As Crude Oil Price Rise, Nigeria’s Subsidy Burden May Rise Along with it

The price of crude oil as of 7th February stood at $93.27, its highest point in seven years.

Tag

The price of crude oil as of 7th February stood at $93.27, its highest point in seven years.

The entire volume of spills within the five years (January 2016 and June 13, 2021) is equivalent to over 850 fully loaded trucks emptied into the country’s territorial waters, onshore and offshore.

he Nigerian National Petroleum Corporation (NNPC) has failed to account for 104.48 million barrels of domestic crude oil it lifted in 2019.

The National Oil Spill Detection and Regulatory Agency (NOSDRA) documents reveal that oil companies cleaned up only two per cent (2.19%) of the 172 thousand spilt barrels of oil spillages reported within the past five years, according to its Oil Spill Monitor.

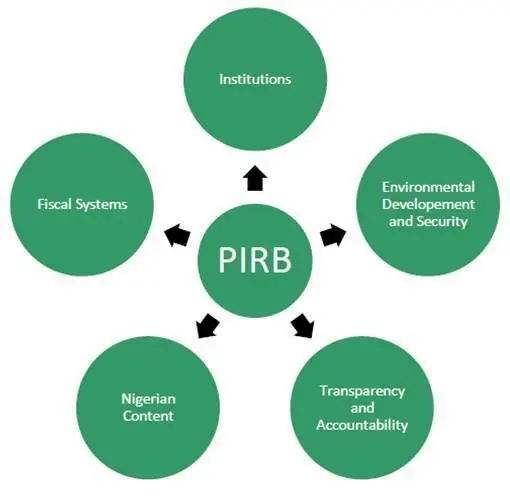

The Nigerian National Petroleum Corporation (NNPC) wrote off debts incurred by its subsidiary, the Nigerian Petroleum Development Company (NPDC), raising questions about fiscal prudence and commitment to the Extractive Initiative Transparency Initiative (EITI) standards.

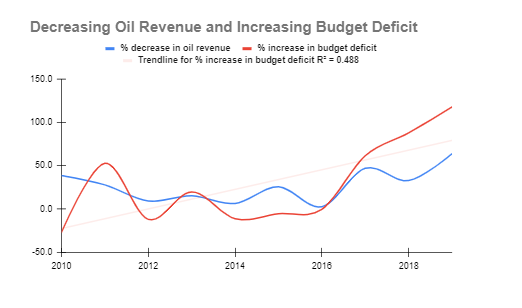

Nigeria’s Finance Minister, Zainab Ahmed, in 2019 acknowledged the country had a revenue problem. Mrs Ahmed made the comment while defending the 2020 budget before the National Assembly, where she sought approval for a loan to finance a ₦4.97 trillion deficit in the budget.

There are no sweet memories as the residents of this community, who are majorly from the Ijaw ethnic group, still cannot boast of any development, despite its historical significance in the country.

A natural resource management expert has identified mismanagement, benefits maximization among issues affecting the oil and gas sector in Nigeria.

The Federal Government has spent over N10 trillion on subsidy in at least 12 years. This is at the expense of the overall wellbeing of the people. Analysis of the opportunity cost of the subsidy spending far outweighs the direct benefits.

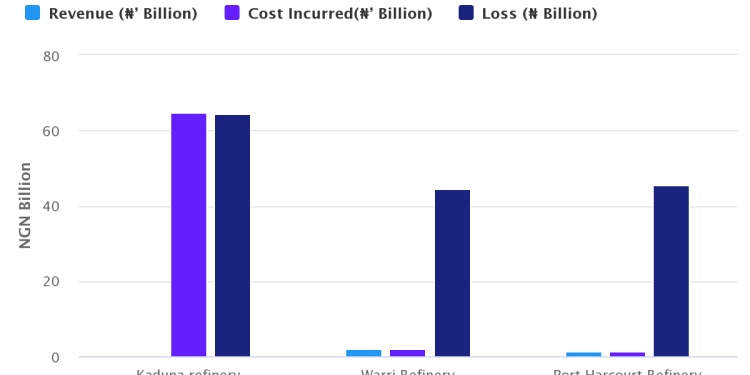

As calls persist for the privatisation of refineries, President Muhammadu Buhari continues to spend public funds to run the loss-making firm.

The Nigeria National Petroleum Corporation (NNPC) recently announced the resumption of 1,000 graduate trainees. While the new hires resumed virtually, this signals increased overheads for the state-owned enterprise. With refineries that have not made profits in the last eight years, it is argued that many NNPC staff are earning salaries without doing anything. By implication, the new hires may end up having little or nothing to do and thus keep up with the existing redundancy at the NNPC.

There is a massive drop in oil earnings by 80 percent and the Nigerian government is struggling to secure proceeds from crude sales. It is clear from reports that Nigeria’s economy is bound for recession. Already, the GDP is expected to drop by 8 percent in 2020.

Earlier this week, news of a fall in oil price below $0 per barrel made wave across the world. However, against the wide misconception on its meaning and implications particularly to the distressed Nigerian economy is the truth that the slump in the US crude oil futures below $0 per barrel does not reflect the reality in the global oil market but is a mere drop in US crude oil price by the New York Mercantile Exchange (NYMEX).