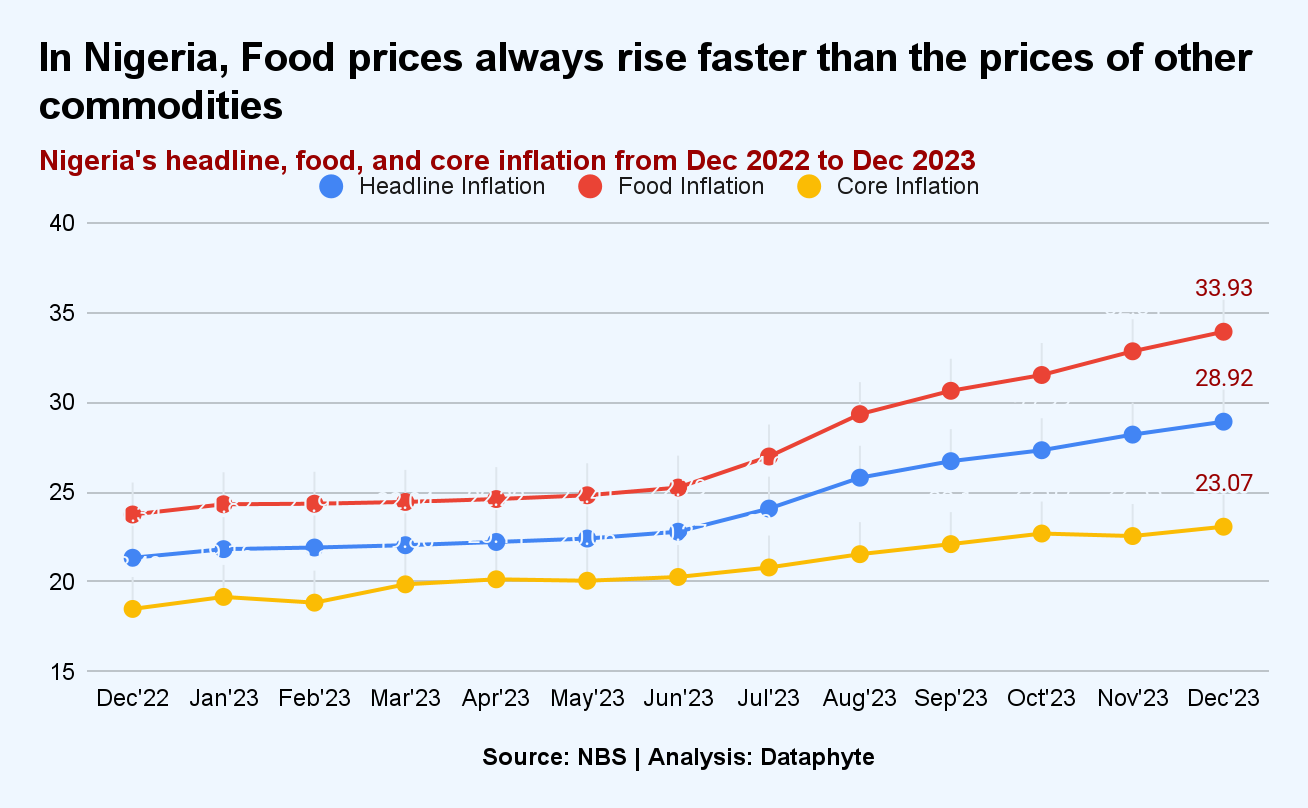

Food inflation has always been higher than other types of inflation in Nigeria due to a decades-long dearth of basic infrastructure and investments in agriculture in the country.

So, if you can survive food prices, you can survive any other expenditure.

So, if you can survive food prices, you can survive any other expenditure.

And this is how: You are either earning an income well above the average cost of living in Nigeria, or you are not earning that much but applying some smart pocket science!

Half Full Pockets

Well, 41% of over 200 million Nigerians don’t earn that much. They live below the contrived national poverty line.

So, on the other hand, the majority’s low income makes food either unaffordable or a threat to their half-full pockets.

This shows why Nigerians need to buy smart and cut costs where possible.

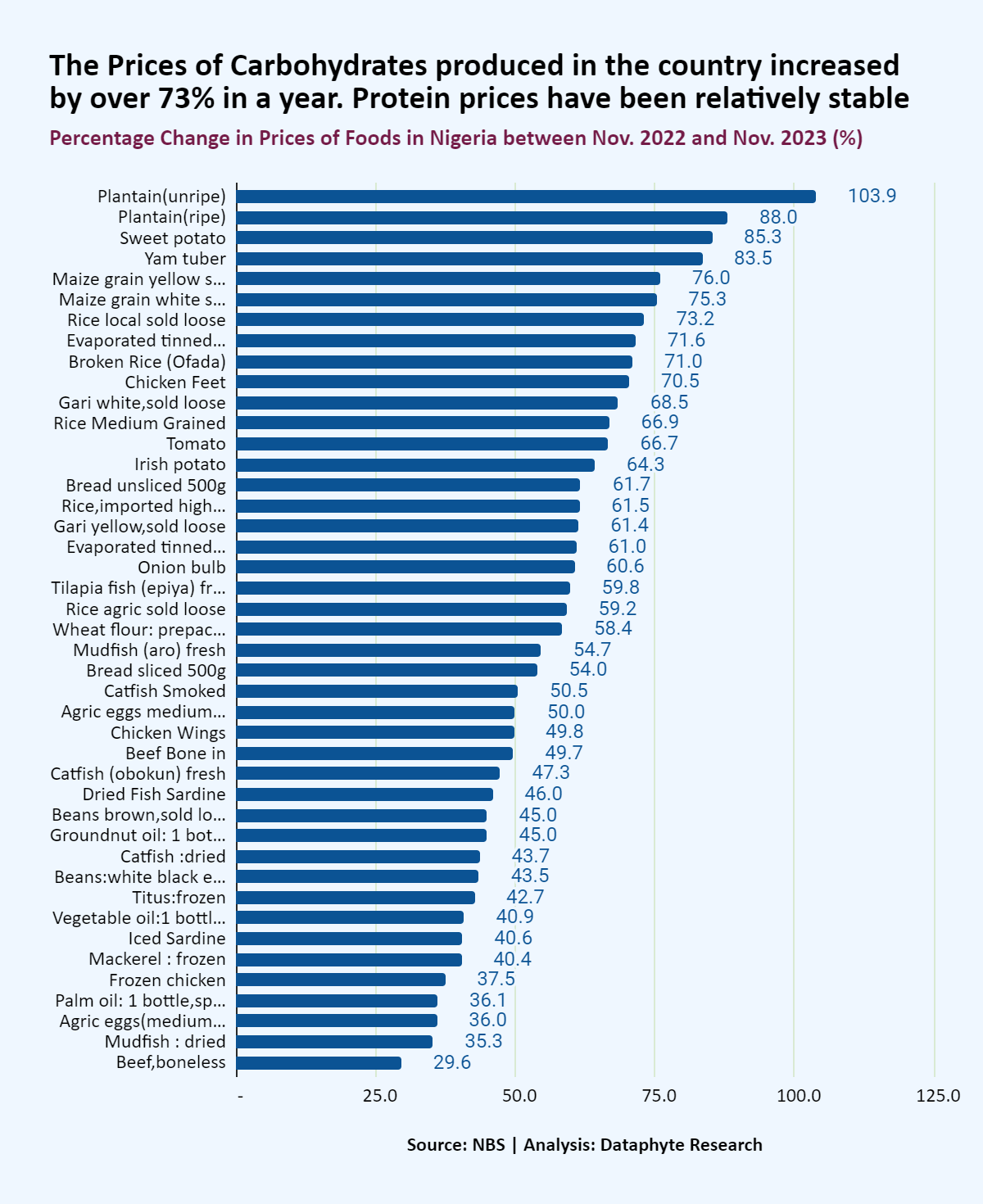

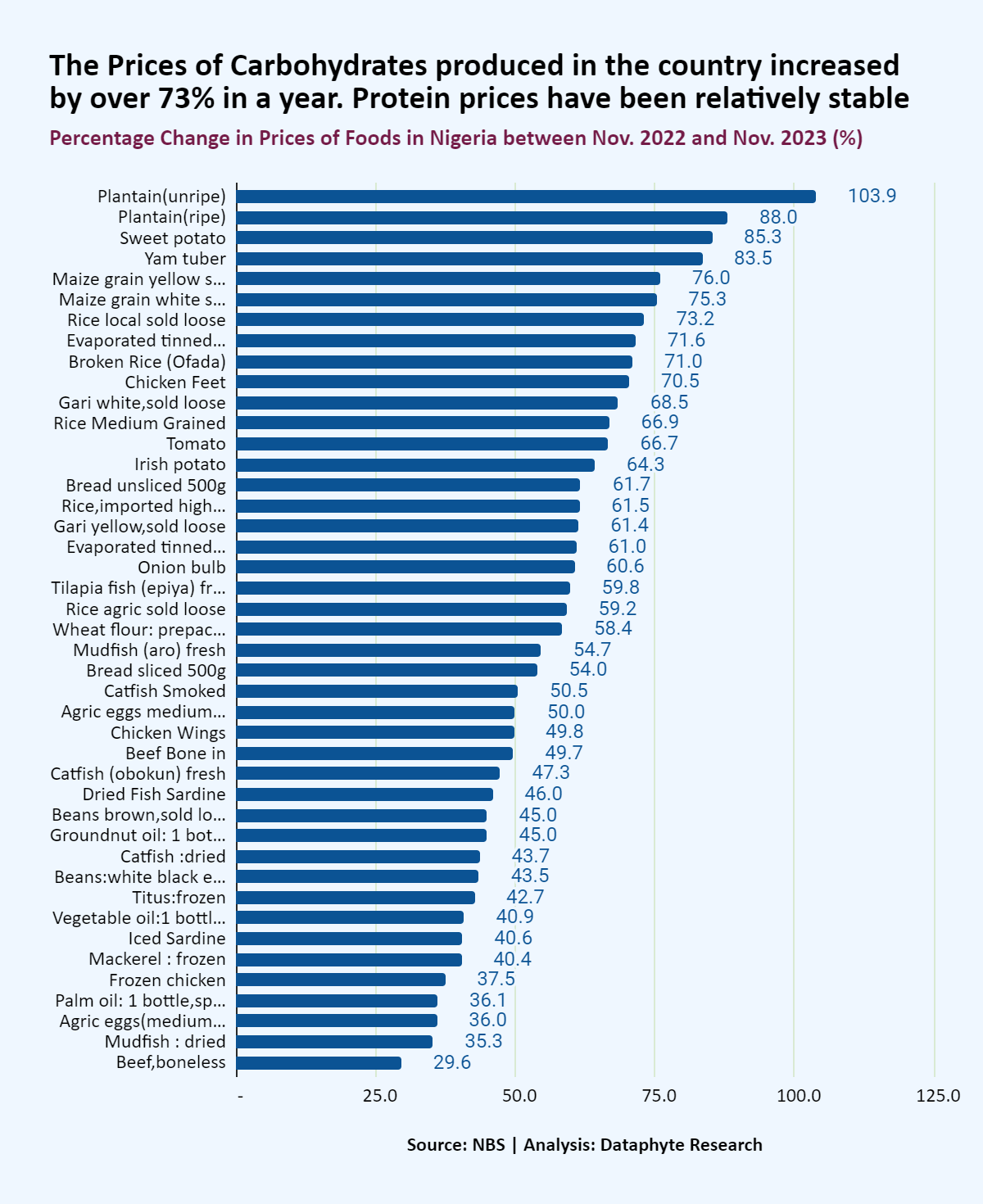

The NBS sampled prices of selected foods show that in the last year, between November 2022 and 2023, the price of some foods doubled. Others, especially carbohydrates, nearly doubled. In many parts of the country food prices increased even in greater multiples.

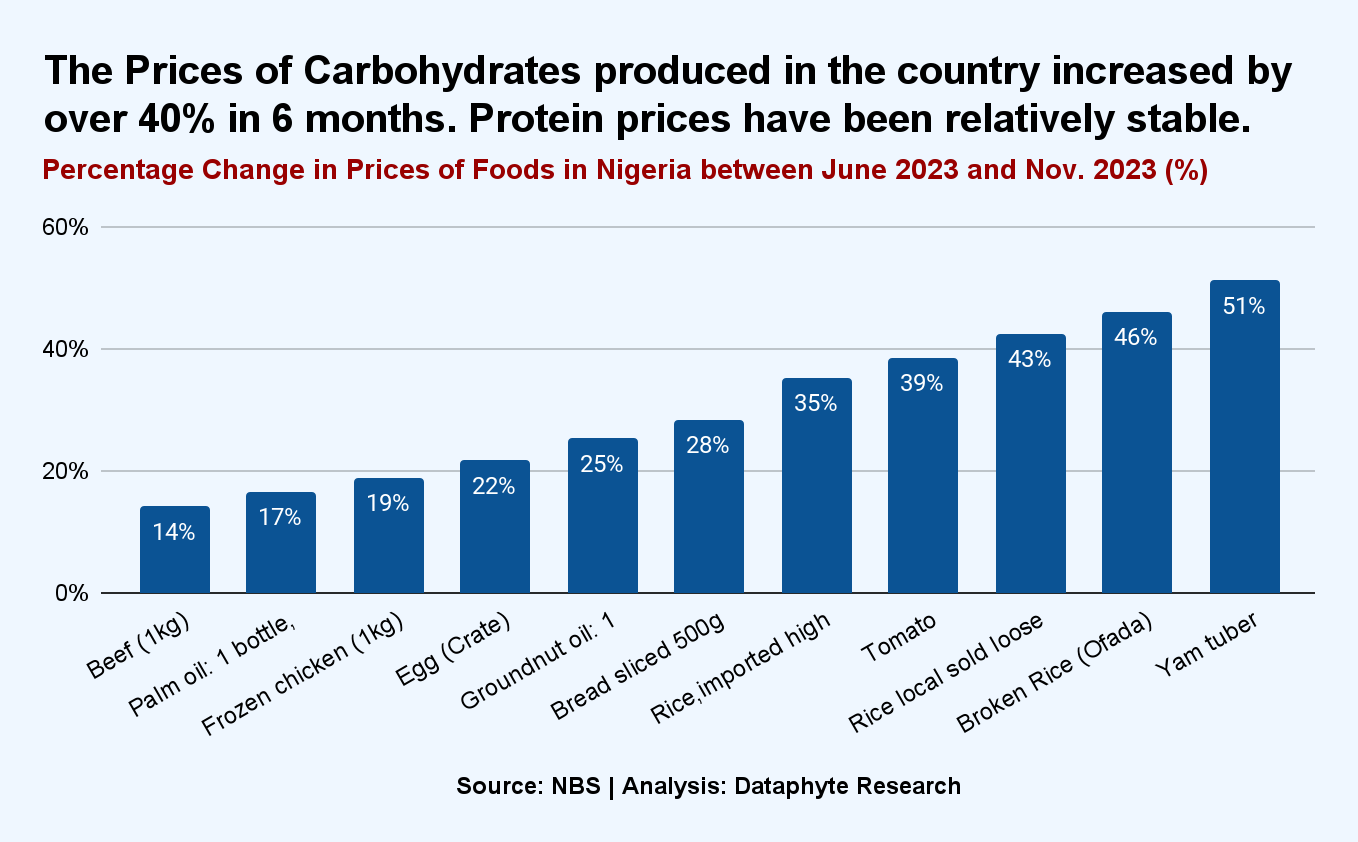

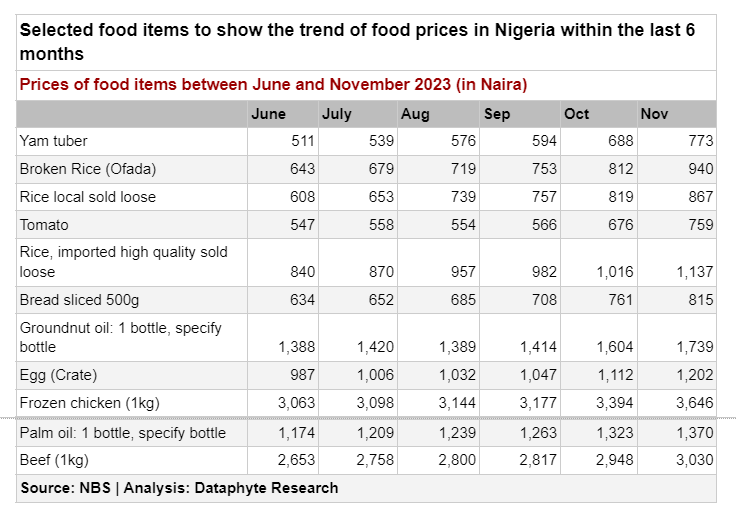

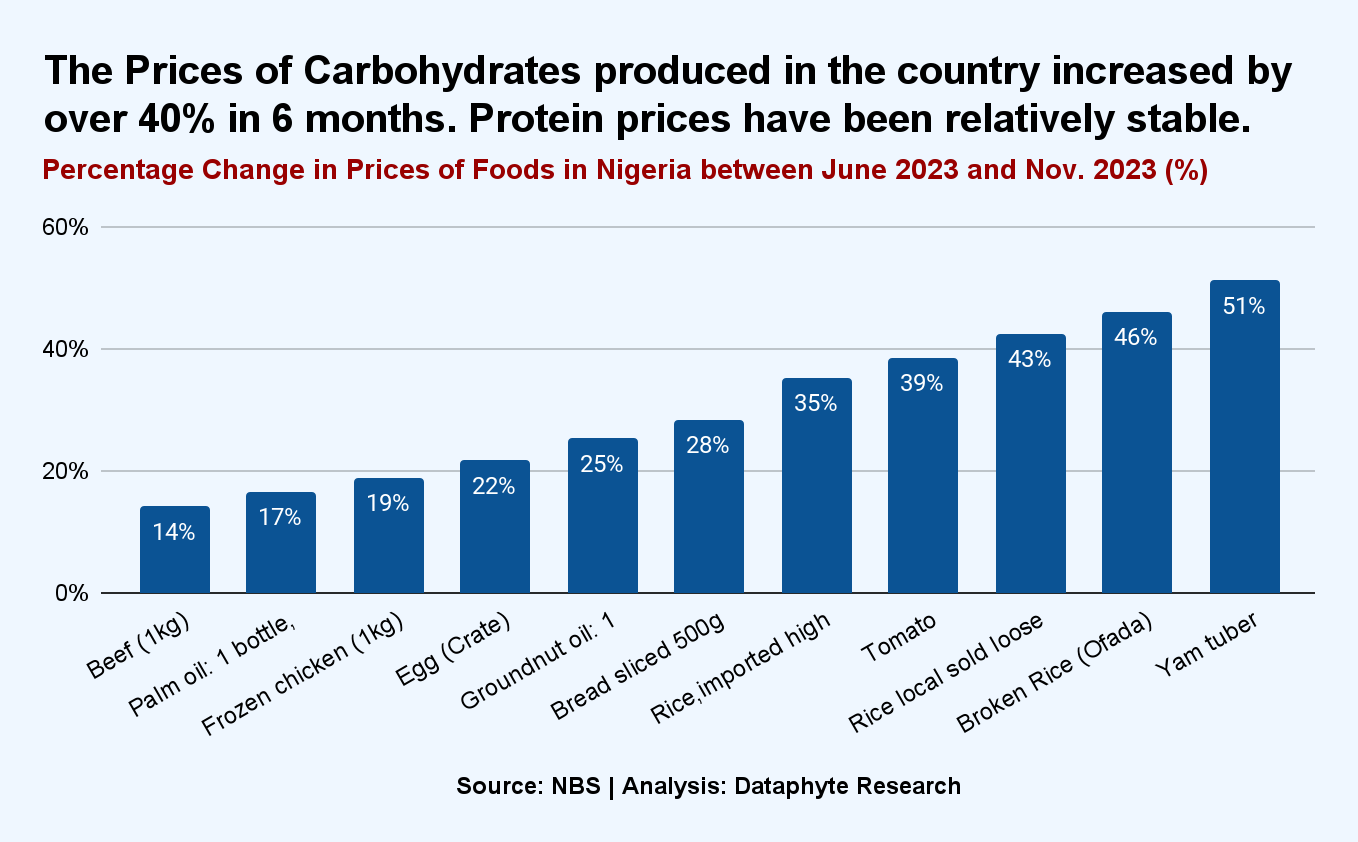

In the last 6 months of the reviewed period, the trend was the same as the annual food price increases. The prices of carbohydrates produced in the country soared faster than the majority of the proteins.

In the last 6 months of the reviewed period, the trend was the same as the annual food price increases. The prices of carbohydrates produced in the country soared faster than the majority of the proteins.

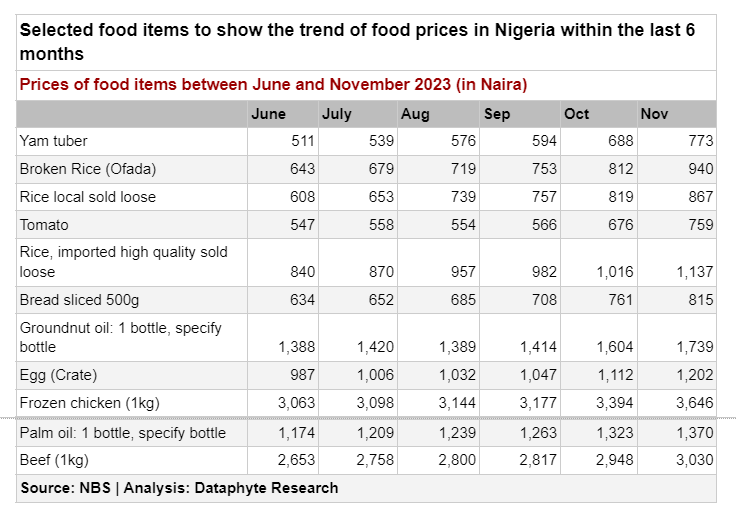

Major food items such as local rice, yam, tomato, bread, groundnut oil, egg, frozen chicken, palm oil, and beef, among others, have drastically increased in prices in the last couple of months.

Major food items such as local rice, yam, tomato, bread, groundnut oil, egg, frozen chicken, palm oil, and beef, among others, have drastically increased in prices in the last couple of months.

Start Small with NAFDAC

Are you in Enugu State (or anywhere in the South-East region) and thinking of importing and packaging wholesome dried catfish from Jigawa (or anywhere in the North West region) for sale at your base, you don’t need to worry about the cost of going fully legit.

The National Agency for Food and Drug Administration and Control (NAFDAC) has implemented strategies to support Micro, Small and Medium Enterprises (MSMEs) in Nigeria by reducing administrative charges for the renewal of licenses for NAFDAC-regulated products for both local and foreign business owners.

According to the Director-General of the agency, Mojisola Adeyeye, the renewal of registration for locally manufactured products will now cost N44,200 with a 65 percent drop in processing fees compared to the current charges. Similarly, foreign products will be charged $450 with a 45 percent reduction in processing fees compared to current charges.

According to the Director-General of the agency, Mojisola Adeyeye, the renewal of registration for locally manufactured products will now cost N44,200 with a 65 percent drop in processing fees compared to the current charges. Similarly, foreign products will be charged $450 with a 45 percent reduction in processing fees compared to current charges.

MSMEs play a major role in the country’s Gross Domestic Product (GDP), as It accounts for economic growth, by contributing to the development, job creation, and export, as well as reducing the poverty level and unemployment in the country.

As of 2022, MSMEs contributed 48% to Nigeria’s gross domestic product (GDP) and accounted for 96% of businesses and 84% of employment.

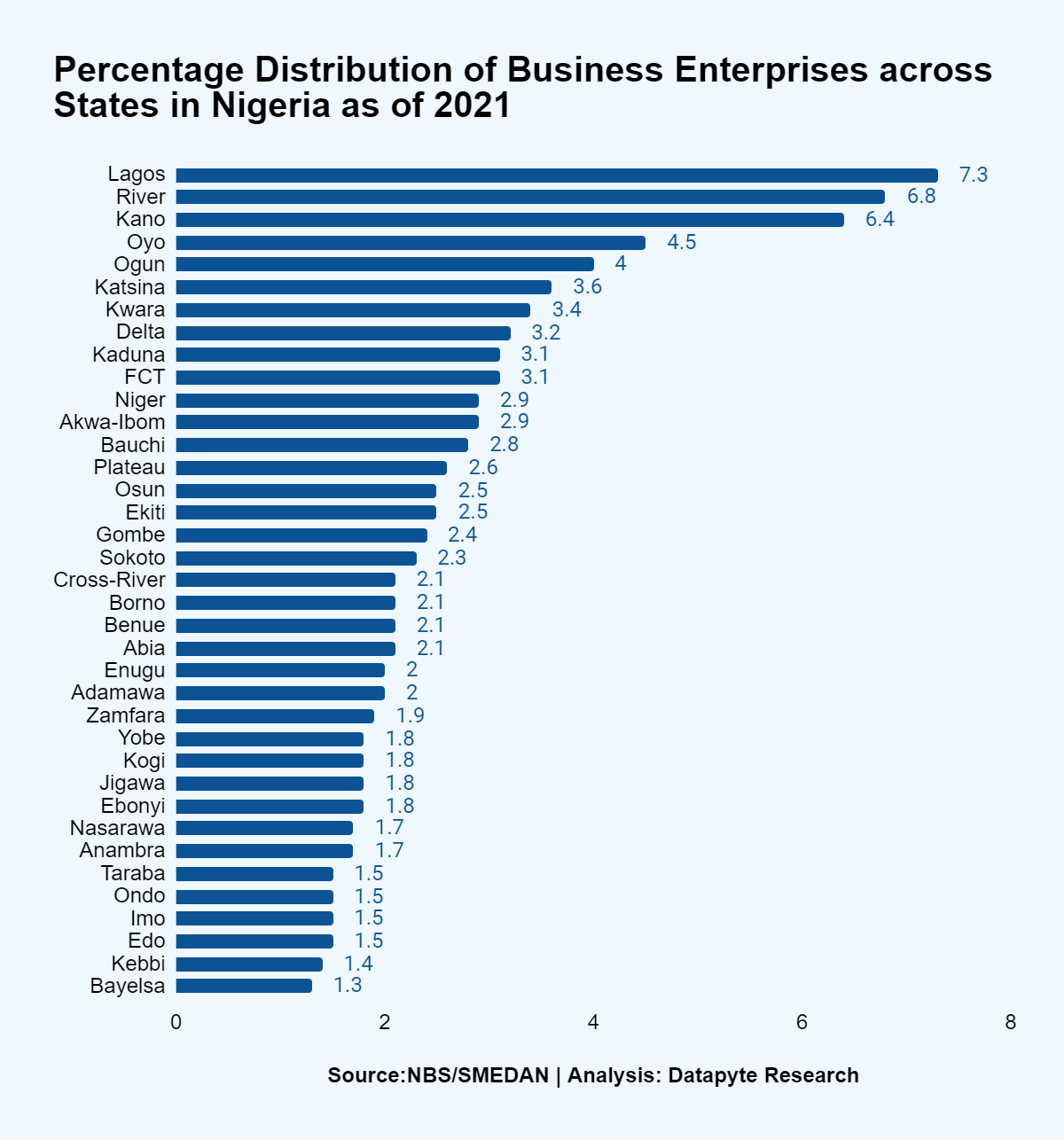

Before 2019, Nigeria had 41.5 million micro, small and medium enterprises (MSMEs), but the number decreased by 4.6% to 39.6 million, according to a survey conducted by the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) and the National Bureau of Statistics (NBS).

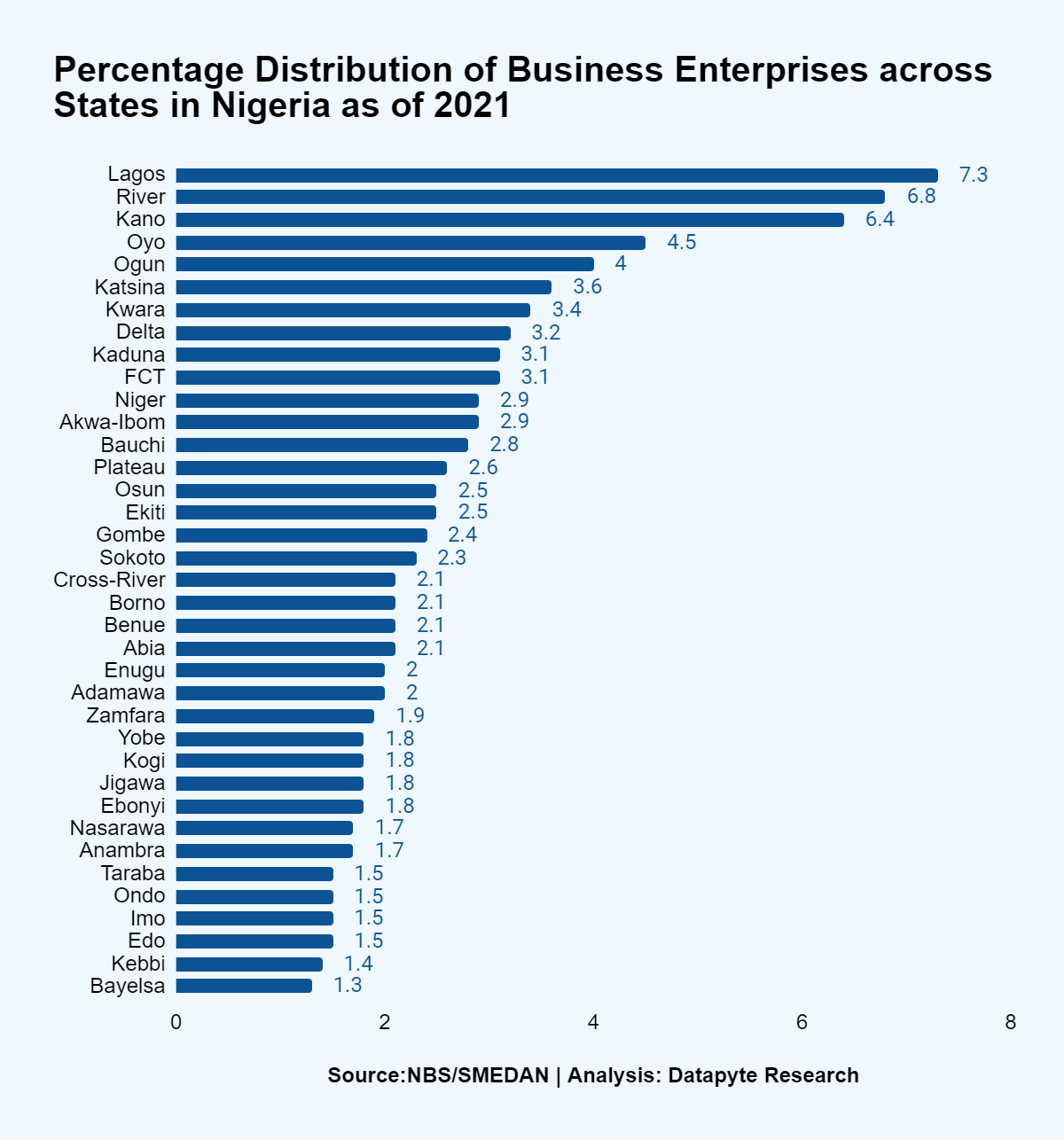

MSMEs are concentrated in Lagos, Rivers, Kano, Oyo and Ogun States, with the 5 states accounting for 30% of the total number of MSMEs in the 36 states of the federation.

Bayelsa, Kebbi, Edo, Imo, and Ondo have the least number of MSMEs, with the 5 accounting for just 7% of all MSMEs in the country.

NAFDAC’s overture to MSMEs may encourage individuals with half-full pockets to start big small businesses small.

NAFDAC’s overture to MSMEs may encourage individuals with half-full pockets to start big small businesses small.

Start Small or Spend Less

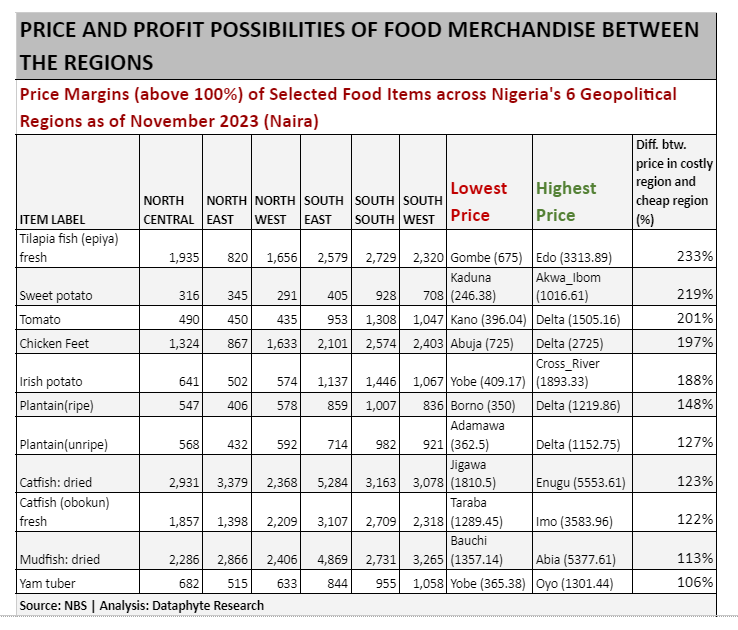

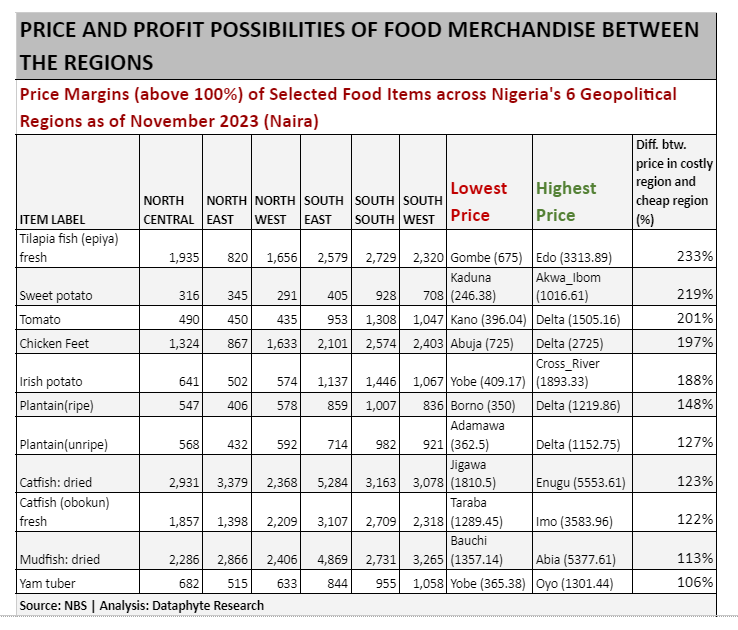

You can leverage your presence in a particular region of the country to run a profitable ‘side hustle’ as a ‘food entrepreneur’.

Continue reading

So, if you can survive food prices, you can survive any other expenditure.

So, if you can survive food prices, you can survive any other expenditure. In the last 6 months of the reviewed period, the trend was the same as the annual food price increases. The prices of carbohydrates produced in the country soared faster than the majority of the proteins.

In the last 6 months of the reviewed period, the trend was the same as the annual food price increases. The prices of carbohydrates produced in the country soared faster than the majority of the proteins. Major food items such as local rice, yam, tomato, bread, groundnut oil, egg, frozen chicken, palm oil, and beef, among others, have drastically increased in prices in the last couple of months.

Major food items such as local rice, yam, tomato, bread, groundnut oil, egg, frozen chicken, palm oil, and beef, among others, have drastically increased in prices in the last couple of months.

According to

According to