Is Nigeria Optimising its VAT Revenue?

Value Added Tax (VAT) has grown to be a major source of revenue for most countries.

Tag

Value Added Tax (VAT) has grown to be a major source of revenue for most countries.

Nigeria generated N563.72 billion as Value Added Tax (VAT) revenue in the fourth quarter (Q4) of 2021, bringing the total VAT revenue for the year to N2.07 trillion.

Nigerians will now pay 7.5% Value Added Tax on Facebook and Instagram adverts from January 1st, 2022. The social media company announced that as a result of the regulation of the Nigerian government, all advertisements on the platform whether for personal or business purposes will be subject to a 7.5% Value Added Tax.

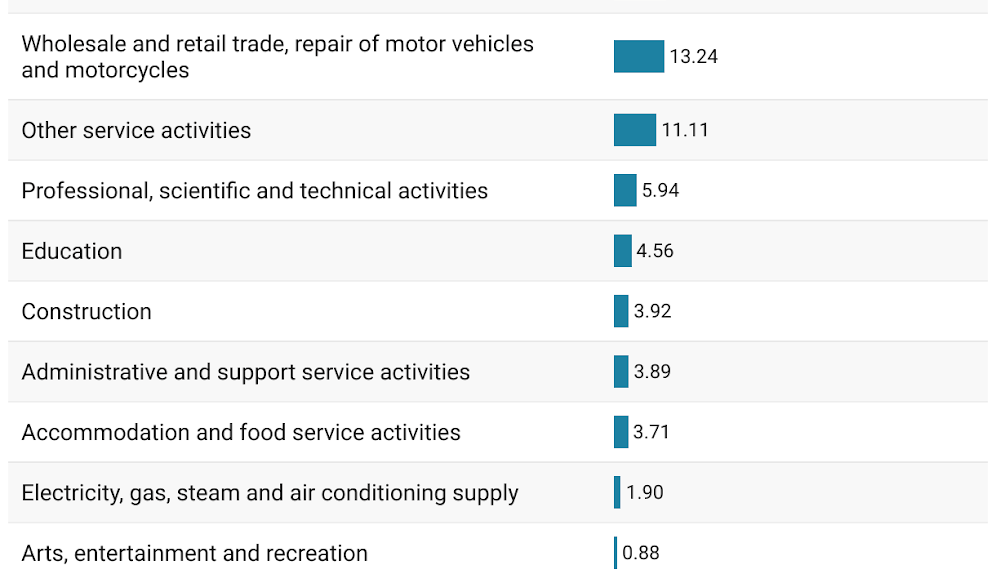

According to NBS, these are the value added tax collected for the various sectoral collections in Q3 2021.

Value Added Tax (VAT) is a consumption tax levied on a product at every point of sale when value is being added. It is collected by the Federal Inland Revenue Service. At every stage of production up to the ultimate level of the final buyer, value added tax is paid.

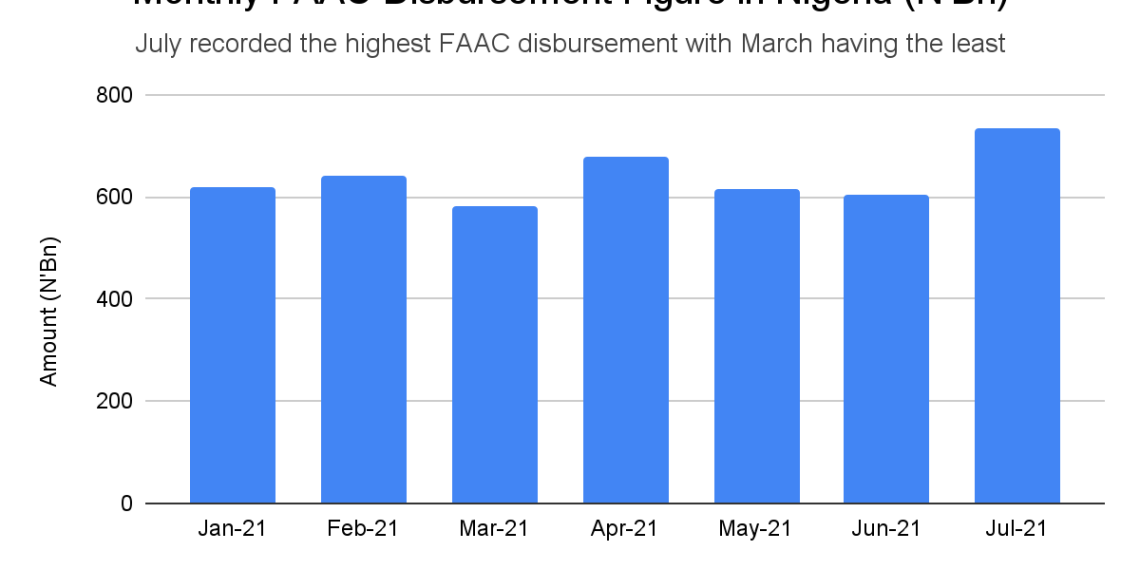

A total sum of N120 billion was spent by the Nigerian government to augment FAAC revenue shortfalls between January and July 2021.

In 2020, Nigeria generated a total of ₦1.41 trillion as revenue from Company Income Tax (CIT). Of this figure, 56.09% came from the sectoral collection, 16.89% was e-payments, and 27.02% from foreign sources.

Failure to receive payment worth ₦974,100 for service rendered;

Whatever happens to the VAT increase, the governments at the federal, states and local governments need to eschew those four cover up tales and embrace these two sobering truths. Employing ingenious macroeconomic policies and consistent fiscal discipline is the way to make any tax regime work for the overall good of the country.

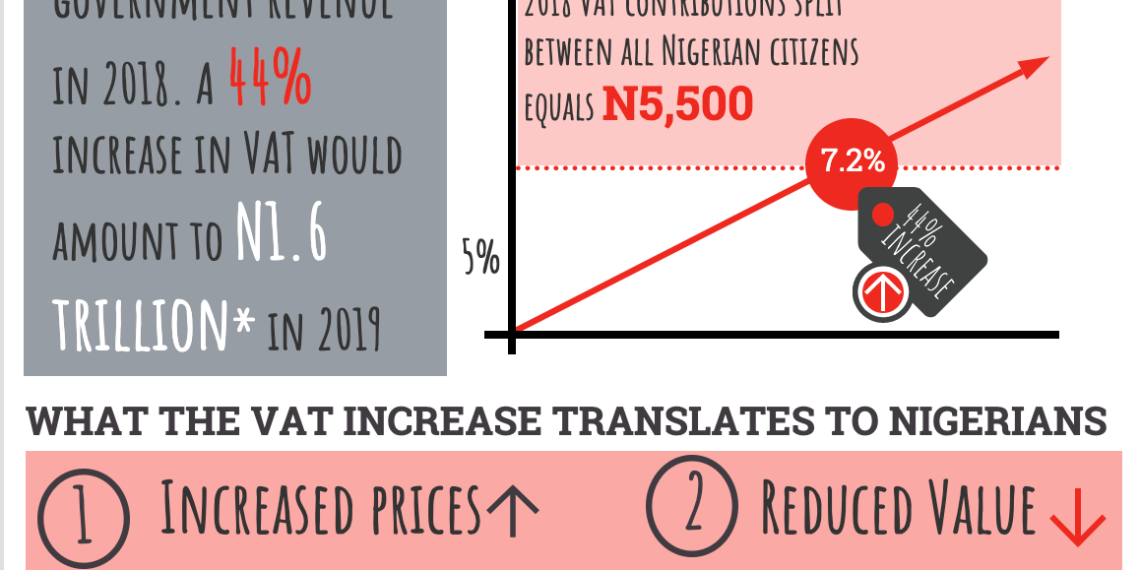

The Federal Government’s decision yesterday to increase the value added tax (VAT) rate from 5% to 7.2% is a polite way of saying to you “We the federal, state and local governments appreciate the money you pay to us every day through VAT, but we seriously need more from you to spend it for the usual things we spend it on. Will you help?”