CBN loses control of Inflation: What else works?

Moreover, the Nigerian government, in recent years, has been suffering from revenue issues which have resulted in budget deficit and ultimately increasing borrowing.

Category

Moreover, the Nigerian government, in recent years, has been suffering from revenue issues which have resulted in budget deficit and ultimately increasing borrowing.

To promote stability and transparency in foreign exchange operations, the exchange rates have been harmonised.

N1.97 trillion was held as money market securities, N1.04 trillion as ordinary shares, N930.74 as corporate debt securities, and N178.81 as state government securities.

There have been several arguments as to whether ways and means should be described as loan or something else. Many have contended that it should not be considered as part of Nigeria’s loan profile.

“We have so far frozen 50 accounts. We have taken over 12 applications off the Google Play Store and we are in discussions with more than 10 companies right now. The rate of defamatory messages has dropped by at least 60 per cent,” he said in an interview with The Punch.

According to the report, the region’s micro businesses lose N4.618 trillion ($10.495 billion) annually to the sit-at-home exercise.

Zenith Bank, in the 2022 financial year, lent a total gross loans of N4.12 trillion. The loan composition shows that corporates got 62.3 percent of the total loans disbursed for the 2022 financial year.

Agriculture has been a shining light in the Nigerian economy, contributing 25.58 percent to the gross domestic product in 2022, according to the National Bureau of Statistics (NBS). The sector contributed 26.46 percent to overall GDP in real terms in the fourth quarter of 2022,

Its naira redesign policy has led to frustrations as businesses and households struggle to access their cash at banks to make daily transactions.

The cash withdrawal policy of the Central Bank of Nigeria is threatening to defeat the rationale behind point-of-sale (POS) services, Dataphyte analysis shows.

AMID Nigeria’s economic slump, the president and the vice president will be spending a total of N3.85 billion on feeding and travels in 2023.

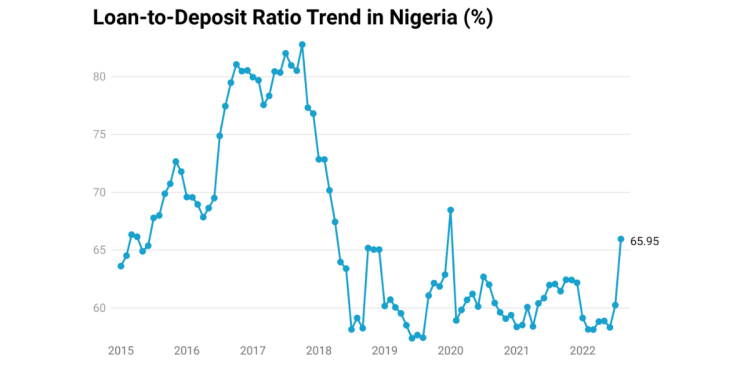

The loan-to-deposit ratio (LDR) of Nigeria’s commercial banks averaged 63.51 per cent between January to August 2022. Simply put, deposit banks in Africa’s biggest economy gave out 63.51 per cent in loans of all the deposits they received this year.

.webp)

The financial and insurance activities and mining and quarrying sectors followed with 12.2% and 11.66% contribution. Altogether, the four sectors accounted for 59.2% of the N209.13 billion generated from the sectoral collections.

Nigerians continue to seek ways of preserving their wealth as they invest in other economically stable economies. The country ranked 7th, with a 15% growth rate in Nigerians investing abroad in 2021.

The government has not kept up with efficient and timely publishing of financial statements to show how monies are spent in the country.