For many weeks, Nigerians have been battling with petrol scarcity.

At the onset, the NNPC had blamed the scarcity on the importation of 100 million litres of adulterated/dirty fuel, however, many weeks after, the queues have remained at petrol stations.

.jpg)

Long queues at petrol stations

Nigeria largely subsidises its petroleum products, making it cheaper for its citizens and as such inability to make available petroleum at a subsidised rate will lead to disruption in supply.

Earlier this year, the country’s minister of petroleum revealed that N3 trillion was needed for the country to meet its subsidy demand for the 2022 fiscal year. This bill was calculated with the crude oil price hovering at about $80 per barrel.

However, currently, crude oil is hovering at about $140 per barrel. The implication of this is that the calculation of the NNPC for landing costs are likely altered already. Which means that the NNPC may need to spend more on subsidies for the 65.7 million litres of petroleum quoted as Nigeria’s daily consumption rate.

Landing costs are usually decided by factoring Platt and Nigeria’s Petroleum Pricing Regulatory Agency templates.

Crude oil price as of March 4 was at $118.11 per barrel and with one barrel producing 170 litres of refined petroleum. With the naira exchanging at N416.34 to one dollar at the Central Bank’s official rates, the initial landing cost of petroleum hovers around N289.

Other costs factored in based on the PPPRA pricing template include; Jetty charge at N1.61/litre, storage charge at N2.58, wholesalers margin N4.03, admin charge N1.23, Transporters allowance N3.89, Retailers margin N6.19, Bridging fund N7.19, Marine Transport average N0.15, freight N8.31, Nigerian Port Authority Charge N2.49 and littering expense N4.81.

The final cost of petroleum without subsidy will be about N333 per litre. Costs like product cost, NIMASA charge and insurance cost are yet to be added to the prices above.

The higher the cost of crude, the higher the landing price of petrol will be. Already, the price has risen above $118.11 per barrel.

Crude prices have exceeded the government’s initial estimation of $80 per barrel at an average of $0.47 per litre of petroleum.

The N3 trillion subsidy bill presented by the Nigerian government for 2022 shows that the country planned to subsidise a litre of petroleum by an average N125 each. Based on increased crude prices, the country is likely subsidising each litre of petrol with at least N168, N43 higher than it had initially planned.

At the least landing cost of N333, about N10.9 billion will be required to offset subsidy daily at 65.7 million litres daily consumption, that is N2.7 billion higher than the initial estimates.

If the cost of crude does not fall below $118 per barrel or even rises higher, Nigeria will need an additional N985 billion added to the subsidy bill for 2022, at the least. This takes the subsidy bill up to N4 trillion for 2022.

It is possible that the unplanned increased burden of subsidy is proving to be a challenge and Nigeria may be struggling to meet up the demand for footing the subsidy bill and making petroleum available at the subsidised price to the petroleum stations.

For a country whose budget deficit is already 3.39% of its GDP and slightly above the 3% ceiling set by the Fiscal responsibility Act 2007 (FRA), the increasing subsidy bill is a problem to say the least.

Petrol Marketers Fracas

Another issue that may be fueling the current scarcity could be a disagreement between the Nigerian government and petrol marketers. In February, Petrol marketers kicked against a N500,000 transhipment price for petroleum. The newly introduced fee, according to the marketers, will increase their cost of doing business and may reflect on the price at which petroleum products are sold.

Transshipment is when a cargo or container is moved from one vessel to another while in transit to its final destination.

Already, some marketers have been accused of selling petrol from depots above the official market rate, a development they were quoted as blaming on the high cost of purchasing petroleum. An additional fee will only further increase the costs of business for marketers and Major Oil Marketers Association of Nigeria has said it would resist any attempt to have a Shipment fee as they cannot bear the brunt of such costs.

Marketers are also reported to be unhappy with losses as a result of the dirty fuel imported by the NNPC. While citing that they are finding it hard to operate, they had demanded compensation to cover these losses.

This is not the first time that petrol scarcity in the country will be blamed on marketers, and these disagreements may impact on refined petroleum products distribution in the country further aggravating the scarcity.

Should the Russia-Ukraine War Affect Fuel Supply in Nigeria?

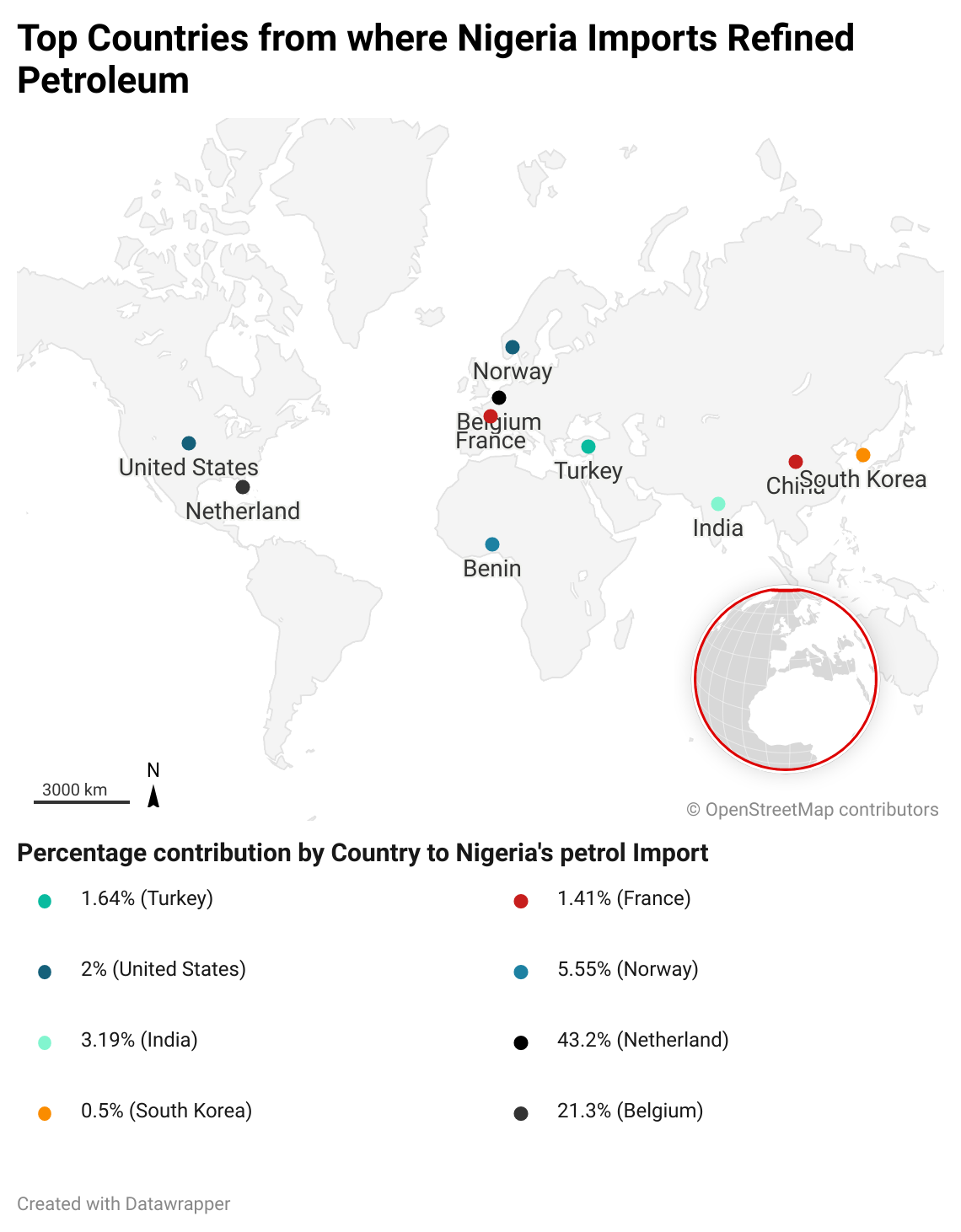

Nigeria’s refined petroleum is largely imported from the Netherlands and Belgium, details from the Observatory of Economic Complexity show that Russia contributes only 0.6% to our refined petroleum importation.

However the Netherlands which also supplies refined petroleum to Belgium, the two countries from where Nigeria imports most of its refined petroleum, imports a large portion of their crude from Russia like most of Europe. Thus Nigeria could potentially experience some disruption to its refined petroleum supply.

The war between Russia and Ukraine is what has led to the rise in crude oil prices, and this price increase may continue if the crisis is not resolved. There are fears Russia may weaponize its position as the highest supplier of crude oil and natural gas to the entirety of Europe.

Rising crude prices abroad occasioned by a far away war is perhaps the most direct impact of the war on Nigeria and its subsidy regime and in that way the war does impact on Nigeria’s supply and distribution of Petrol.

.jpg)