Value Added Tax (VAT) has grown to be a major source of revenue for most countries.

It contributes one of the highest averages in developing countries compared to other taxes.

The history dates back to the ancient Chinese era when emperors generated revenue from salt traders to build the great wall to defend themselves. This system of taxing consumer goods by the Chinese emperors is the earliest example of taxing consumer goods.

However, German economists developed the concept in the 18th century but was first adopted in France in 1954.

This tax system has grown over the years into the VAT system we have today.

Nigeria increased its VAT rate from 5% to 7.5% in the 2020 Financial Act. The increased rate took effect from March 2021 and the collection of VAT rate of 7.5% began.

Since the country increased its VAT rate, it generated N1.53 trillion in 2020 and N2.07 trillion in 2021, an amount that is the highest VAT collection figures in seven years.

At 7.5%, VAT alone accounts for over 20% of the tax revenue generated in Nigeria between 2015 to 2020. However, its percentage of total GDP remains low (less than 1%).

VAT is an important tax revenue source for developing countries. However, there are questions about Nigeria’s VAT optimization, which includes the ability of the generation agency to meet its target and surpass it as well as effectively collect VAT on all economic activities in the country.

How is VAT Collected?

VAT is not imposed only on the sales to the ultimate consumer. It spreads across all the transactions that lead to the last purchase. It is charged as goods and services pass through the supply chain until it gets to the ultimate consumer.

The system works such that the 7.5% is split across the supply chain. If, for example, at a retail shop, a bottle of wine goes for N1,000. The retailer will charge the customer a VAT of 7.5% inclusive in the final cost, which will be N75.

The shop owner got the supply of the wine from the factory. Suppose he purchased the bottle of wine for, say, N750. He will pay the factory N806.25 (at N56.25 VAT of N750).

When the shop is remitting the VAT on the bottle of wine, he will take into cognizance the input tax of N56.25 paid to the supplier. Thus, he will pay N18.25 as VAT.

The government received N75 VAT charged on the bottle of wine, but this money is spread across the supply chain. Though the process looks cumbersome, collecting tax across the supply chain is the dominant feature of VAT. This process helps avoid tax evasion.

How has Nigeria Performed in VAT Collection?

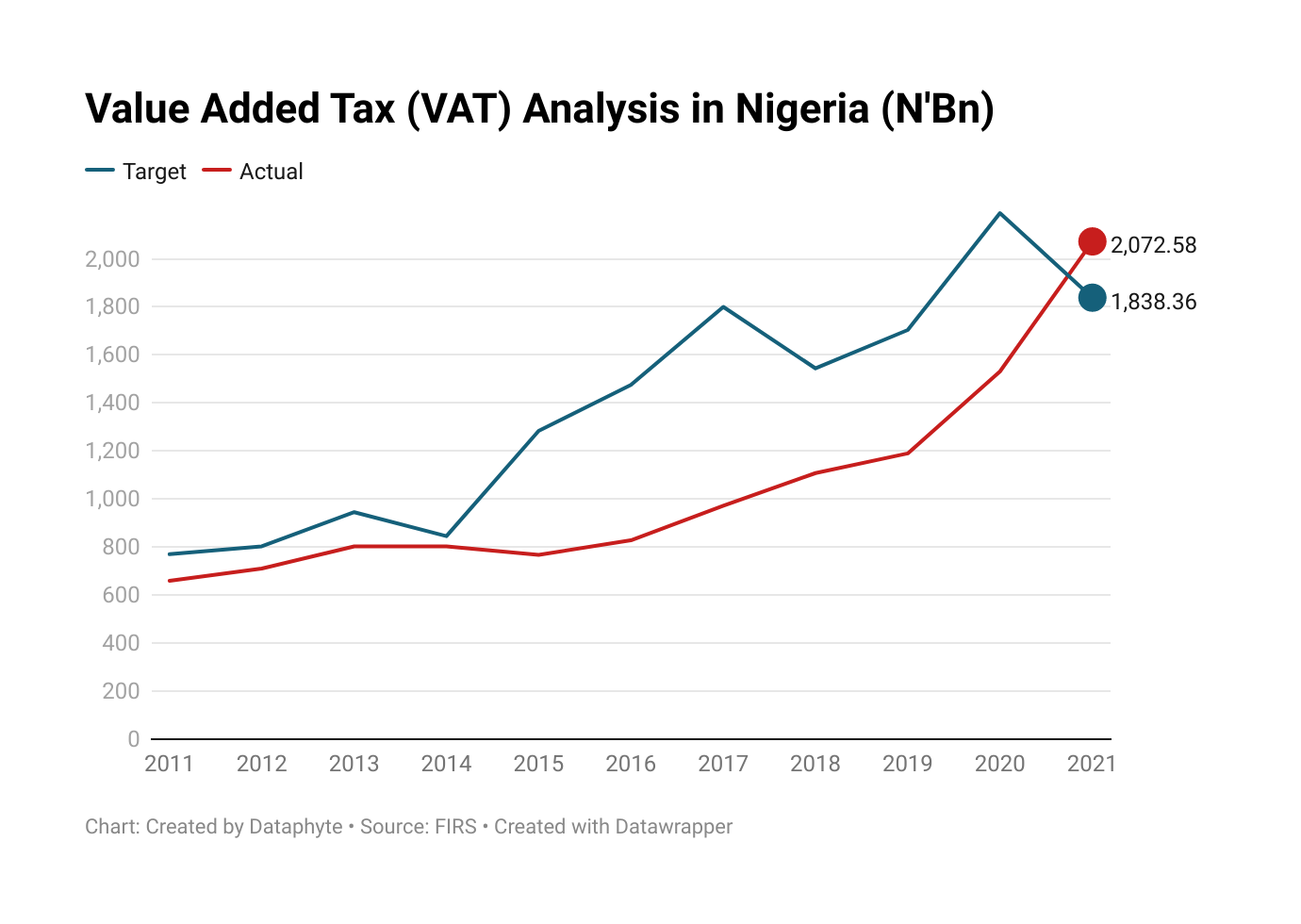

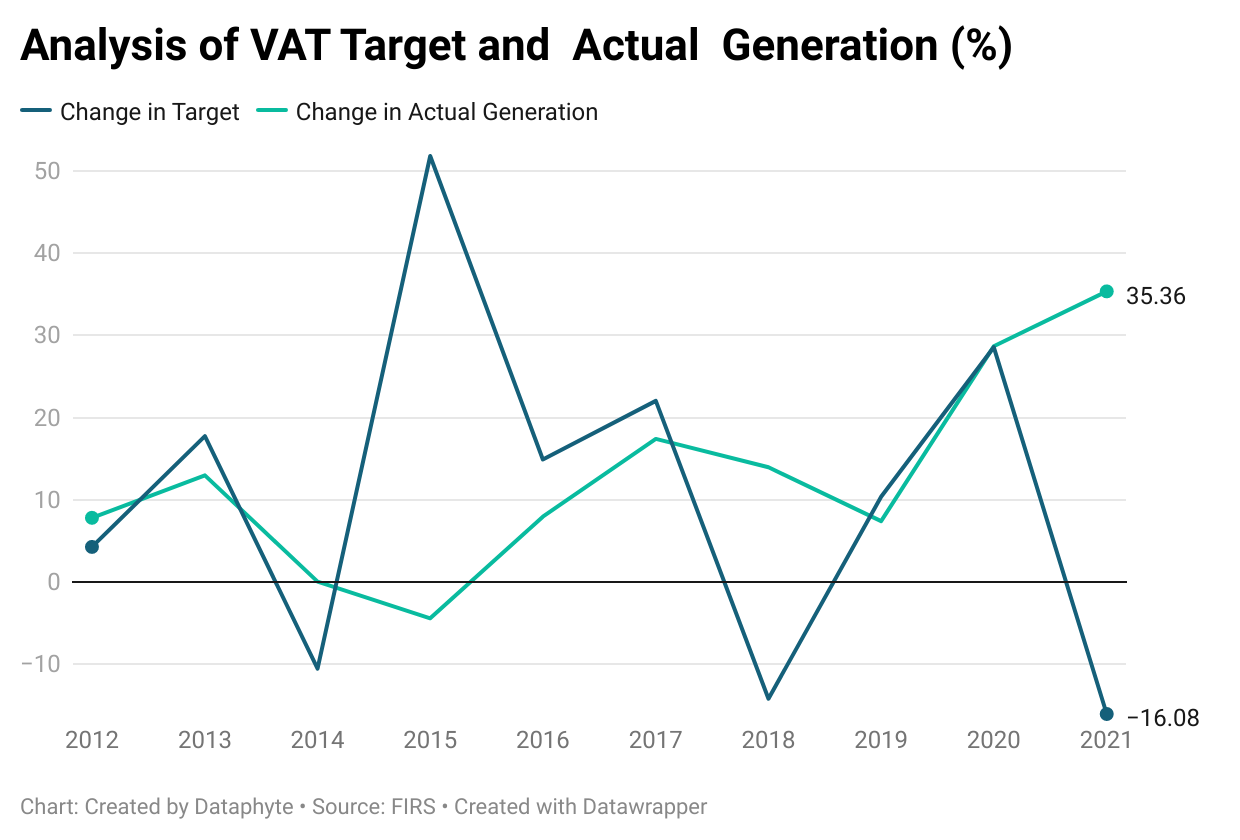

Analysis shows that the amount generated has remained lower than the target set since 2013, except for 2021.

The country only surpassed its target for the first time in 2021, although the target was set lower from N2.19 trillion in 2020 to N1.8 trillion in 2021.

Asides from the lower target, the increase in VAT revenue can be attributed to the increase in the VAT rate to 7.5%, as 2021 was the first full year of its implementation.

Over the last eleven years, Nigeria’S FIRS generated N11.45 trillion as VAT against the target of N15.19 trillion. This leaves an N3.55 trillion deficit in VAT generation compared to the set target.

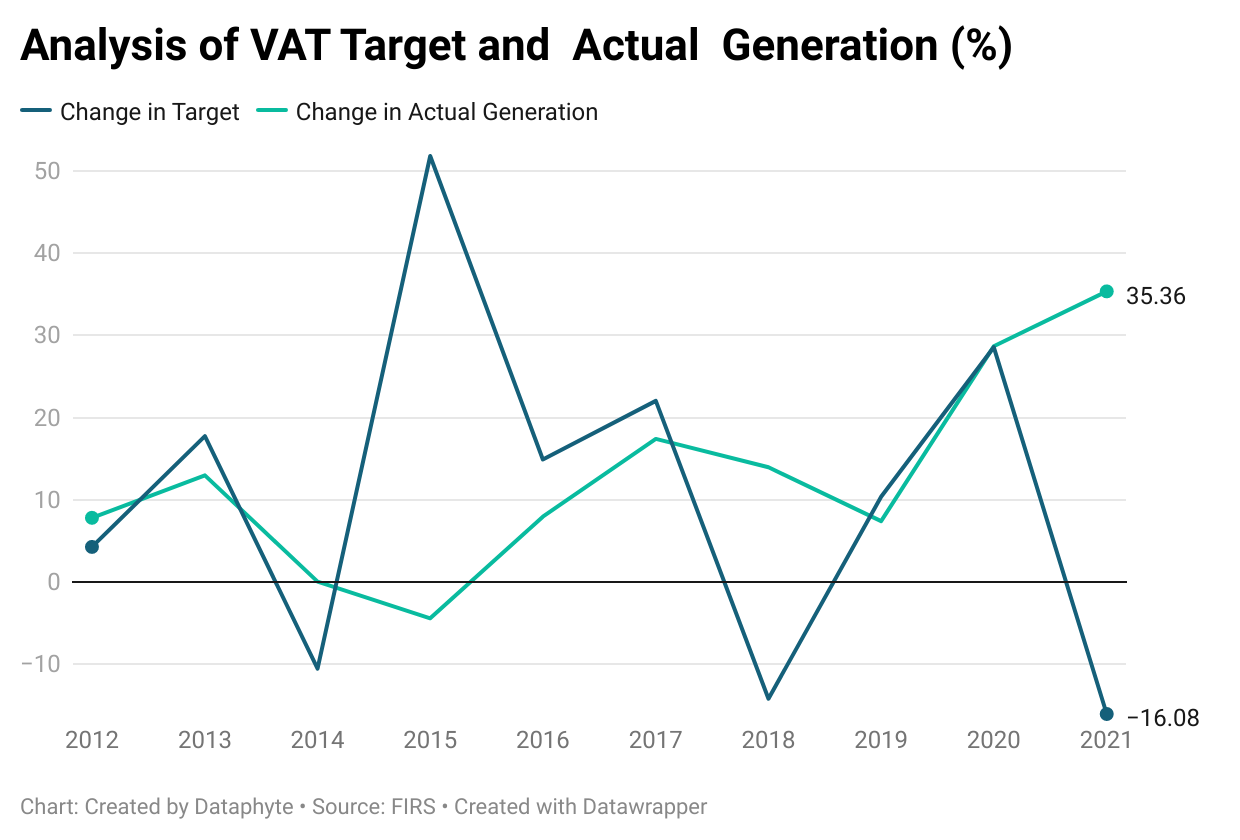

The amount generated dropped from N802.96 billion in 2014 to N767.33 billion in 2015. It, however, increased in 2016 to N828.19 billion, after which it continued to grow although never meeting the set target until 2021.The country’s relationship with its VAT target since 2012 has been that when there is an increase in the target, there is no proportionate change in a generation, rather, generation appears to dip. However, at the points where there is a reduction in target, there is a positive change in a generation.

The chart (table) above shows that in 2012, the target increased by 4.26% compared to the previous year, and generation also increased by 7.8%. However, in subsequent years, the increase in target led to a decrease in generation, when target increased by 17.74% in 2013, there was a 12.97% fall in generation.

In 2014, 2018, and 2021, where there was a negative change in target, that is the target decreased, the change in a generation was positive. The changes in target were -10.56% in 2015, -14.22% in 2018 and -16.08% in 2021. The corresponding changes in generation were 0.04% in 2014, 13.96% in 2018, and 35.36% in 2021.

While the collection from VAT has increased over the last seven years, VAT revenue in the country is however, not optimised because Inland Revenue Service does not meet the VAT generation target.

Some challenges to VAT optimisation in Nigeria revolve around VAT administration. These challenges include the technical ability of the collection officers, the lack of operational knowledge by VAT-able organisations that treat VAT as cost, and issues of tax evasion.

In addition, VAT administration faces problems of non-compliance by business owners, lack of transparency, the false VAT element of translation, and the lack of apathy towards VAT.

Moreso, there are concerns if the VAT revenue collected actually reflects the total economic activities in the country.