Nigeria’s Gas sector master plan and policy are an effort to further maximise Nigeria’s gas potential and also ensure better commercialisation of the sector.

Key to the plan is ensuring the supply of gas for domestic use, driving investors into Nigeria’s gas sector, delivering gas to power and other industrial sectors, and facilitating all gas bills currently at the national assembly.

How far has Nigeria in terms of commercialisation of the sector and other key issues concerning the sector’s progress?

Has the master plan achieved gas affordability for domestic purposes?

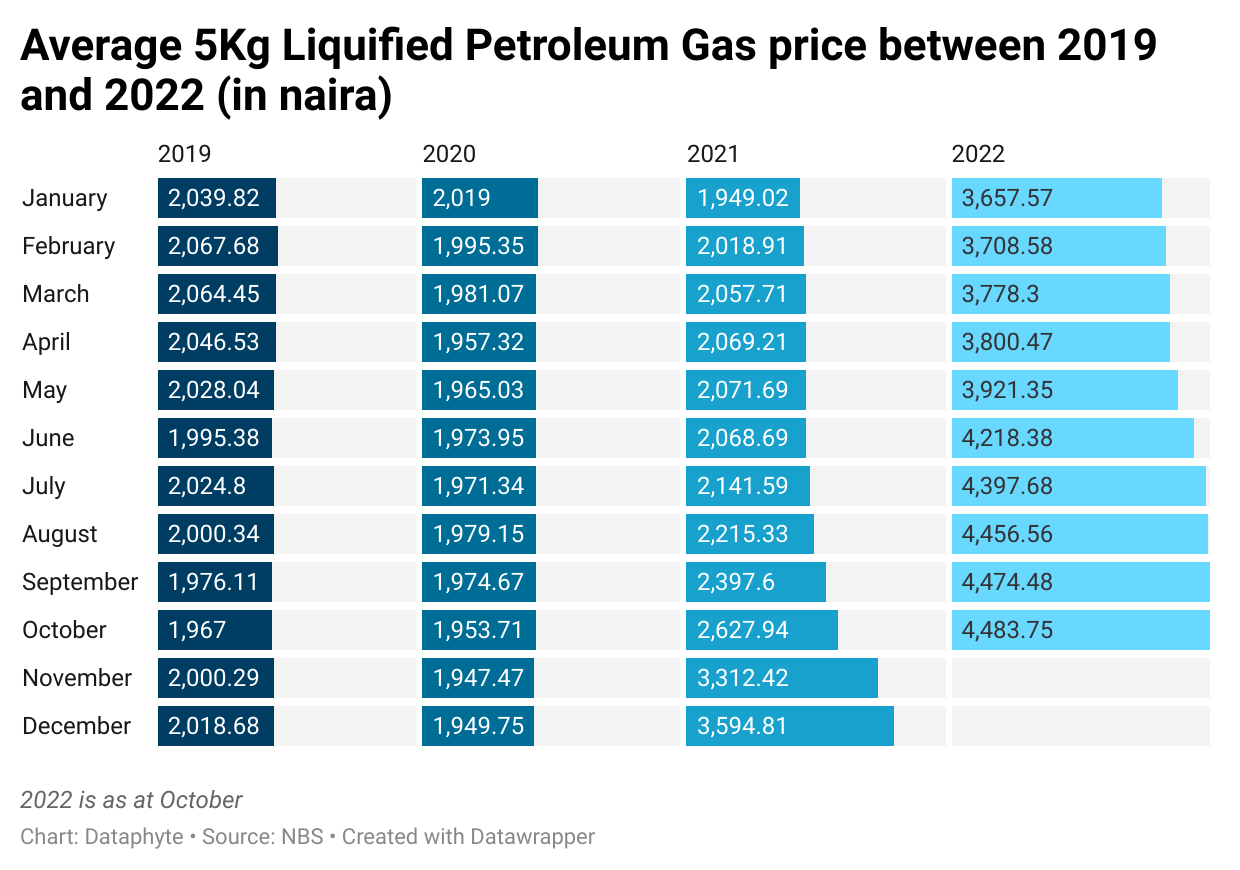

Improving availability for domestic use is to ensure availability and affordability. Are Liquified Petroleum Gas (Cooking Gas) and Automotive Gas Oil (Diesel) faring well in terms of price?

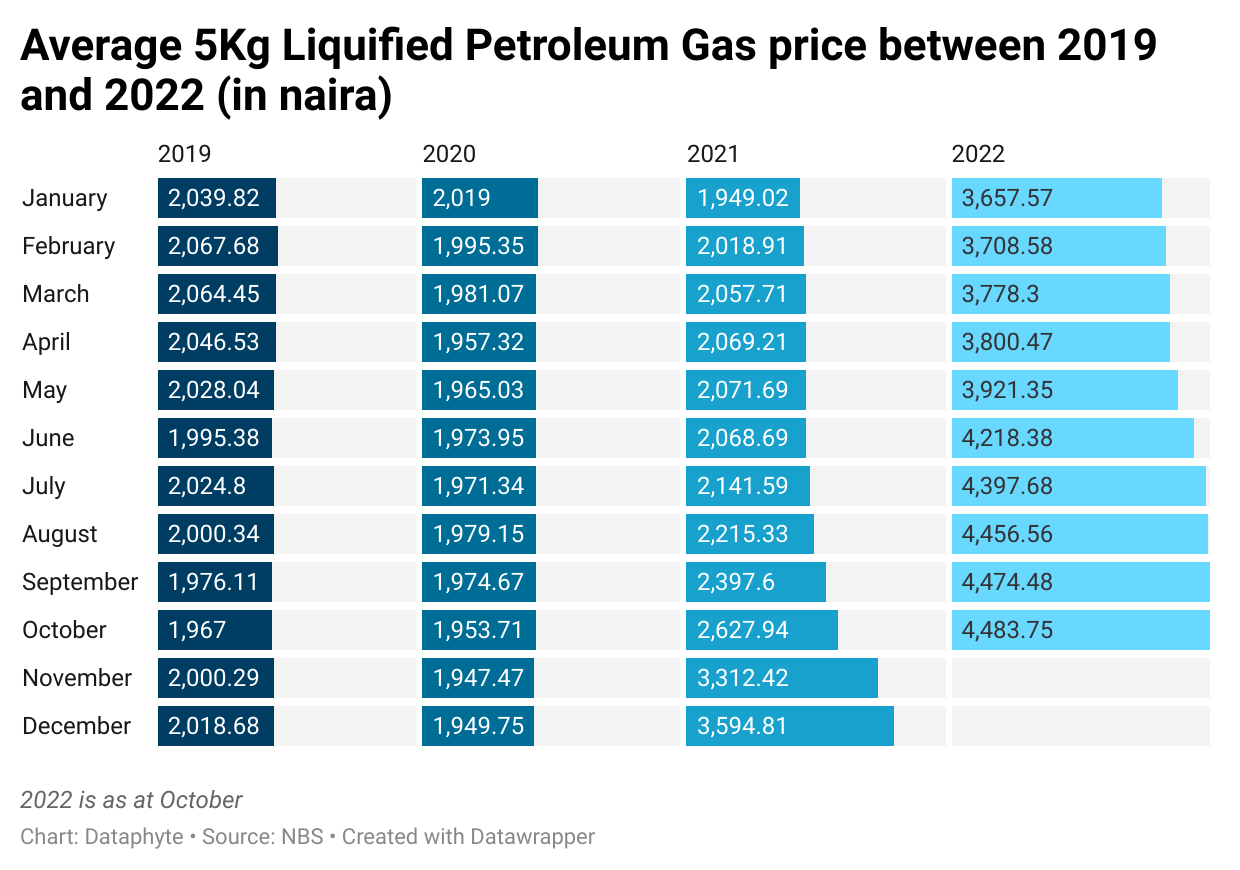

The price of the LPG (cooking gas) moved from N2039 for every 5 kg in 2019 to N4483 as at October 2022, representing a 54.5% increase.

Since the beginning of 2021, the price has risen steadily from N1949.02 in January of 2021 to end the year at N3594.81. The increase has continued into 2022 and was N4483 at the end of October, 2022.

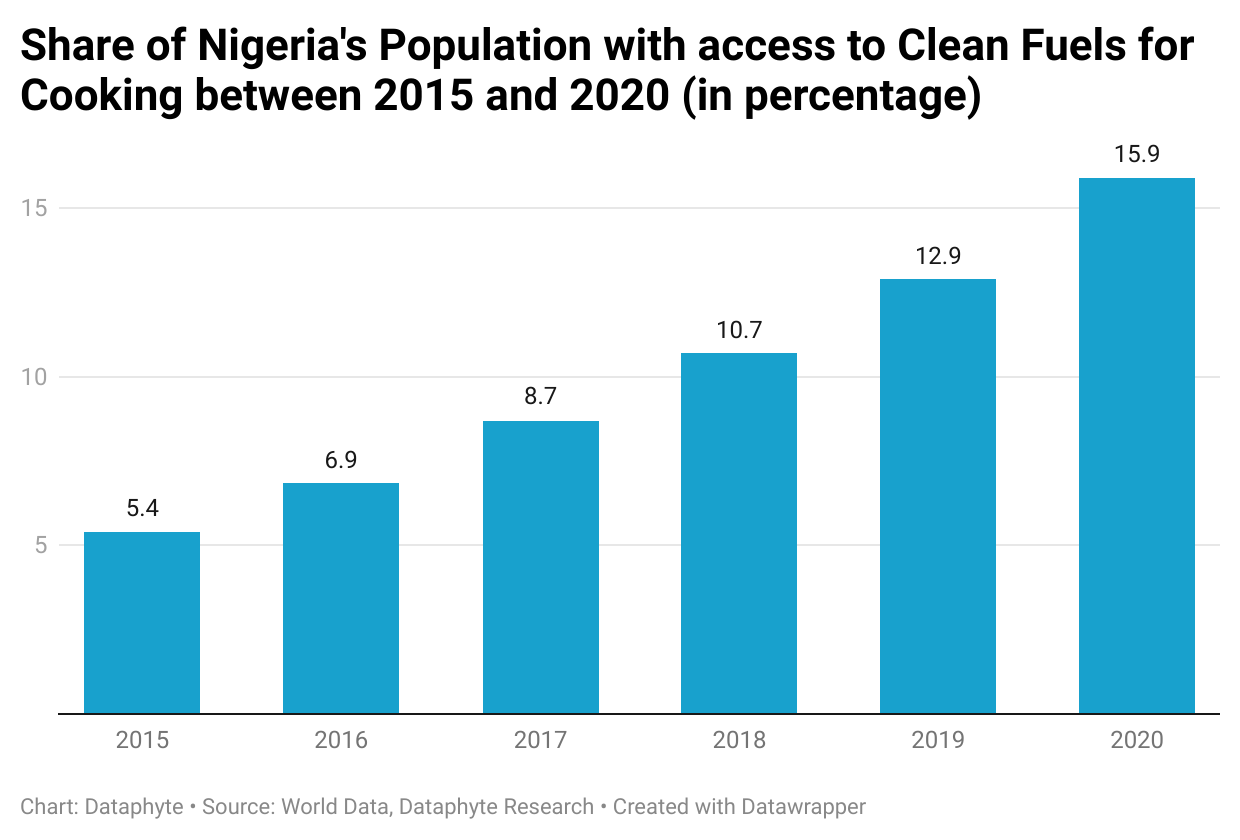

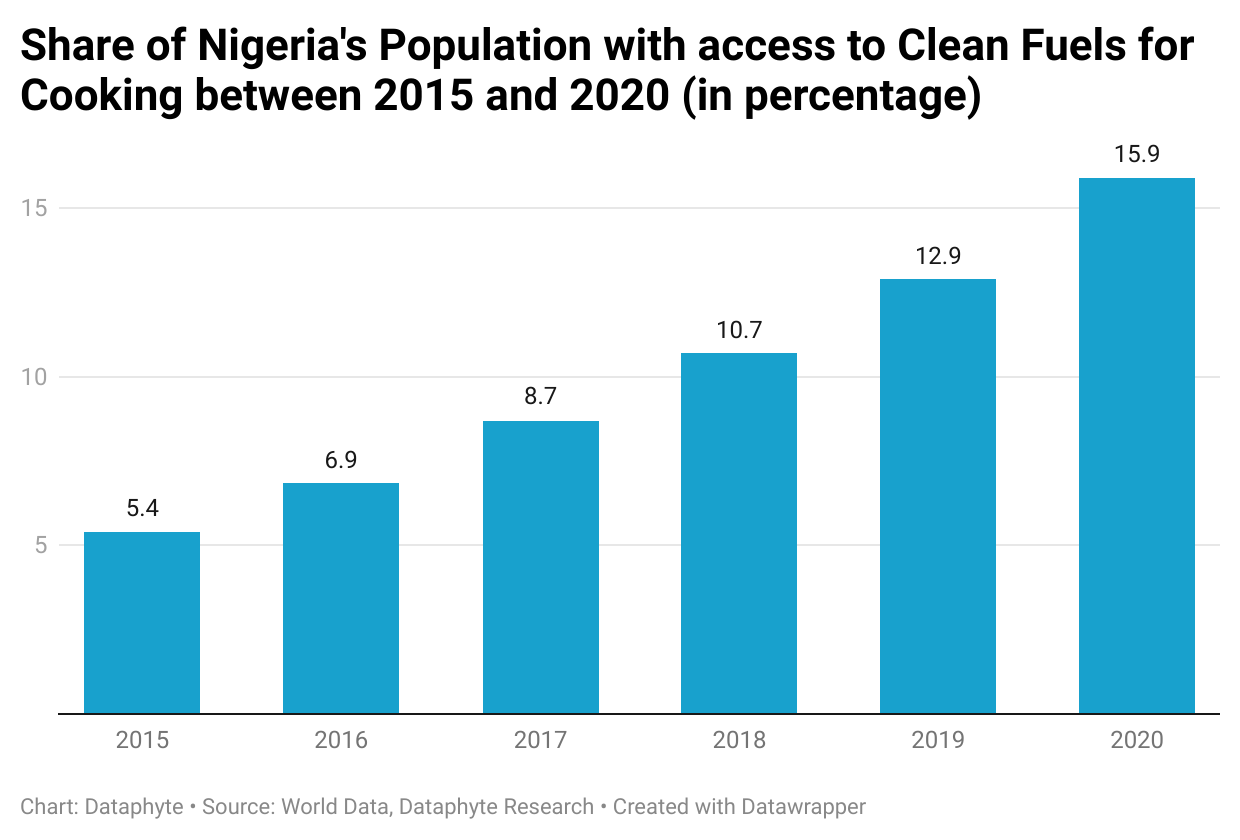

Aside from LPG, data analysis shows an increase in the number of Nigerians who have access to clean fuels for cooking. Clean fuels include natural gas, ethanol, and electricity.

While Nigeria may have a long way to go in terms of making a substantial number of its citizens have access to clean fuels for cooking, the percentage of citizens with access has grown from 12.9% to 15.9% between 2019 and 2020.

Nigeria’s long road to making clean fuel available and accessible for its citizens faces a significant challenge because 94% of poor and vulnerable households in the country are still deprived of access to cooking fuels, per the 2022 multidimensional poverty report.

In Ekiti, Kogi, Enugu, Benue and Abia, 100% of the poor and vulnerable households are deprived of access to clean fuels. Other states such as Adamawa, Akwa-Ibom, Anambra, Bauchi, Cross-River, Delta, Ebonyi, Edo, Gombe, Imo, Kwara, Niger, Ondo have over 90% of its citizens unable to access cooking fuels.

How is Nigeria’s Gas sector faring in terms of Revenue?

According to details released by the NNPC limited, the revenue of Nigeria in terms of gas sales grew from N524.4 billion in 2020 to N786.295 billion in 2021.

In the second quarter of 2022, the gas sale proceeds stood at N178.334 billion, which would put the gas revenue of the country for 2022 at N713 billion if the trend of earnings continues, a fall from the N786.295 billion posted in 2021.

A study of N-gas, a company tasked with transporting gas to Ghana, Togo and Benin, shows that in 2021, an operating profit of $8.154 million was declared, a fall from the $9.532 million declared in 2020 and a decline of about 17%.

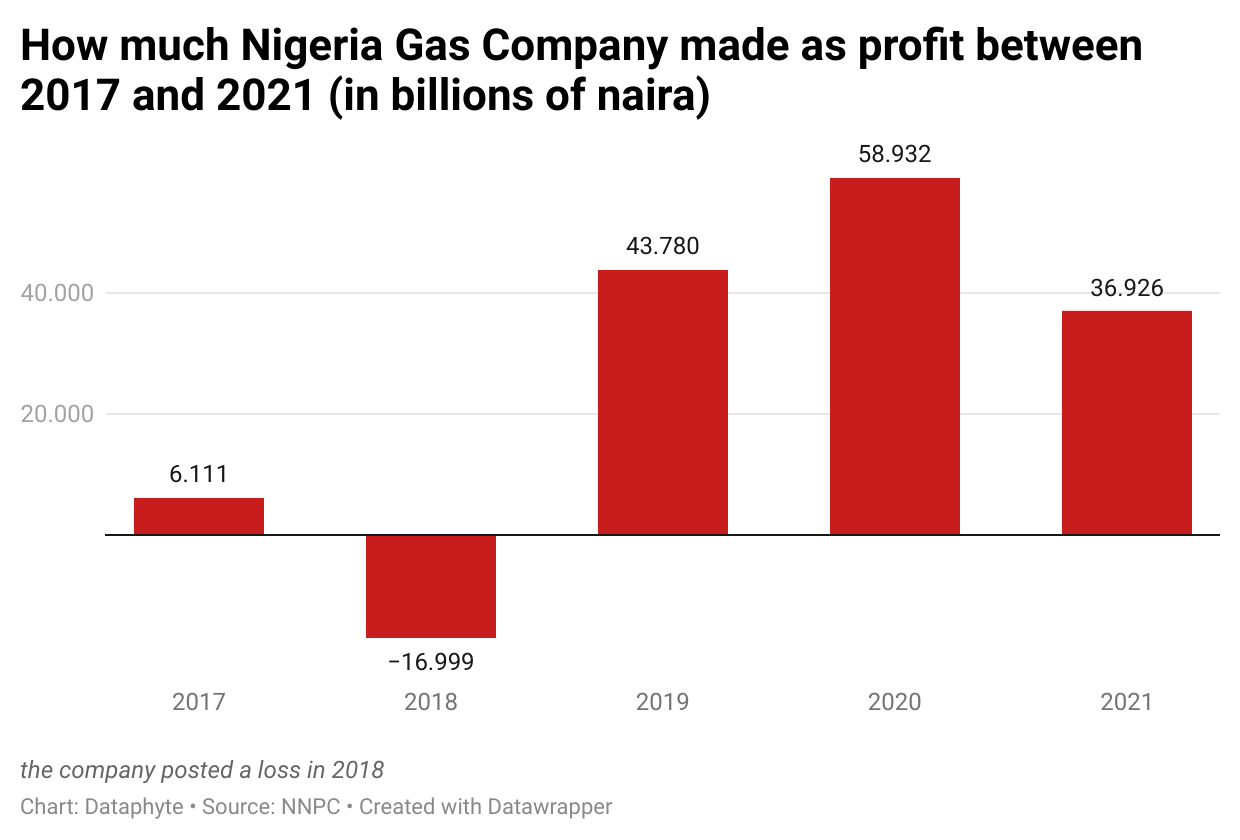

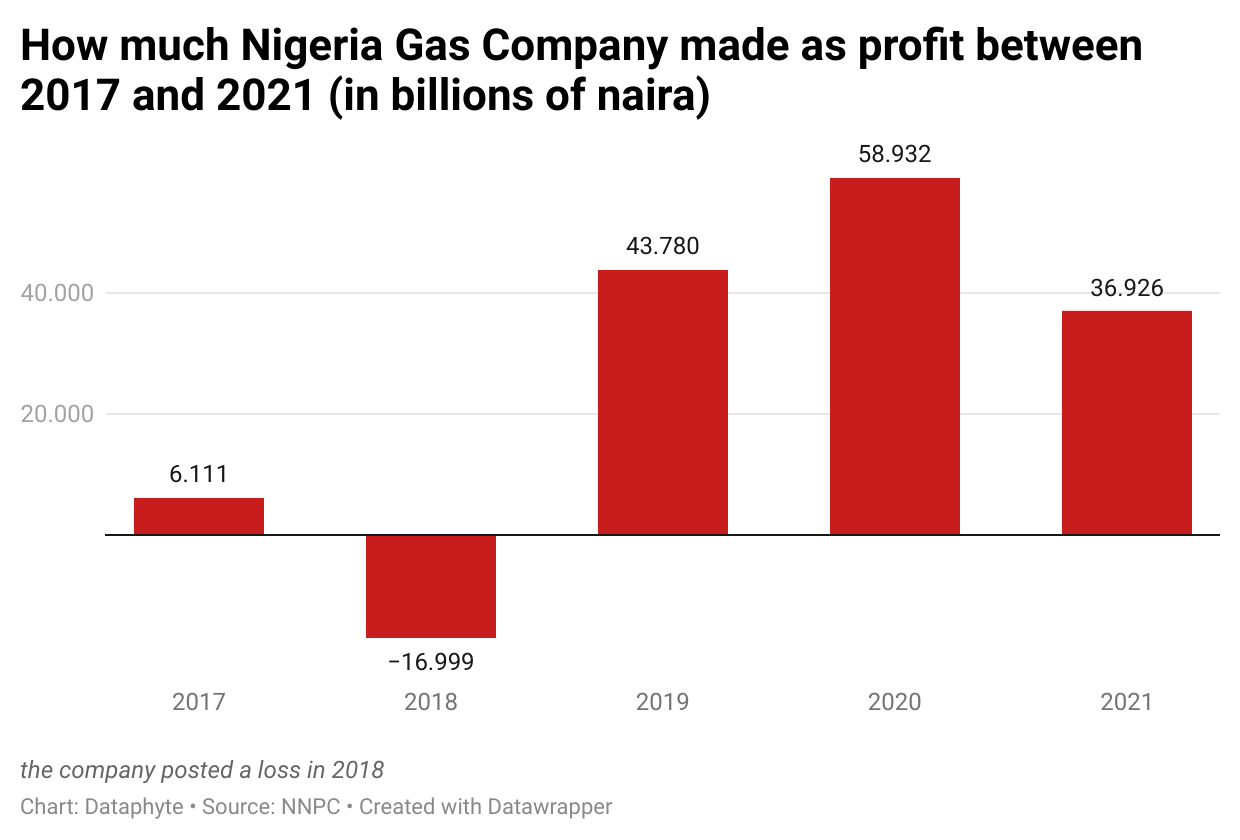

A review of the financial audit report of the Nigerian gas company also shows that the country has made profit from the gas sector. Although the company posted a loss of N16.999 billion in 2018, it bounced back in 2019, declaring a profit of N43.780 billion. In 2020, profits again climbed up to N58.93 billion, but the 2021 profit figures were N36.92 billion, a significant decline from the profits made in 2020.

How much has Nigeria expended on Gas infrastructures?

In March, the Nigerian government announced plans for a $6 billion gas investment between 2022 and 2032. This initiative is under the national gas expansion program of the Nigerian government.

A study of the NNPC FAAC report shows that the country budgeted to spend the sum of N46.022 billion on gas infrastructure development in 2022 but has only spent N7.437 billion between January and July.

The quoted expenditure for national domestic gas development stood at N50 billion, but as of July 2022, only N8.047 billion had been spent since January.

How has Nigeria Performed in terms of Gas production?

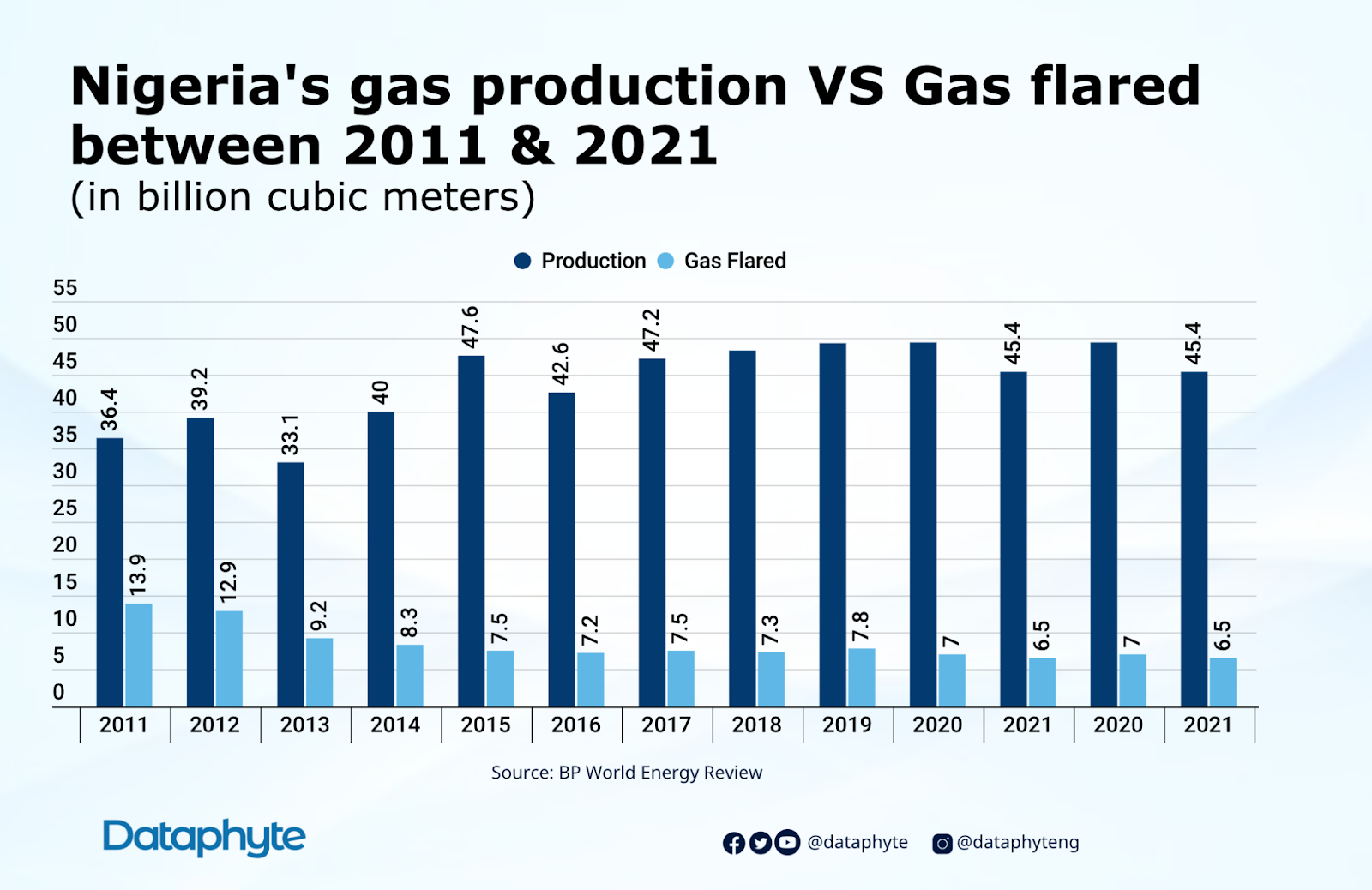

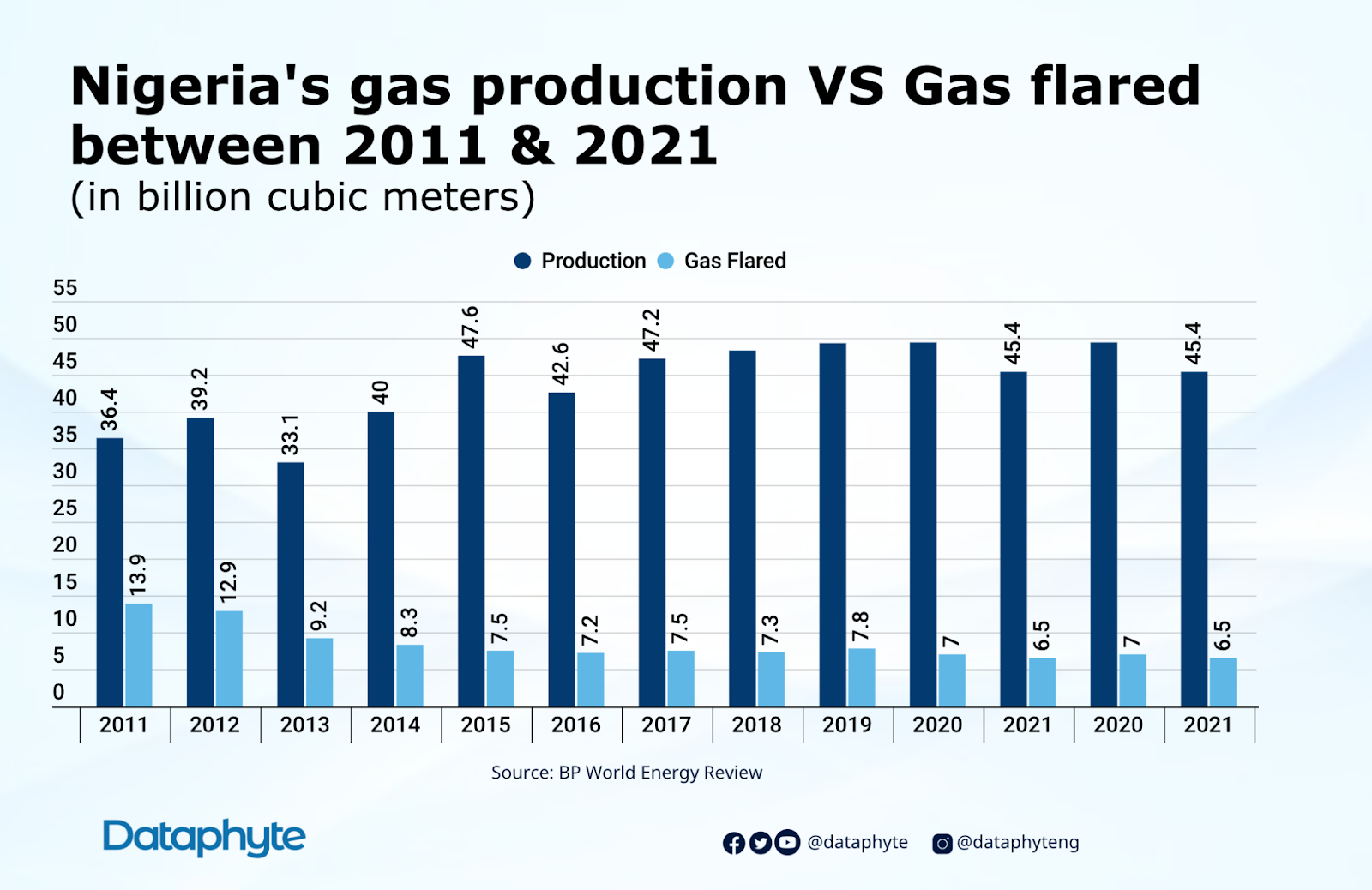

The country’s 2017 National Gas Policy aimed to improve gas production and tackle gas flaring.

How has the country fared?

Nigeria’s gas flaring continues to be an issue although there has been a reduction in the billion cubic metres of gas flared between 2011 and 2021, dropping from 13.9 billion cubic metres to 6.5 billion cubic metres, a 53.23% reduction.

Nigeria’s gas production is behind Algeria and Egypt, making it the third largest producer of natural gas on the African continent.

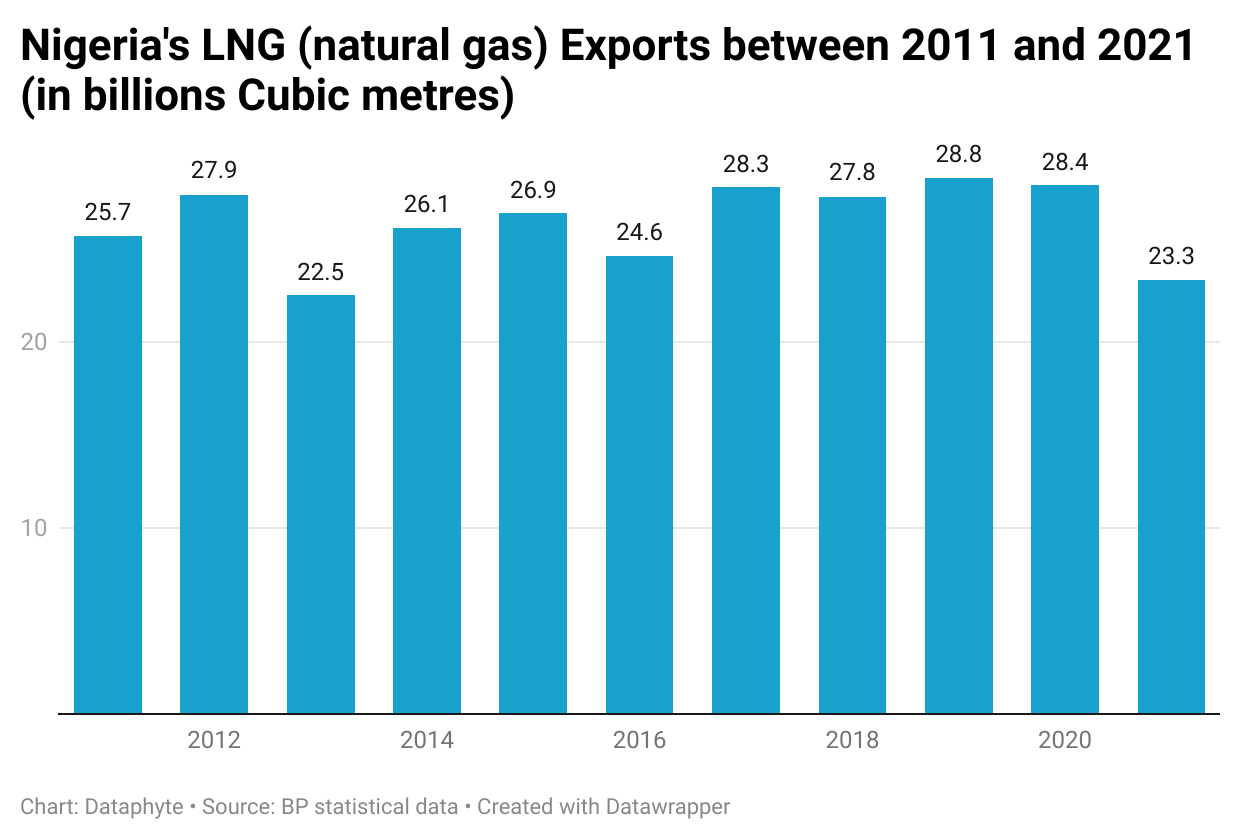

Of the amount produced, how many cubic metres has Nigeria exported?

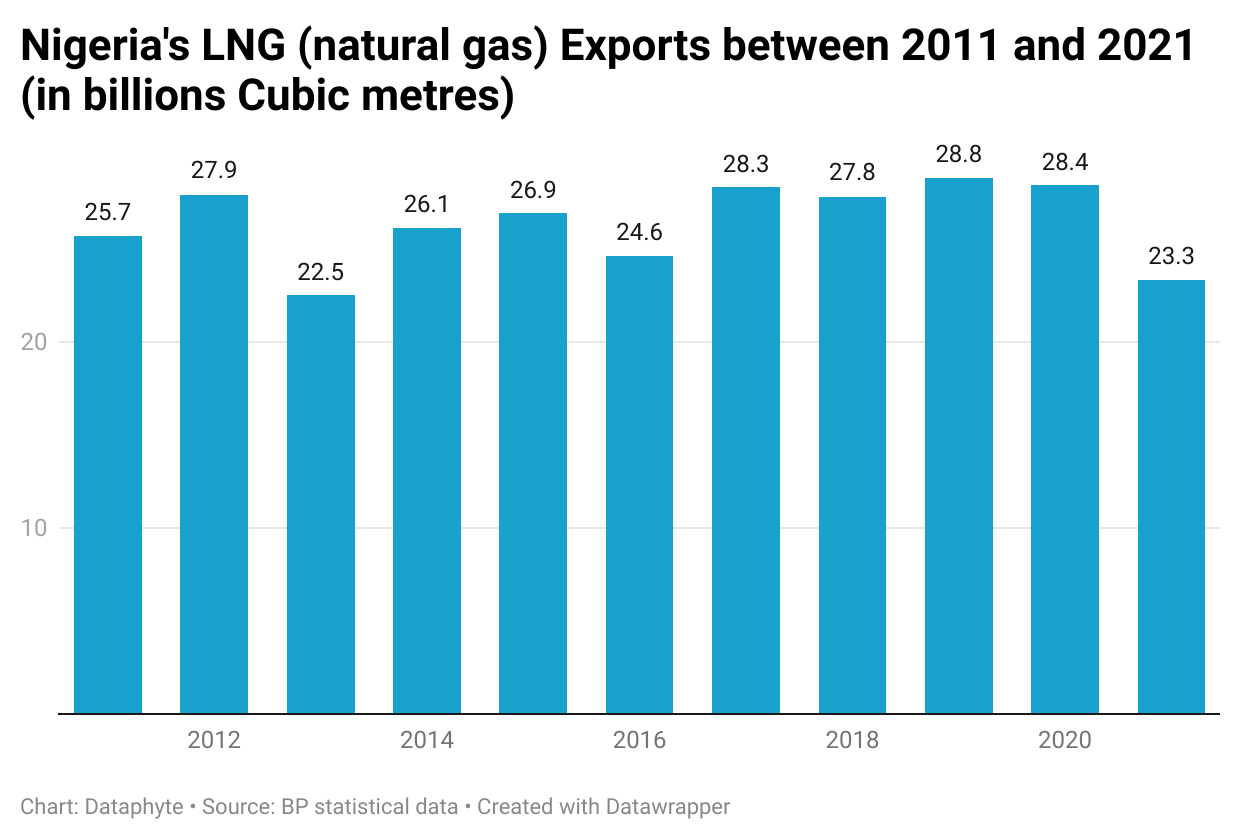

Nigeria’s natural gas export dropped from 28.4 billion cubic metres in 2020 to 23.3 billion cubic metres in 2021.

The highest export of natural gas occurred in 2019. Nigeria’s gas export has been inconsistent in growth, declining on some years and increasing in others.

How much gas has the country been able to provide for critical sectors?

73% of Nigeria’s installed power generation capacity is powered by gas, according to a review of Africa Power Fact Sheet by the USAID.

Of the 16,384 megawatts (MW) installed capacity, gas accounts for 11,972 MW. However, there have been challenges with the supply of gas for the purpose of electricity generation in the country.

The transmission company of Nigeria at various times has blamed poor electricity in the country on low gas supply. There have also been concerns about the capability of the generating companies (GenCos) to afford the gas needed to power their plants.

While there is no adequate data on the amount of gas supplied to the power plants, reports on gas supply and the state of electricity in the country points to inadequacy of gas supply.