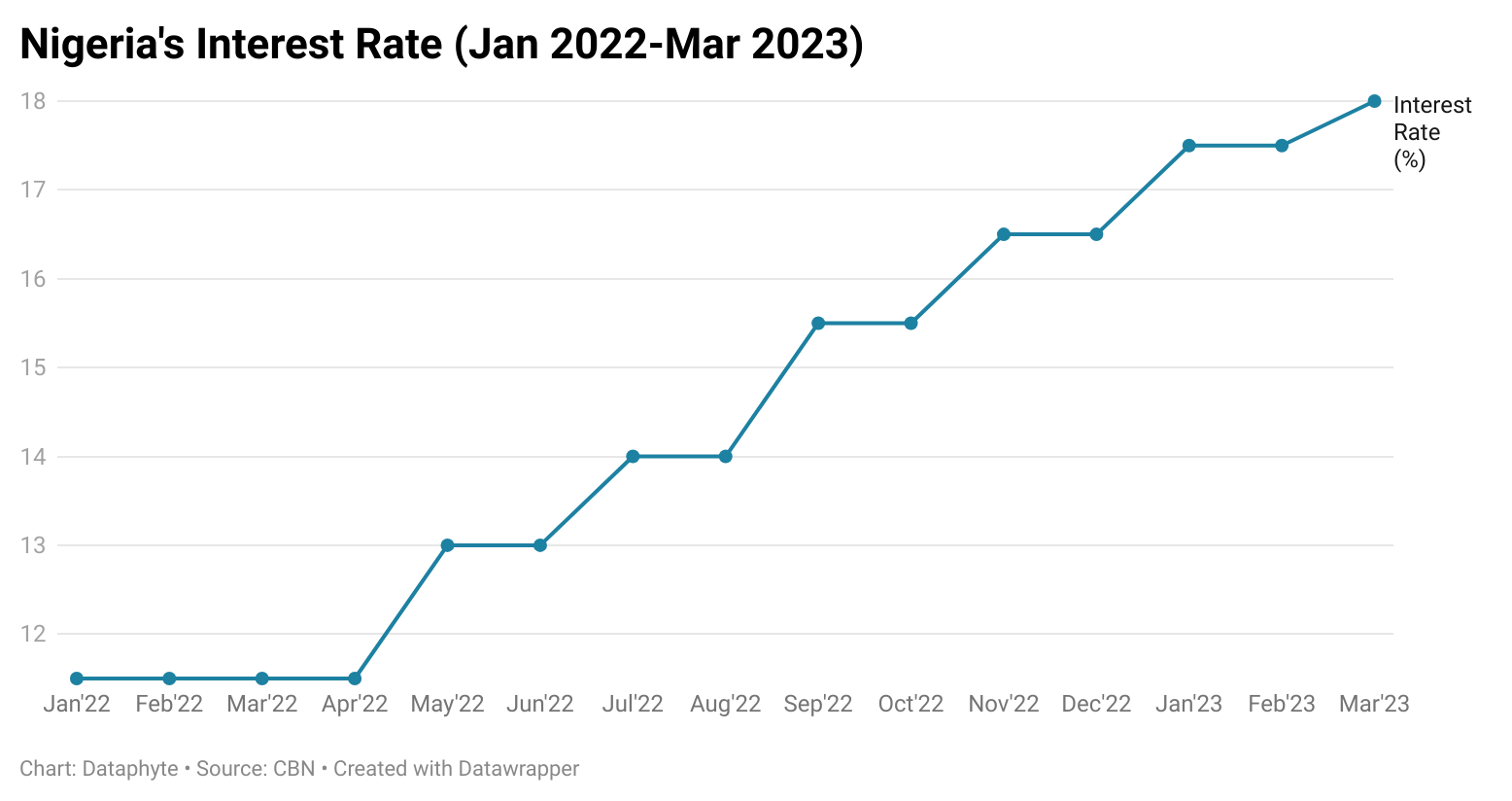

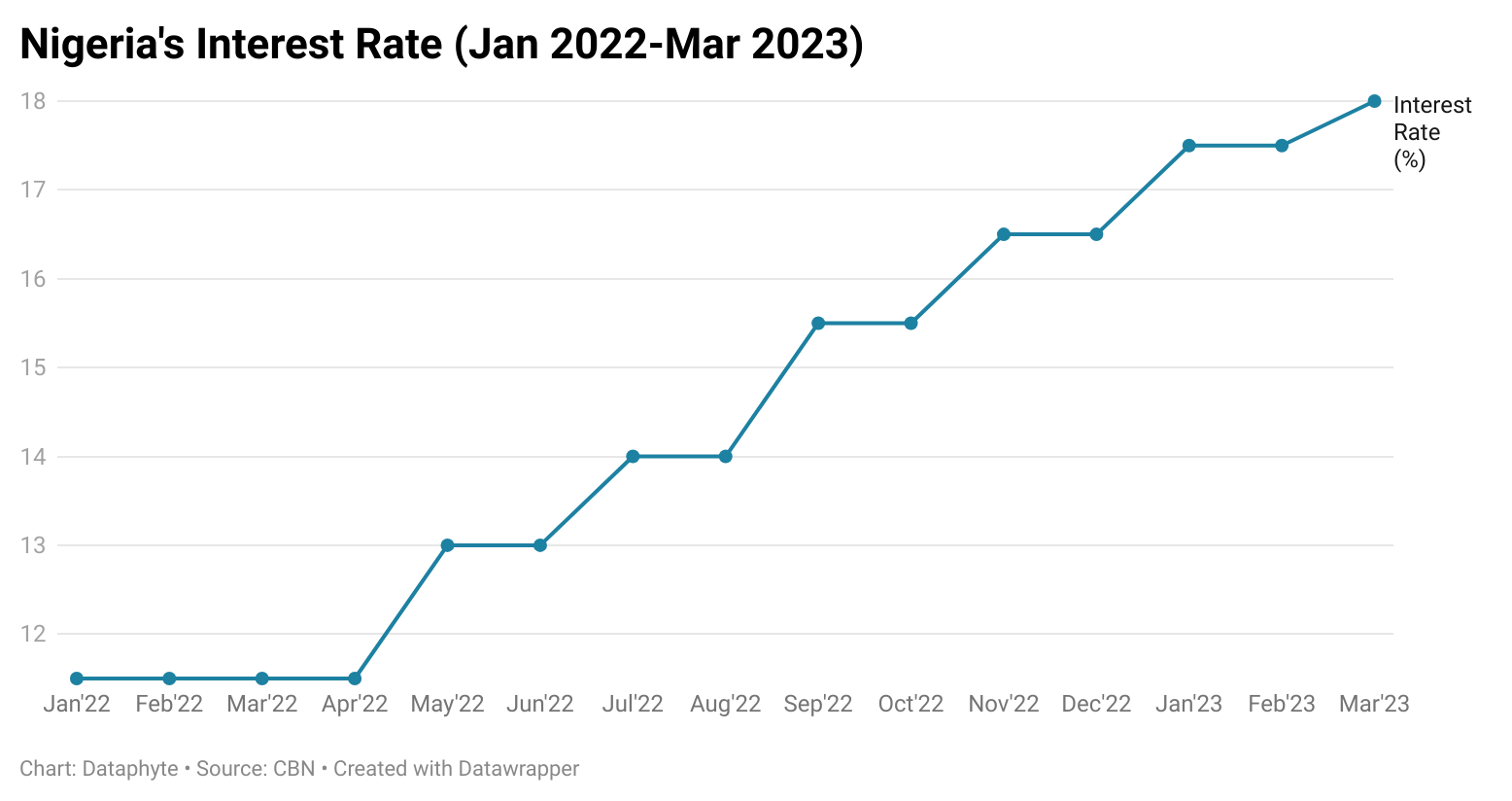

The Central Bank of Nigeria (CBN) has increased the benchmark interest rate from 17.50 to 18 percent.

At the end of the Monetary Policy Committee (MPC) meeting on Tuesday, the CBN Governor, Godwin Emefiele, attributed the interest rate raise to the need to reduce inflationary pressure.

Nigeria’s central bank has increased the interest rate six times. The interest rate was initially set at 11.5 percent between 2021 to March 2022. It was raised to 13 percent in May and 14.0 percent in July. It rose to 15 and 16.5 percent between September and December 2022. The interest rate increased further from 16.5 percent in December 2022 to 17.5 percent in January 2023 until this month when it was raised to 18 percent.

Interest rate increase fails to tame inflation

A greater interest rate implies that the lender will compensate the borrower with a high rate relative to the amount borrowed. A reduced interest rate implies a lower cost for repaying borrowed funds but a higher rate is the opposite, economists say.

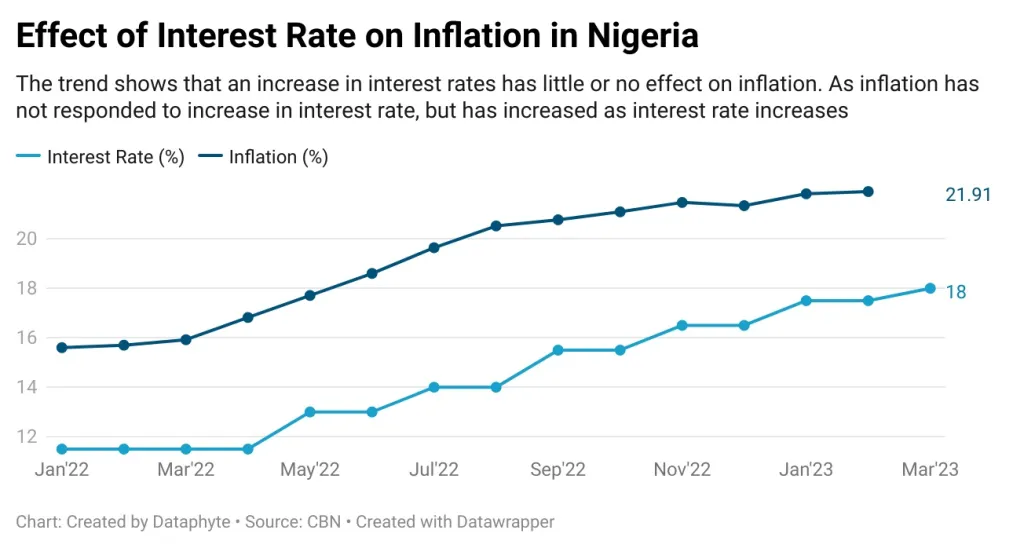

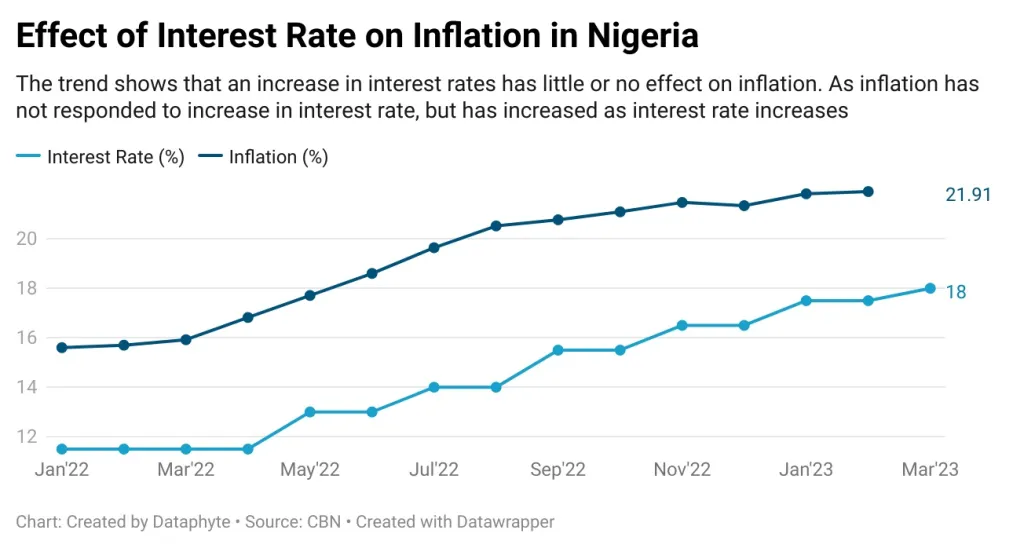

The current inflation rate in Nigeria is 21.07 per cent, up 0.9 percent from the rate that was registered in the previous month. Nigeria’s inflation has continued to trend upwards in nearly one year despite the CBN's interest rate hikes.

Since interest rate was raised in May 2022, inflation has accelerated from 17.71 percent to 21.91 percent, according to the National Bureau of Statistics (NBS) data.

The implication is that the interest rate hikes have not tamed inflationary pressure on the economy.

Supply-side issues must be resolved

The Chief Executive Officer, Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said Nigeria needed to address supply-side issues that were fuelling inflation.

“It is important to look at the drivers of inflation and address them instead of proffering solutions that will not help production. These steps will not tame inflation but will rather worsen it. The drivers of inflation are foreign exchange shortages, insecurity, weak purchasing power and low production. These are the things we must address with our policies," he said.

According to the CEO of Cowry Assets Management Limited, Johnson Chukwu, the persistent increases in interest rates would contract economic activities, raise cost of credit, and drive up cost of goods.

"It is possible to shut down the productive sectors with this stance," he said in a recent interview.

The European Central Bank asserts that changes in interest rates have different degrees of impact on all aspects of the economy, including bank loans, market loans, mortgages, bank deposit rates, and other investment instruments.

Resource development and SME advisor, Ronke Onadeko, said that interest rates were a form of lawful taxation. However, she stated that the frequency of bank lending would change as a result of the interest rate changes. She noted that there was a negative connection between the borrowing rate and the stock prices of firms that typically depended on loans.

An economics lecturer at Covenant University, Ogun State, Professor Jonathan Aremu, said shortage of funds was driving up interest rates, noting that the government and the CBN must raise interest rates because people lacked the resources to create goods, particularly agricultural goods.

He clarified that the low number of transactions and limited access to capital had caused inflation to rise, which was the primary cause of the rising interest rate.

Aremu recommended that currency be put into circulation because doing so would reduce inflation and eliminate the need to raise Nigeria's interest rate.