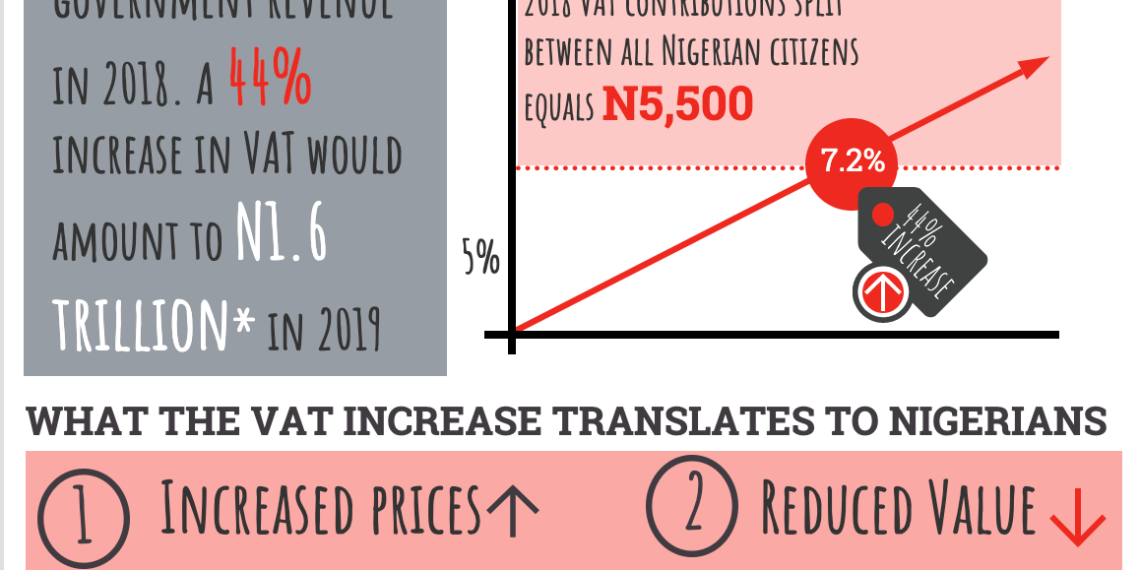

The Federal Government’s decision yesterday to increase the value added tax (VAT) rate from 5% to 7.2% is a polite way of saying to you “We the federal, state and local governments appreciate the money you pay to us every day through VAT, but we seriously need more from you to spend it for the usual things we spend it on. Will you help?”

Value added tax (VAT) is simply a tax on the final user of a service or the final customer that buys a product. That is, it is a tax on every man on the street.

The 44% proposed increase on VAT directly speaks to the notion that the spending power of the Naira has fallen.

Last year, the federal government said you contributed to the One trillion, one hundred and eight billion, forty million, five hundred and sixty-six thousand, one hundred and ninety-seven Naira (N1,108,040,566,197) VAT that the President received and shared with your governor and local government chairman to spend for you and everybody in your community because they know what is good for you more than you do.

Every time you buy an N500 recharge card, you will see them write: VAT inclusive. This is because the value of the airtime they are selling to you is N476. Your remaining N24 is paid on your behalf to the government as value added tax (VAT). But the federal government has decided yesterday that it will now force your phone network service provider to give you only N466 whenever you buy N500 credit. That is, you will get less airtime or internet data for the same amount. It also means that every time you pay your N5000 electricity bill, you must add another N110 to the current N250 extra charge that you pay, making it N5360 instead of the N5250 you are currently paying.

VAT (Value added Tax) can be explained simply this way.

If a textile company spends N650 to produce one yard of cotton and wants to make N350 profit on each yard, they will be ready to sell it at N1000 per yard to a company that uses it to sew T-Shirts and shorts. But they will now charge 5% extra, which is N50 on every yard to give to the government as VAT.

So, the company making T-shirts and shorts buys its cotton raw materials at N1050. If this factory makes one T-shirt and shorts with one yard of cotton, and decides to make a profit of N450 per T-shirt and short they sew, they will be ready to sell at N1,500, but they too will add another 5% VAT and sell the T-shirt and shorts as sport wears to your child’s school at N1,575, and hand over the extra N75 on each pupil in your child’s school to the government as VAT.

Your child’s school will also take the T-shirts and shorts they bought each at N1,575 to a designer to print the school logo and colours on them. The designer will buy paint and other things and pay VAT of N125 on paint needed to design each T-shirt. So if he wants to make a gain of N300 per T-shirt and shorts he designs, he will add the N125 VAT he paid to the N300 profit he wants and charge the school N425 to design each T-shirt and shorts. Recall your child’s school bought those T-shirts at N1,575. So now each T-shirt has cost them N1,575 plus N425, which equals N2000.

Now, because your child’s school has more interest in your child than the money they want from you, they may just sell the T-shirt and shorts to each of your two children at N2100 each. They will not charge you extra VAT because they are an educational institution. So, even though you just paid N2100 per school sport wear, the market collected a total of only N1,850, but you as the final consumer of the cotton product from the textile industry have paid for all the tax the government received at every level of the production of your child’s sport wear which is N250 (N50 + N75 + N125). That is how you pay VAT for everything you buy or service you use presently in Nigeria.

You will recall that though you didn’t pay any VAT to the government when you bought your child’s school sportswear at the school, you have paid it indirectly, because before the shirts and shorts got to your children’s school, VAT had been collected at every stage of the production. The difference that yesterday’s meeting of President Buhari and his ministers make in your life now is that currently, you paid N1850 plus N250 VAT, now you will also pay an additional N110 VAT at the three levels (N22 + N33 + N55). It means for your two kids you will now be paying N4,440 instead of N4,200. Not so much for your children sport wears, it is only when you face the fact that you will be paying that difference for everything you purchase as from now on.

This tax increase will come into effect only if the federal lawmakers accept it. And it could start anytime soon, say January 2020. What the President has decided to do simply means you will either be getting less value for the same amount of money you spend as from now on or you will pay more for the same amount of goods and services. Anyhow you turn, you lose and government gains. The lawmakers will soon come together to discuss whether this decision that you should lose more money so that government will have more money to spend on the many things they usually spend the money for is very good for you.

That VAT daily contribution you made knowingly and unknowingly to the federal government last year 2018, even if it is not election day, all the two hundred million Nigerians will receive over N5,500, no matter what party they belong to. Even thieves, kidnappers, the sick people walking on the street, elderly people, adults, school children, and even a day old baby everywhere in the country will receive it. All the terrorists in Sambisa forest will even have their own N5,500 each. That is if senior green snakes do not swallow their share of the VAT before it reaches them.

.webp)

Now, if you lose your hard-earned money so that the government will gain, will it not result in a greater gain for you when the government spends the money for all? Government has said VAT is a tax that affects the rich alone, so its increase will not affect those who are still trying to make ends meet. Is it the rich only that use airtime on their phones every day? Is it the rich alone that wear clothes every day? Is it the rich alone that pay electricity bills? If the additional VAT you are paying everywhere every day finally gets into the hands of the President, your governor and local government chairman, will your money be used for what they promised you? These important questions are those that each Nigerian that is aged 18+ must answer.

.webp)