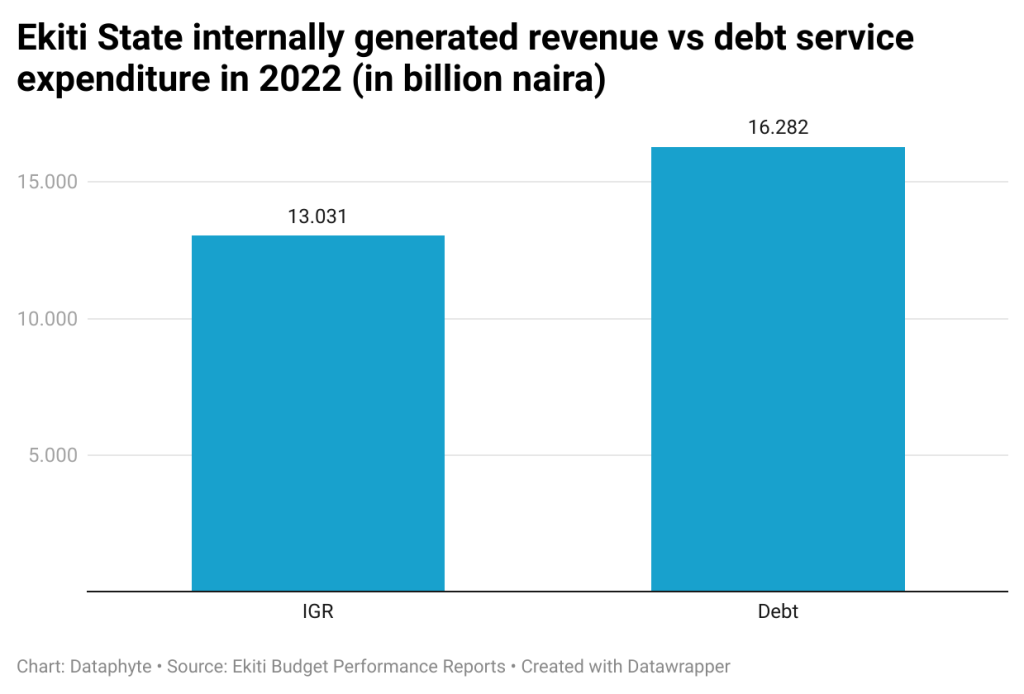

Ekiti is located in the South-West region of Nigeria. A Dataphyte review of budget performance documents of Ekiti State shows that its internally generated revenue (IGR) in 2022 was N3 billion less than its debt servicing expenditure by the end of the year.

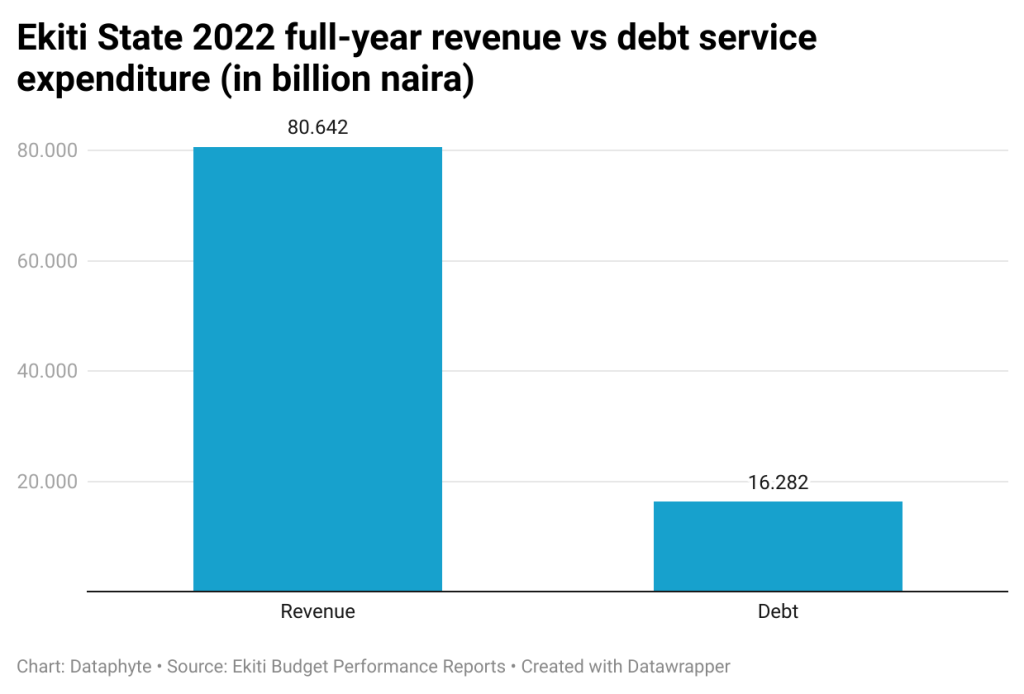

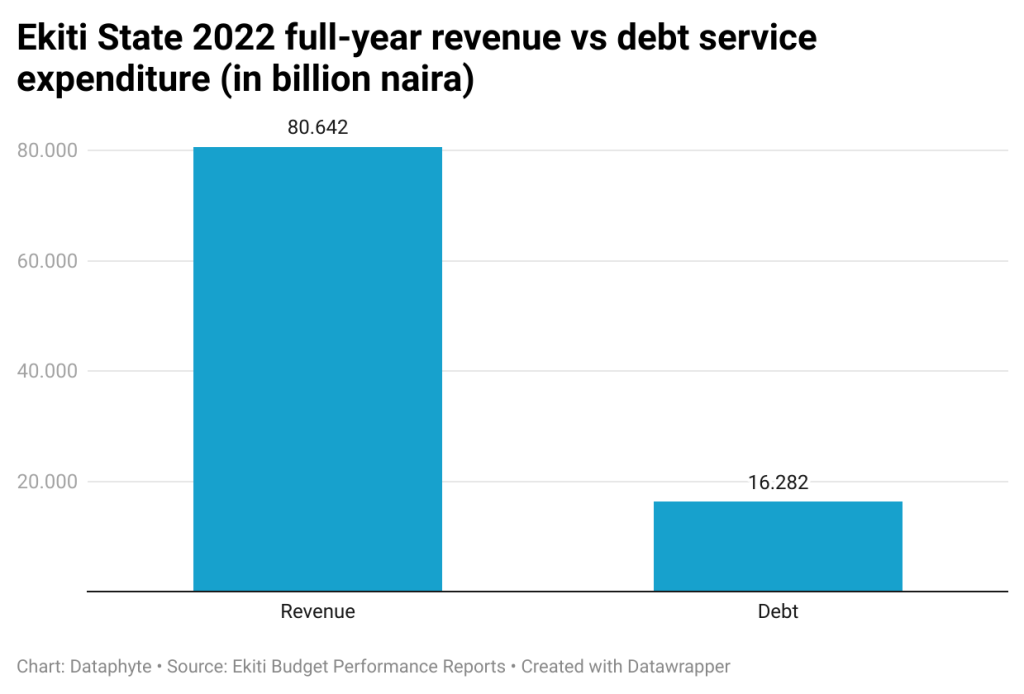

According to budget documents, the state generated N80.642 billion as revenue for 2022 but spent N16.282 billion on debt servicing. Hence, debt servicing represented 20.1 percent of the total revenue.

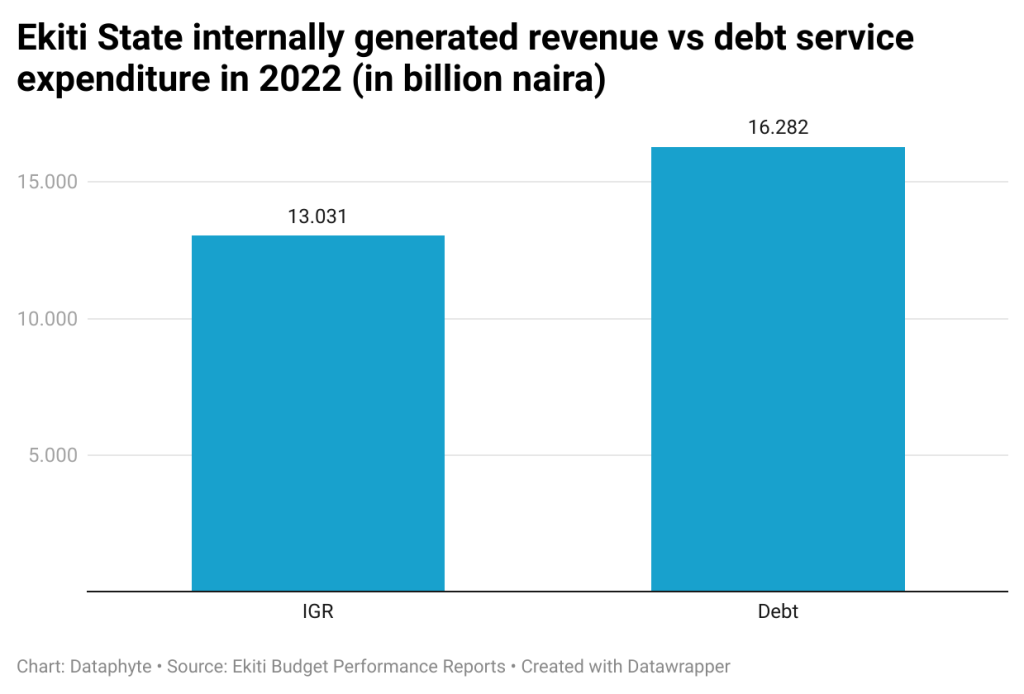

For the 2022 full year, the state generated the sum of N13.031 billion in IGR, but spent N16.282 billion on debt servicing charges.

This means that Ekiti could not even raise enough money locally to cover part of its loan servicing charges in 2022.

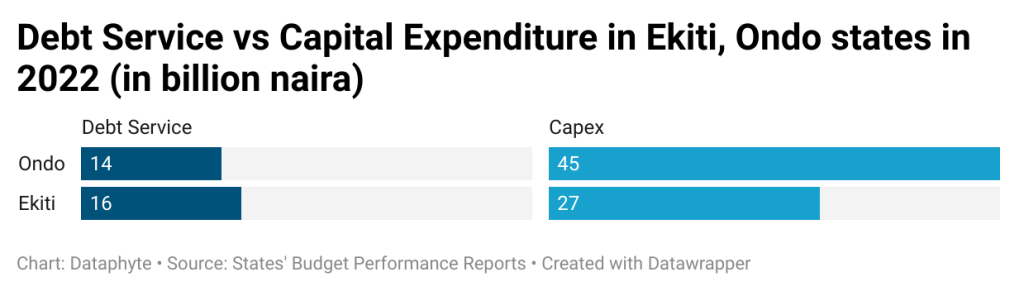

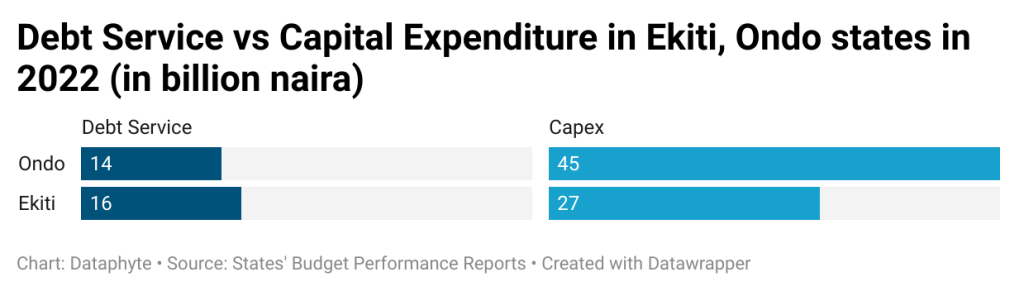

The government also posted N27.902 billion on capital expenditure, representing 69.6 percent of the approved capital budget totaling N41.761 billion for the year.

The government’s expenditure on debt servicing represents the equivalent of 58.3 percent of its capital expenditure.

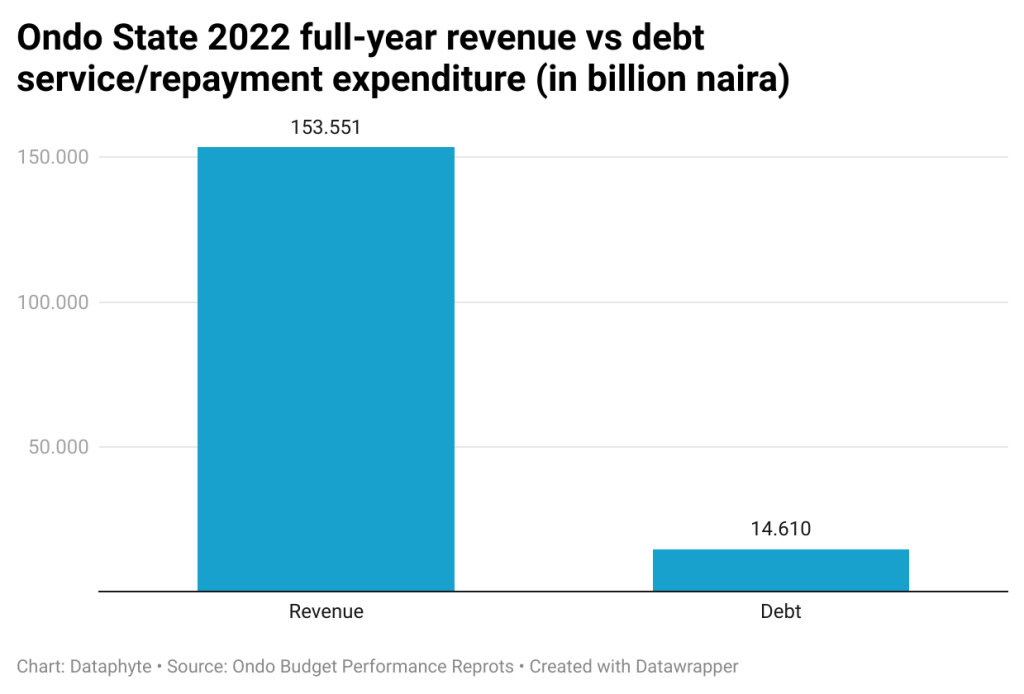

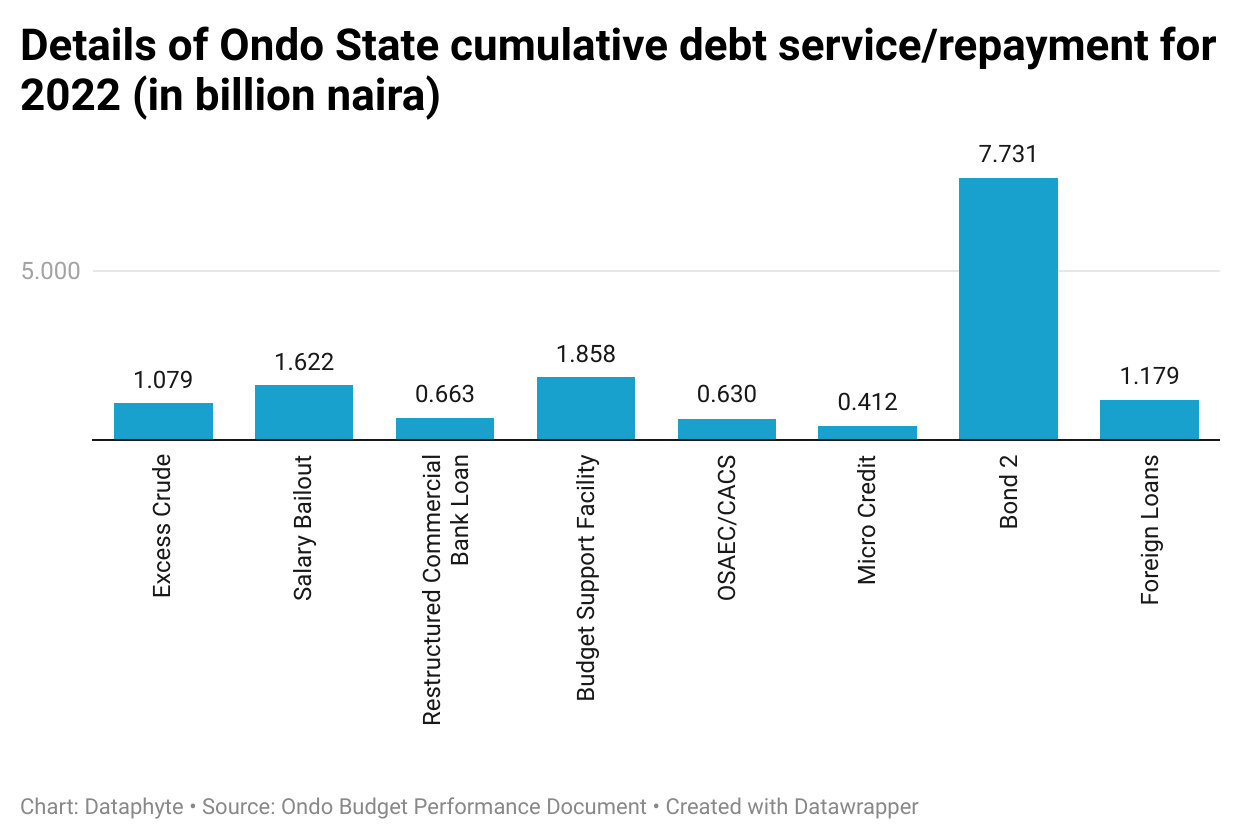

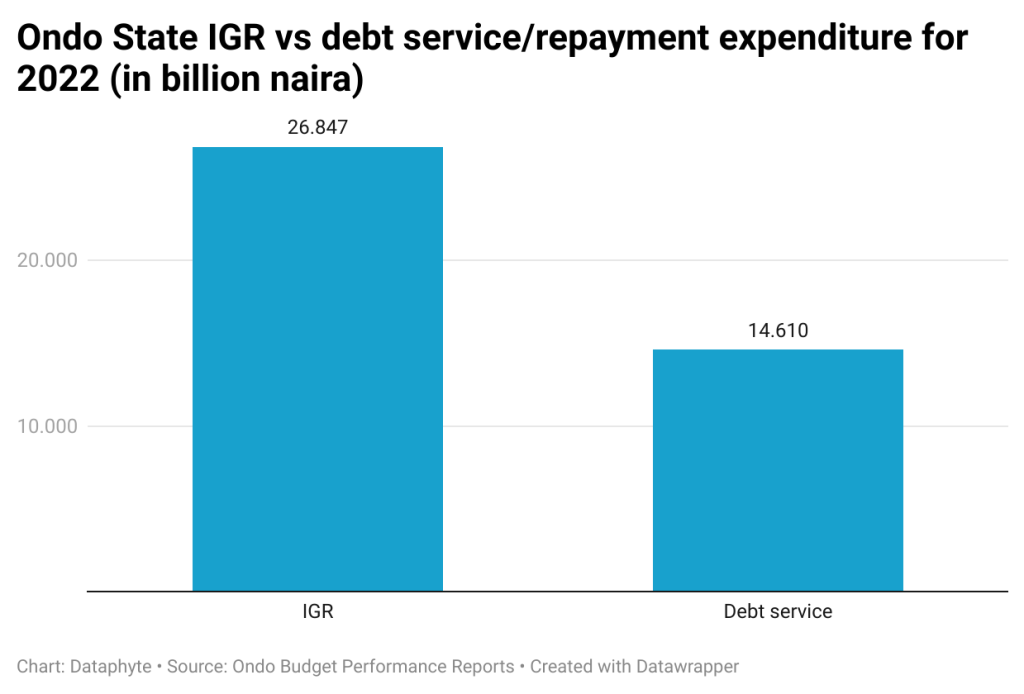

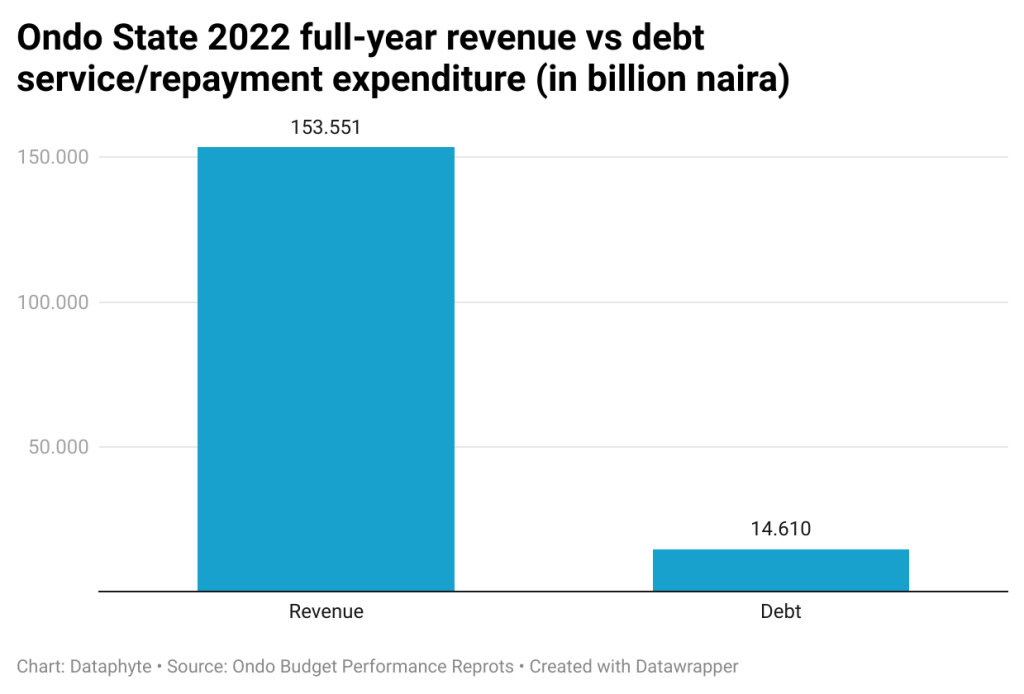

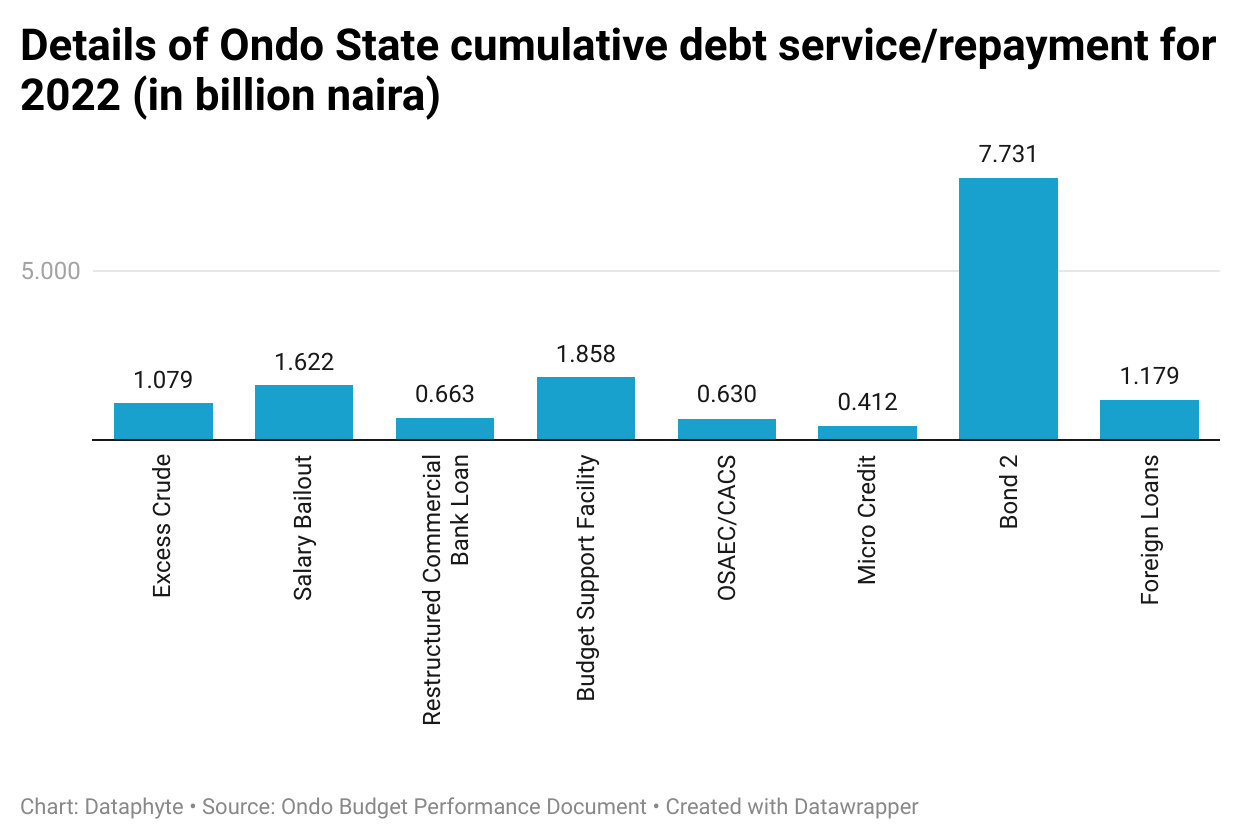

In a related development, Ondo State spent N14.610 billion on debt servicing/repayment, representing 9.54 percent of the N153 billion 2022 full year revenue.

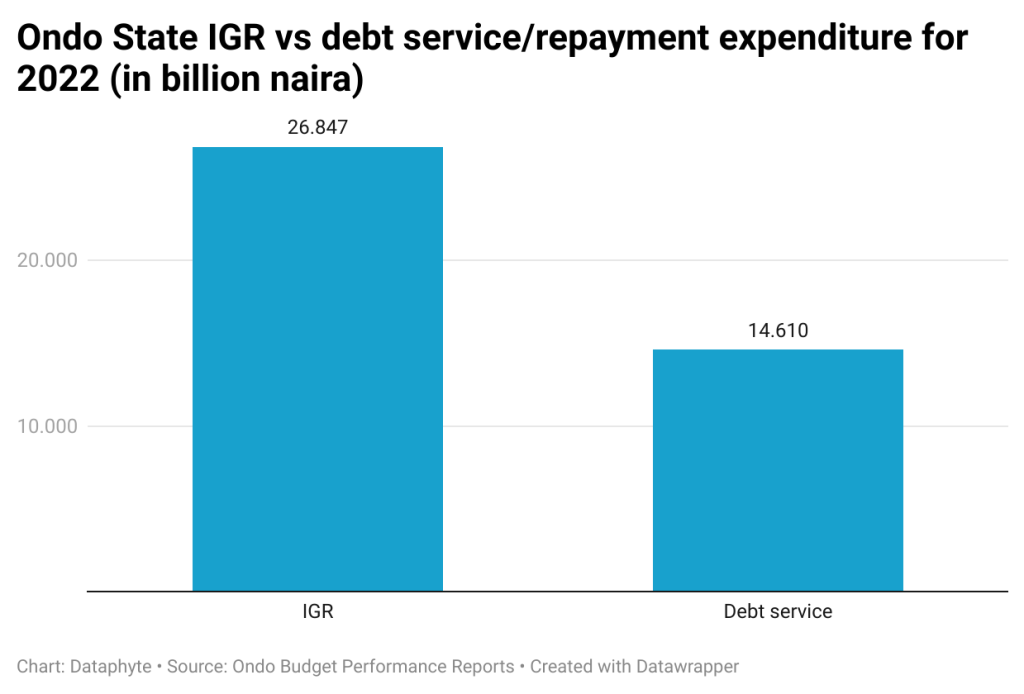

Further analysis shows that the state generated N26.847 billion as IGR but N14.610 billion went to debt servicing.

The state spent an equivalent 31.8 percent of its N45.856 billion capital expenditure on debt service for the year.

Debt servicing has been a major problem at both state and federal levels.

The Lagos Chamber of Commerce and Industry has expressed worry over the growing public debt in the country, noting that this development had become worrisome in the face of decaying infrastructure in the country.

The International Monetary Fund’s 2021 Article IV said Nigeria spent 85.5 percent of its revenue on debt servicing in 2021.

The Debt Management Office (DMO) said Nigeria’s debt servicing rose by 14.68 percent to N3.36 trillion in 2022 from N2.93 trillion reported in the previous year.

Nigeria’s revenue to GDP is nine percent, but Ghana’s is 13 percent, Kenya’s is 17 percent while Angola’s is 21 percent.

The Chief Executive Officer of Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said Nigeria often borrowed at very high rates, making debt servicing quite expensive.

“Nigeria often borrows at expensive rates, especially the Eurobonds. Sometimes, the yields are higher than those of other countries but they are quite high. This affects our debt servicing ratios,” Yusuf said.

An emerging market analyst, Ike Ibeabuchi, said states must begin to explore resources within their domains to raise revenue.

“We have not really tapped local resources. Take for instance, what is Ogun generating from solid minerals? Have we not left this area for illegal miners? Each state or region should look inwardly to increase revenue and reduce exposure to debts,” he further said.