Costly Oil Contracts: Crude Oil, Cooking Oil, and Commuters on Okada

The oil and gas sector, last week, made a wide impression on government revenue. It impacted even the governed and their kitchen and transport grooves.

Tag

The oil and gas sector, last week, made a wide impression on government revenue. It impacted even the governed and their kitchen and transport grooves.

Compressed natural gas (CNG) is a natural gas under pressure that remains clear, odourless and non-corrosive. Although vehicles can use natural gas as either a liquid or a gas, most vehicles use the gaseous form, compressed to about 218 kg/cm2.

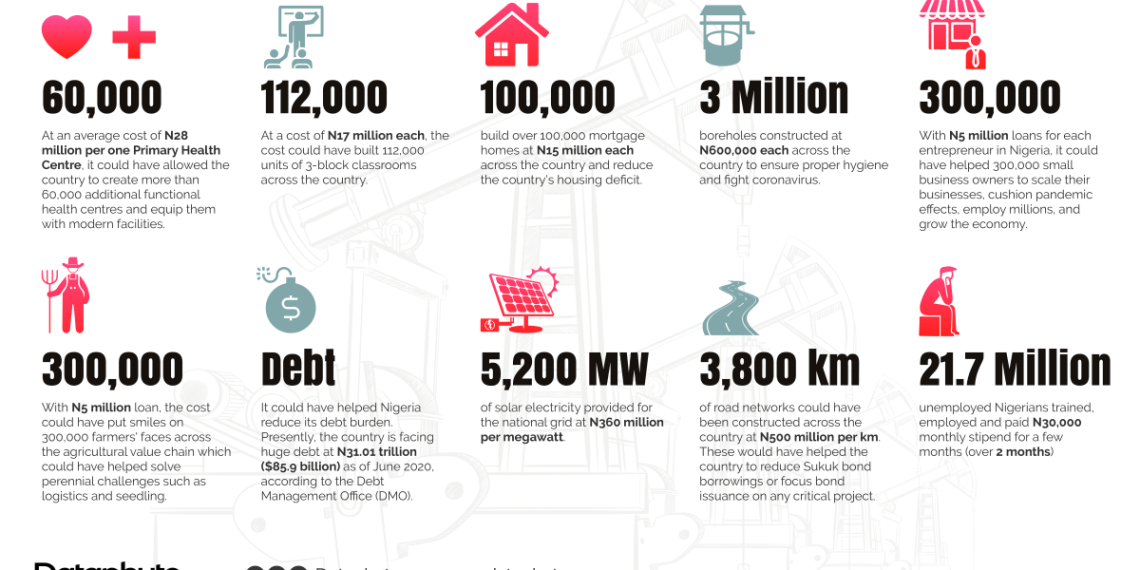

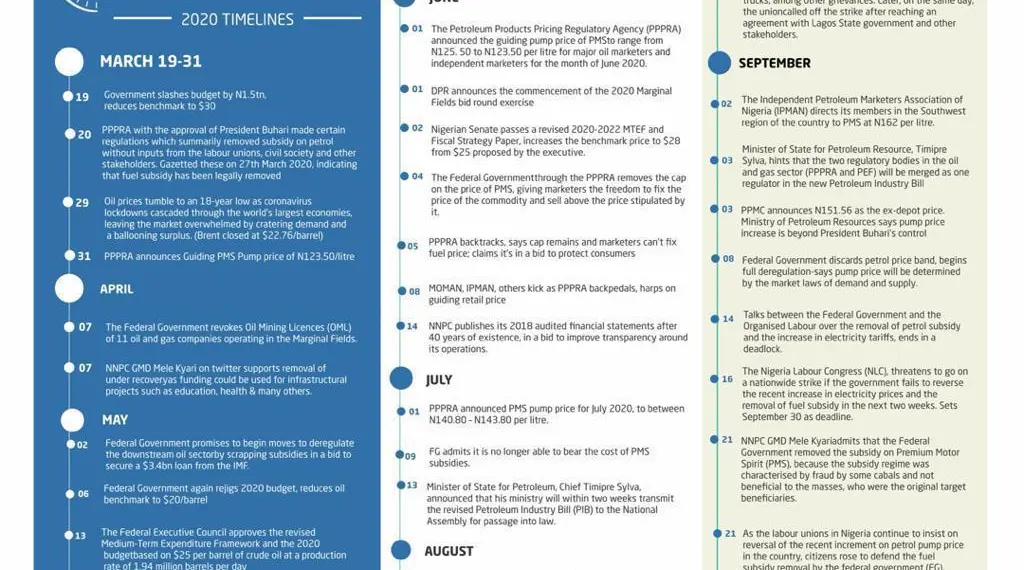

In 2019, the Nigerian National Petroleum Corporation (NNPC) paid the sum of ₦508 billion on petrol subsidy. This spending lowered the revenue it should remit to the government coffers. By implication, for every kobo spent to subsidise fuel, there is a corresponding loss of funds for the necessary infrastructure to every citizen.

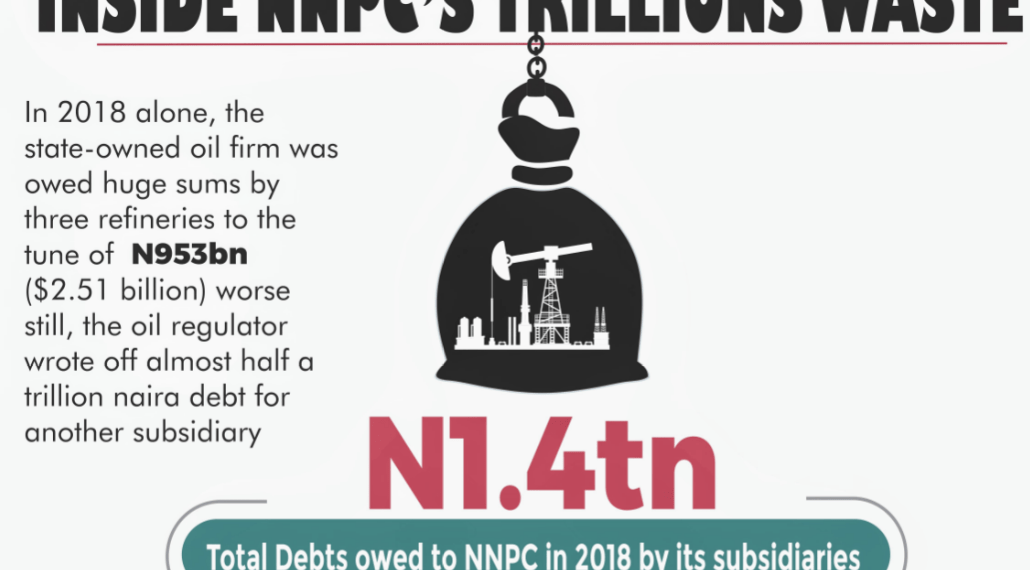

The Nigerian National Petroleum Corporation (NNPC) wrote off debts incurred by its subsidiary, the Nigerian Petroleum Development Company (NPDC), raising questions about fiscal prudence and commitment to the Extractive Initiative Transparency Initiative (EITI) standards.

Following the furore that greeted the Petroleum Products Pricing Regulatory Agency, PPPRA’s announcement of a new petrol price regime, the NNPC has countered the regulatory body’s advice, stating “there would be no increment in the ex-depot price of petrol in March”.

While some believe that oil subsidy is needed to lessen the plight of the poor, others believe it is an open window for corrupt enrichment of a few private and public officials who run the oil business.

Earlier, Buhari’s administration revealed a ten-year plan to lift 100 million Nigerians from poverty. But NNPC’s transactions with OML 119 revenue may delay this plan by 12 years because of subsidy repayment.

Reacting to allegations over alleged diversion of NLNG dividends over the years, NNPC GMD, Mr Mele Kyari, in a video posted on the NNPC Twitter handle, said it was impossible not to remit funds to the federation account.

Past is truly prologue as NNPC’s shady dealings 11 years ago raise questions today on the opportunity cost forgone on a $5 billion dividend payment still missing.

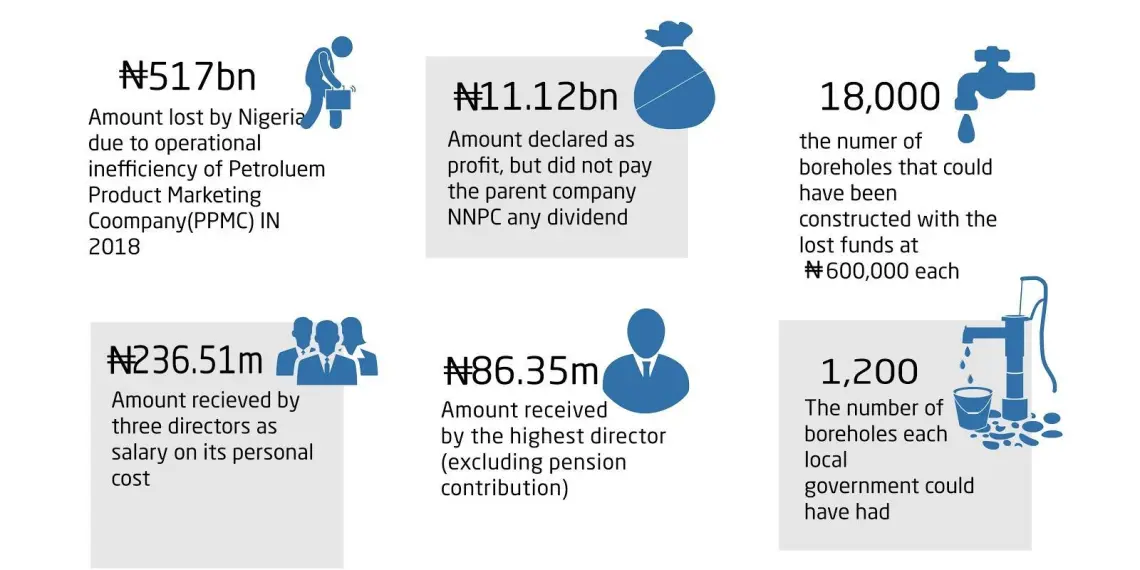

Nigeria has lost ₦517 billion from the operational inefficiency of Petroleum Product Marketing Company (PPMC), a downstream subsidiary of NNPC.

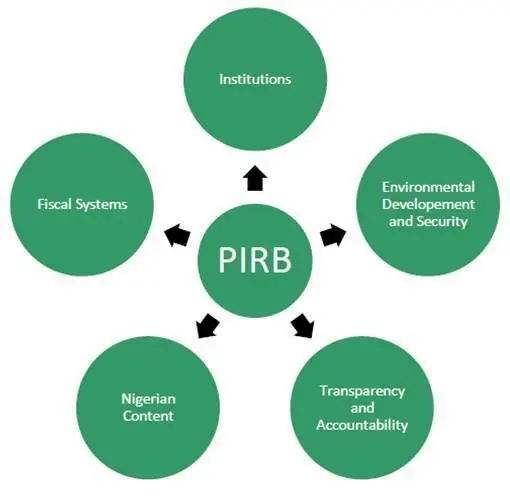

Nigerian lawmakers kick off work on the new Petroleum Industry Bill (PIB).

Parent companies enjoy profits in the form of dividends from their subsidiaries; think of it like royalties or tribute to a Queen. The Nigerian Petroleum Development Company Ltd (NPDC), however, denied her parent company, Nigerian National Petroleum Corporation (NNPC) any such tribute in 2018. NPDC made ₦179 billion profit-after-tax, yet declared no dividends to NNPC.

The money cost lost on Nigeria’s National Petroleum Corporation (NNPC) futile investments is no longer news, but what is perhaps more infuriating is the opportunity cost forgone in a dying economy.

Without Due Process, NNPC Recruited More Staff Despite Losses, Personnel Earn More Than Nigerian President

The Nigeria National Petroleum Corporation (NNPC) recently announced the resumption of 1,000 graduate trainees. While the new hires resumed virtually, this signals increased overheads for the state-owned enterprise. With refineries that have not made profits in the last eight years, it is argued that many NNPC staff are earning salaries without doing anything. By implication, the new hires may end up having little or nothing to do and thus keep up with the existing redundancy at the NNPC.