Jane, an Abuja-based Nigerian wholesaler of powdered milk, bemoans that “the prices of a bag of milk increases by 6,000 naira every time I restock.” She clarifies that she used to purchase a bag of milk for 86,000 naira, but now she pays 106,000 naira in just a period of four months.

Opeyemi Olasimbo, a fashion accessories retailer, told Dataphyte that the ongoing devaluation of the Naira is depressing and that she is considering exploring other business opportunities because it is so expensive to import the accessories that she resells to Nigerian wholesalers.

For business owners dependent on foreign products, the constant fall in forex rates presents a significant challenge. Increased import costs, reduced profit margins, and currency risk are just a few of the issues they must navigate.

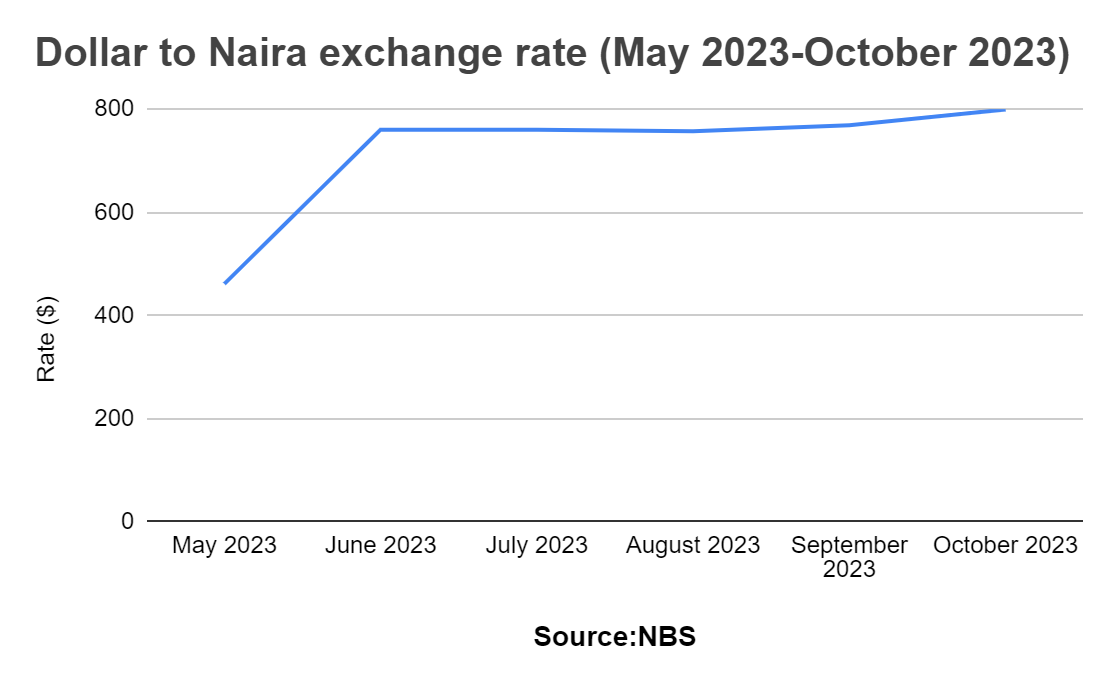

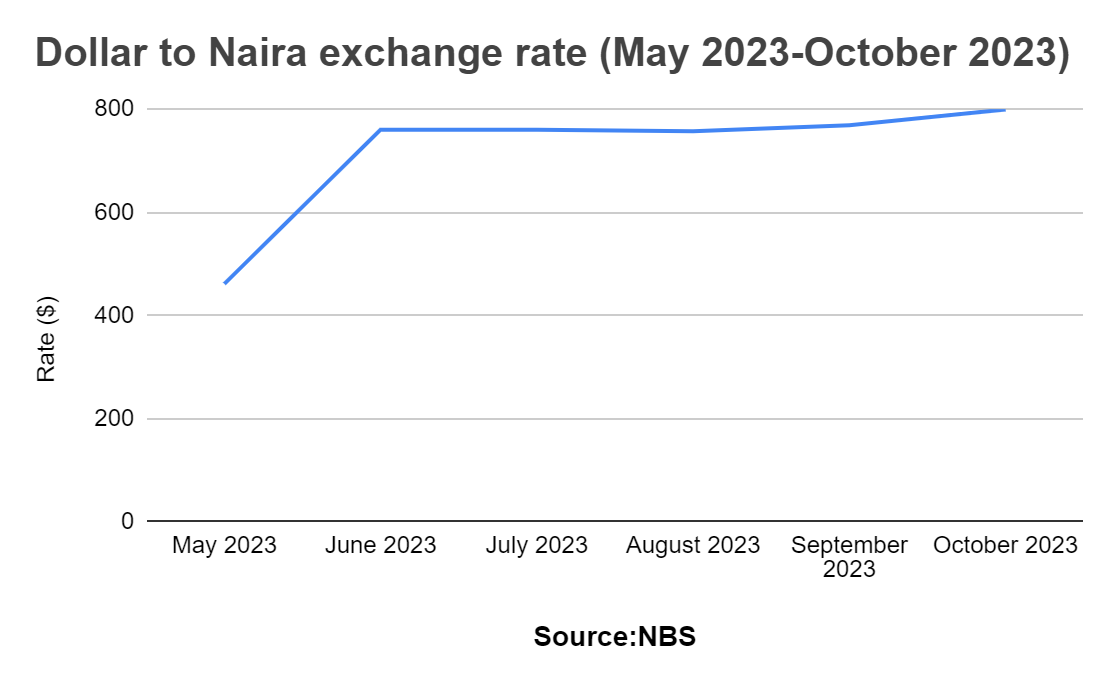

On June 14, 2023, the Central Bank of Nigeria introduced a free-floating policy of the Naira to other international currencies to guarantee that foreign exchange values in Nigeria are determined by its demand and supply without the CBN’s interference.

Other currencies have freely fluctuated since the policy was put in place, and more crucially, they have strengthened against the naira, greatly depreciating it.

Foreign exchange markets are known for their inherent volatility, with currency values fluctuating constantly. These fluctuations can have far-reaching consequences for businesses that depend on importing foreign products.

Foreign exchange markets are known for their inherent volatility, with currency values fluctuating constantly. These fluctuations can have far-reaching consequences for businesses that depend on importing foreign products.

Many factors, including economic indicators, geopolitical events, interest rates, and investor sentiment, influence forex markets. These complex dynamics can lead to currency values rising and falling unpredictably.

Efforts to unify the CBN and parallel market exchange rates, however, have contributed more to the constant depreciation of the Naira against other foreign currencies over the past six months.

One of the most immediate consequences of the depreciating domestic currency is the increased cost of importing foreign products. Business owners must pay more in their local currency to purchase the same goods they imported when the exchange rate was more favourable.

This puts pressure on profit margins, making it essential for business owners to consider their pricing strategies carefully.

For businesses that rely heavily on foreign products, a constant fall in forex can eat into their profit margins. With import costs rising, maintaining profitability becomes challenging. Sometimes, businesses may be forced to raise prices, reducing customer demand.

Striking a balance between cost management and maintaining competitiveness is a delicate task.

The currency risk is a significant concern for business owners in a constantly fluctuating forex environment. A falling currency can create uncertainty regarding future import costs, which makes financial planning and budgeting more complex.

Despite the challenges posed by constant forex fluctuations, there are strategies that business owners can employ to mitigate the impact on their operations.

Businesses may consider hedging strategies to mitigate these risks, such as forward contracts to lock in exchange rates for future transactions. Currency hedging involves using financial instruments like forward contracts, options, or futures to protect against adverse currency movements.

Also, diversifying suppliers by sourcing products from countries with more stable currencies can reduce the exposure of businesses to exchange rate fluctuations.

Businesses can also explore diversifying their revenue streams to counter the effects of a depreciating domestic currency.

Adapting to the ever-changing world of forex markets is essential for the long-term sustainability of businesses that depend on foreign products. However, with careful planning, diversification, and the use of currency hedging strategies, they can minimise the impact of these fluctuations and continue to operate successfully in a global marketplace.

Foreign exchange markets are known for their

Foreign exchange markets are known for their