It’s three weeks since Mr Tinubu resumed office as Nigeria’s first employee.

In this short time, President Bola Ahmed Tinubu has revealed his tendencies in the policy, politics and policing trinities.

In the three weeks that Tinubu called the shots at Aso Rock, his policy stance communicated a positive outlook for businesses but a negative one for the masses.

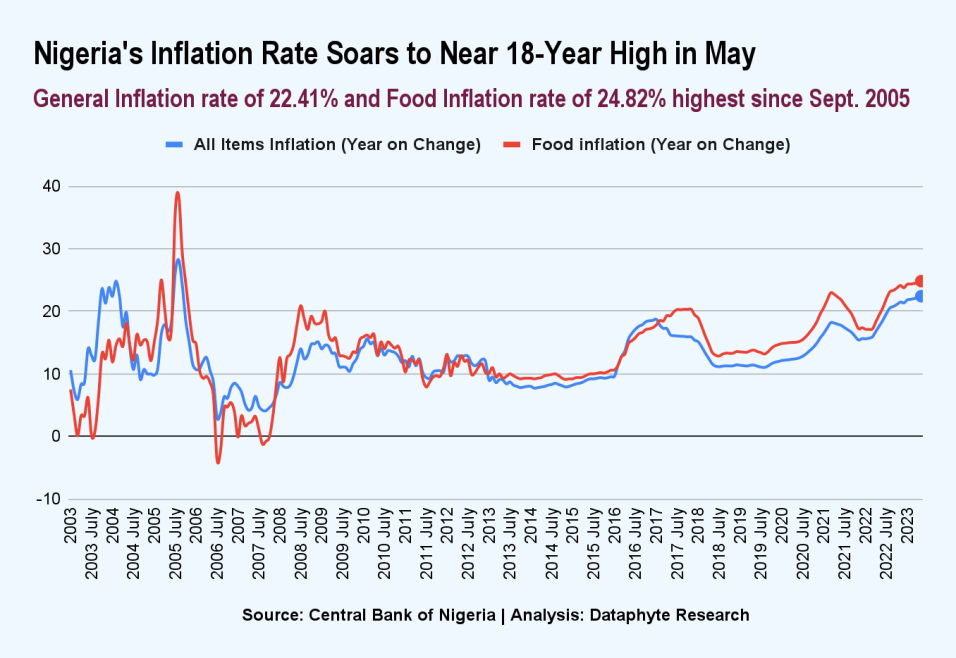

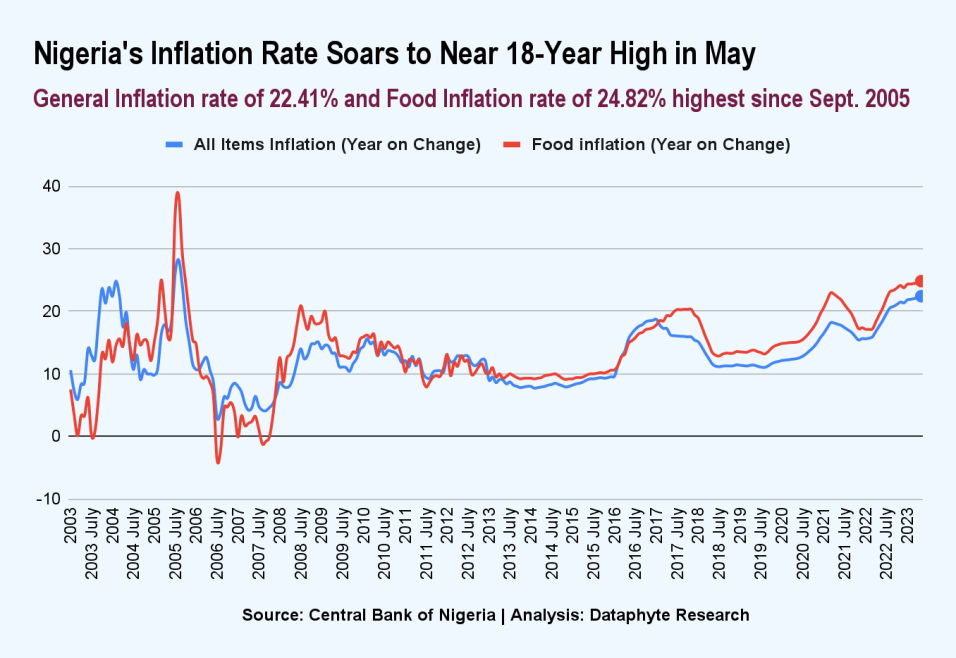

Nigeria’s corporate businesses performed best in 15 years in Tinubu’s 3 weeks old presidency, but the inflation rate hit hardest in 17 years during his first week.

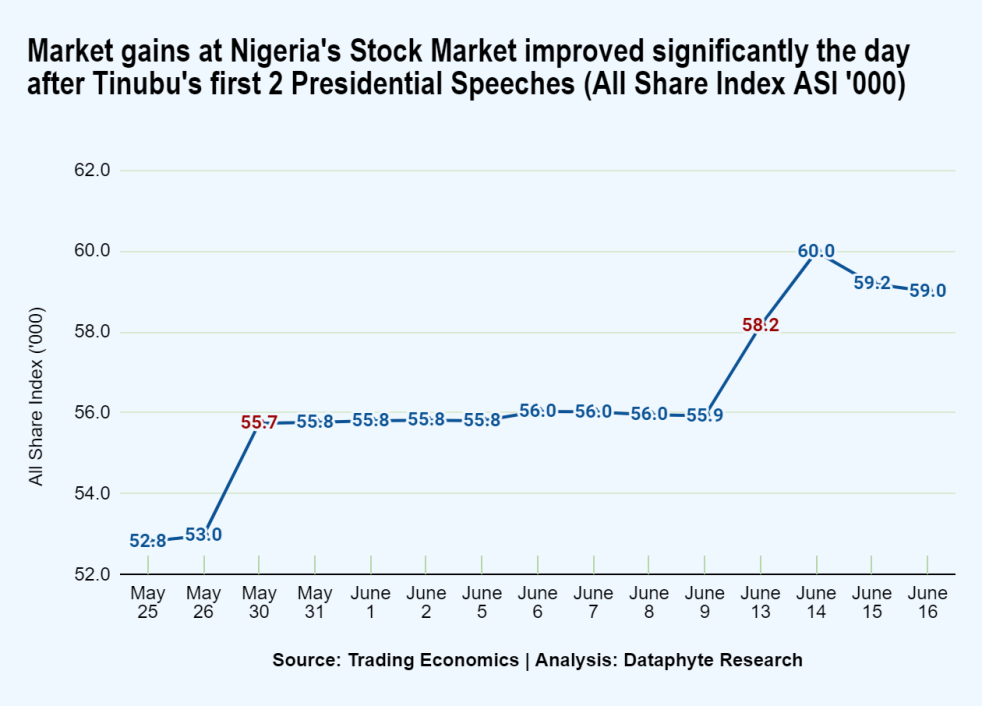

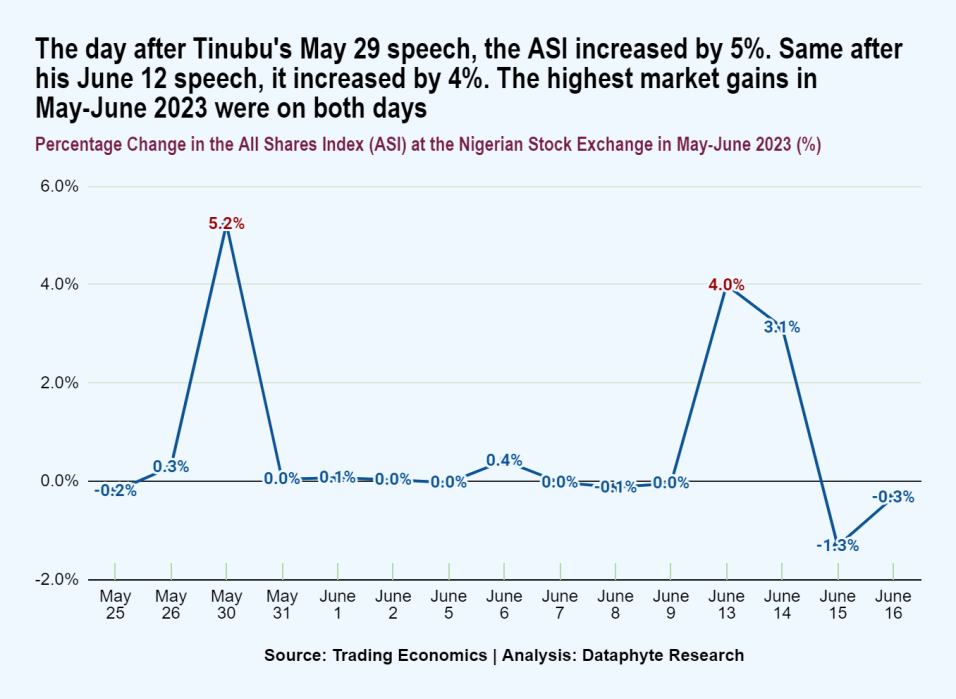

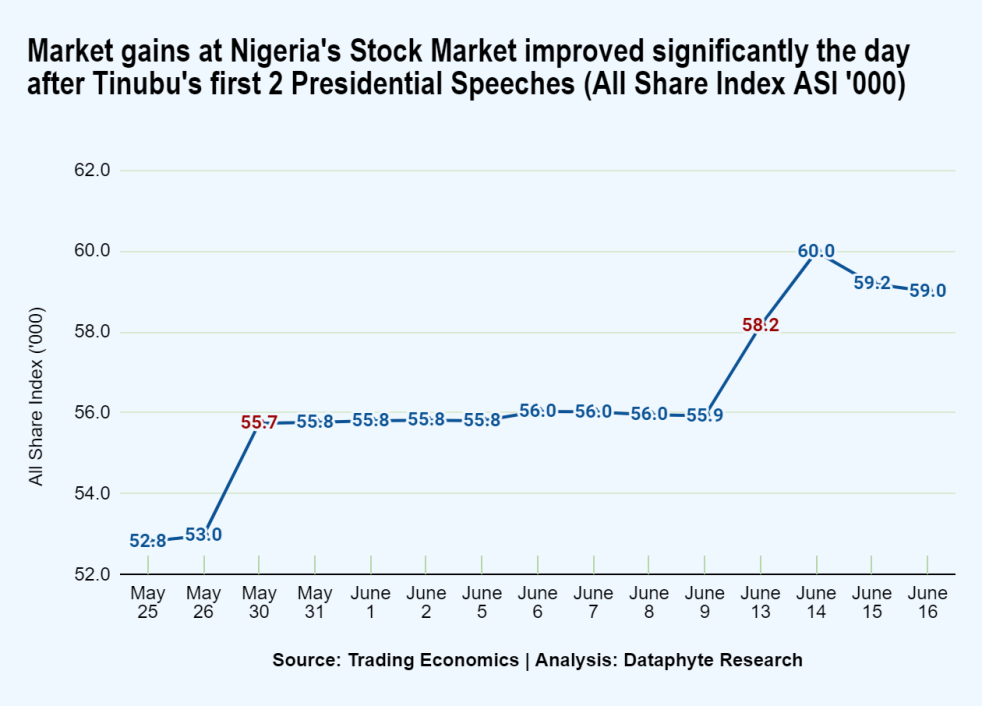

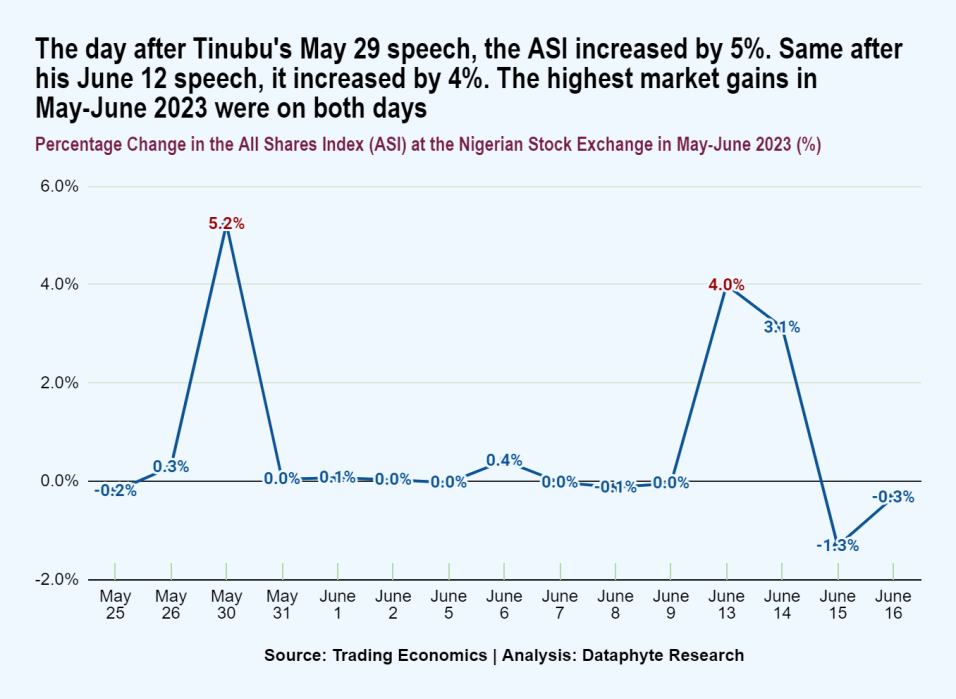

The Nigerian stock market recorded unprecedented gains in the first half of June, Tinubu’s first month in power, than in any month in the last 15 years, since April 2008, precisely.

Source: Trading Economics

The reverse is the case for those buying the goods and subscribing to the services that these thriving businesses supply.

Inflation? Yes. You got it.

Tinubu’s twin policies of deregulation of the oil sector (removing all subsidies on petrol), and of the foreign exchange market (closing the gap between the official rates and the black market rates), have increased business costs.

However, businesses safely transfer these costs to the masses who pay higher prices for their goods and services.

“The annual inflation rate in Nigeria rose for the fourth month to a near 18-year high of 22.41% in May 2023, up from 22.22% in the prior month and matching market estimates,” Trading Economics noted.

This hard inflation rate cuts deepest on low-income earners because over 50% of the price increases are those of foodstuffs.

The food inflation rate in Tinubu’s first month is higher than the general inflation rate and is projected to worsen.

“Prices of food, which is the most relevant in the CPI basket, continued to accelerate to 24.82% in May, after jumping by 24.61% in April, mainly on account of vegetables, oils, bread, fruits, meat and tubers,” according to the NBS.

In Nigeria, the Consumer Price Index (CPI) measures the change over time in prices of 740 goods and services consumed by people for day-to-day living.

Trading Economics reports the criteria used by the national Bureau of Statistics (NBS) in measuring the CPI and Inflation rate:

“The index weights are based on expenditures of both urban and rural households in the 36 states (and the FCT). The most important categories in the CPI are:

Food & Non-alcoholic Beverages (52% of the total weight),

Housing, Water, Electricity, Gas & Other Fuel (17%),

Clothing & Footwear (8%).

Transports account for 7% and

Furnishings & Household Equipment Maintenance for 5%.

Education (4%);

Health (3%);

Miscellaneous Goods and Services (2%);

Restaurants and Hotels (1%);

Alcoholic Beverages, Tobacco & Kola (1%);

Recreation & Culture (1%);

Communications (1%).

Inflation is the rate of change in consumer prices, signified by the consumer price index (CPI). The consumer price index measures the price of a set of goods and services in one period, say monthly.

The prices represented by the CPI usually change (increase or decrease) by some points from one period to another. Even when this price increases, it is not inflation per se.

Inflation measures how much the increase is in the prices of these sets of goods and services (when it increases).

Considering the prices of things in Months A, B, and C, inflation could be lower in month C than in month B, because, even though prices increased in month C than in B, the amount of the increase in prices in month C over B is smaller than that in month B over A).

Tinubu’s Business-facing Policies

Following President Tinubu’s warnings of a thorough house cleaning of the Central Bank of Nigeria in his inaugural speech May 29, 2023, the stock market index improved by an unprecedented 5%.

By the time he reinforced his commitments to devalue the Naira, proven by the suspension of the then incumbent Governor of the Central Bank, Mr Emefiele, the stocks index rose by another 4%.

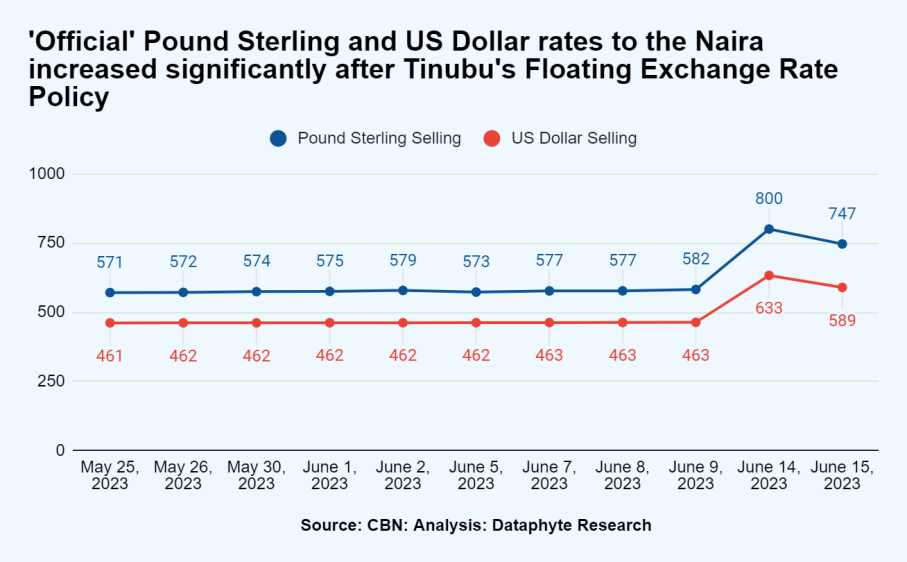

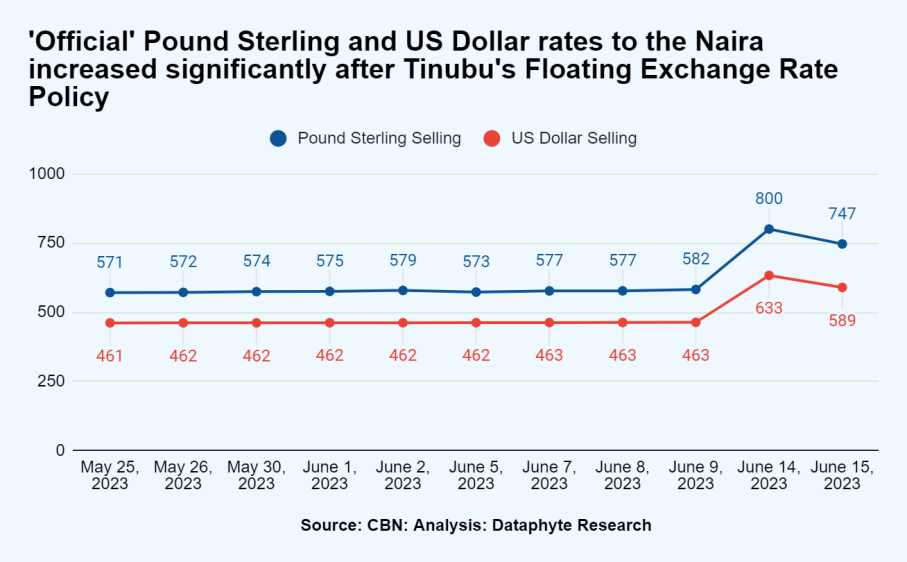

But the naira immediately fell 36% against the dollar on the official market,” African Business noted,

“Although sizeable currency weakening is usually associated with a sharp surge in inflation in the short term, the fact that the vast majority of people and businesses currently access FX at the expensive black-market rate in Nigeria means that the inflationary impact of a devaluation of the official would likely be limited,” it noted further.

The Nigerian naira depreciated from N463 per dollar to 633 and from 582 per pound sterling to 800 after Nigeria’s Central Bank announced that Commercial banks and dealers in the forex market could now trade forex at market-determined rates.

Dr Muda Yusuf, Chief Executive Officer, Centre for the Promotion of Private Enterprise [CPPE], in his conversation with the Vanguard insists that a floating exchange rate need not lead to a devaluation of the Naira. In his words:

“Admittedly, the increase was quite high. And the shock on citizens was enormous as well. But these are some of the inevitable costs of reforms. And we need the reforms to prevent the collapse of the economy. Apparently, things have to get worse before it gets better. It would be painful initially, but it would progressively get better. As the supply side response improves, the prices will moderate.”

He further highlighted the difference between the current reforms and the former regime:

The former foreign exchange policy regime “creates multiple exchange rates and results in the following distortions and negative outcomes:

Widening gap between the official and parallel market exchange rates which allows forex round-tripping to flourish.

Collapse of liquidity in the foreign exchange market resulting in acute forex scarcity.

It fuels demand for forex because of the incredible rent opportunities created by the huge parallel market premium.

Creates a major disincentive for forex inflows into the economy, thus suppressing forex supply.

Mounting trade debts.

Increasing factory closure as many manufacturers are not able to access foreign exchange for raw materials and other inputs.

Many investors are not able to meet offshore obligations creating credibility problems with their offshore suppliers.

Mounting inflationary pressures

Sharp drop in capital inflow

On the other hand, under the current reforms, “a unified exchange rate regime offers the following benefits for the economy:

It enhances liquidity in the foreign exchange market

It reduces uncertainty in the foreign exchange market and therefore enhances the confidence of investors.

It is more transparent as a mechanism for forex allocation.

It minimizes discretion in the allocation of forex and reduces corruption vulnerabilities.

It reduces opportunities for round-tripping and other sharp practices.”

Unarguably, Tinubu’s reforms focus on a business-minded and efficiently-run economy that optimises income (government revenue), minimises waste, and promises to reallocate resources from imprudent uses to serve economic and development purposes.

How does the vulnerable and distressed majority cope with all of this?

That is the political question Team Tinubu must respond to effectively.

Continue reading

.webp)