2019 Audit Report: Where are the Recovered Monies? CBN Records Nil Recoveries in 3 years.

The 2019 audit report has revealed that the Central Bank of Nigeria recorded zero naira (nil) as recovered funds between 2016 and 2019.

Category

The 2019 audit report has revealed that the Central Bank of Nigeria recorded zero naira (nil) as recovered funds between 2016 and 2019.

Jola Adekola Initiative for Retired, Ageing, and Aged (JAIRAA) in partnership with Dataphyte is set to host a Roundtable themed “Access and Inclusion for the Elderly” today 25th November 2021.

Value Added Tax (VAT) is a consumption tax levied on a product at every point of sale when value is being added. It is collected by the Federal Inland Revenue Service. At every stage of production up to the ultimate level of the final buyer, value added tax is paid.

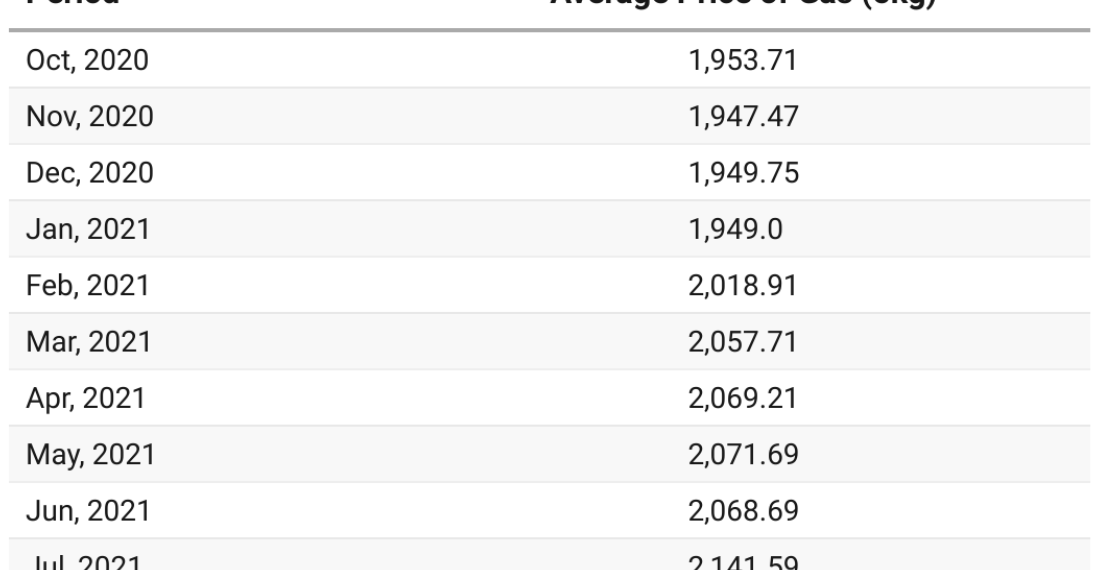

The National Bureau of Statistics (NBS) report on the Liquefied Petroleum Gas Price Watch for October 2021 reveals that there was a 34.61% month-on-month change in the price of cooking gas and a 34.51% year-on-year price change.

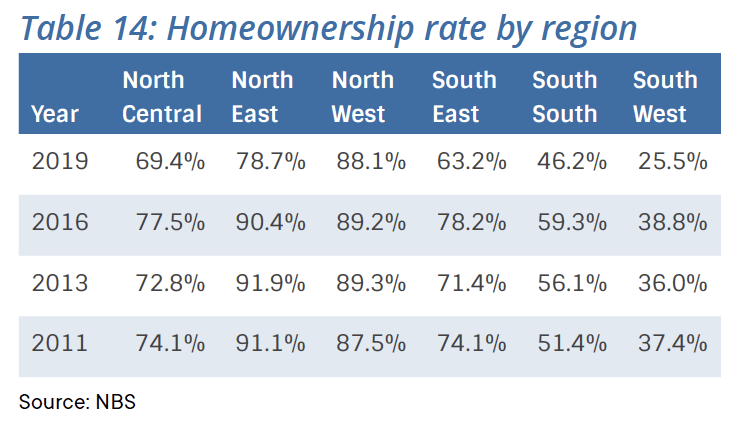

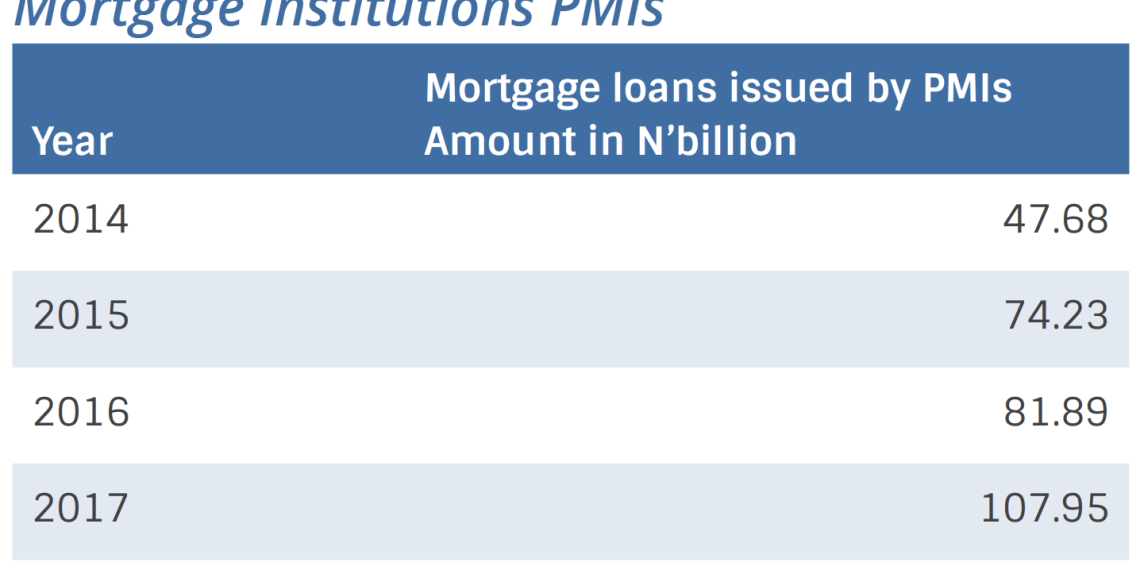

Dataphyte’s Advisory Note ‘Nigerian Post-oil Economy: Going the Housing Consumer Credit Path’, sheds much-needed light on Nigeria’s housing deficit and the potentials it holds. It has been revealed in the report that about 26 million households in Nigeria do not own their homes.

Seven Area Commands of the Nigerian Customs Services reported zero revenue despite being mandated to collect Common External Tariff (CET) levies and fees.

Dataphyte, leading media research and data analytics organisation has revealed in its maiden Advisory Note that Nigerians typically rely on personal savings to pay for their homes.

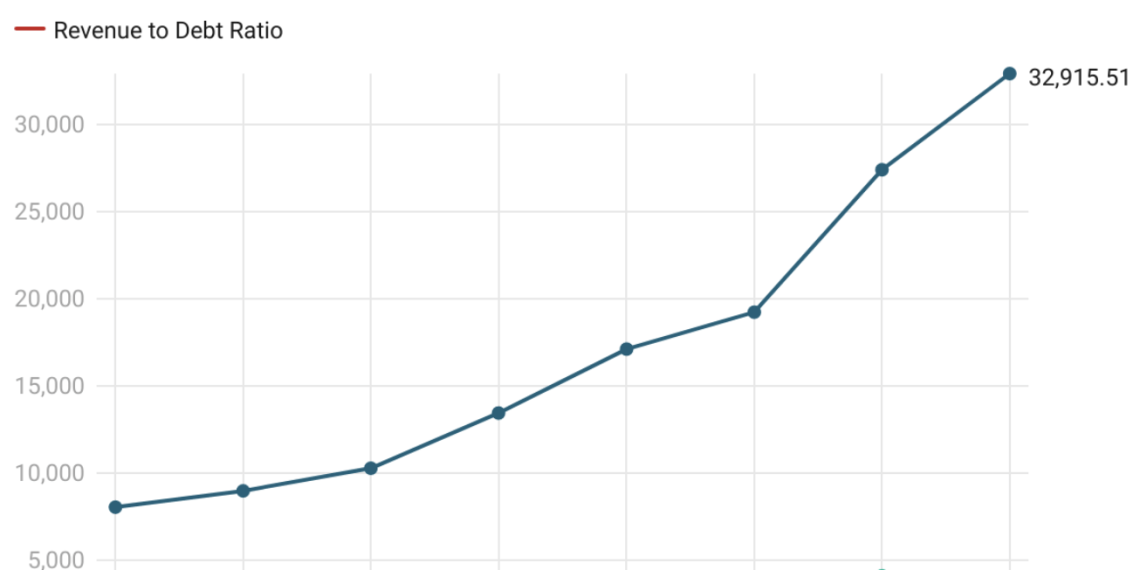

Nigeria’s revenue to debt ratio appears to be one of the worst in the world according to Debt Management Office (DMO) data.

Adenike Aloba, a renowned communications and media development professional has joined The Interactive as Programme Director. She doubles as the Managing Editor of Dataphyte, the Media and Research program of the organisation to provide leadership for the day to day operations of the organisation.

.webp)

The Federal Inland Revenue Service (FIRS) approved a Capital Allowance of N5.61 billion for 13 companies and also failed to collect the statutory 30% Company Income Tax (CIT) of the total capital allowance given to these companies. The revenue lost by this failure is N1.68 billion.

Dataphyte Nigeria has released its maiden Dataphyte Advisory Note, the first in a series of sectoral reports that provide expert appraisal of critical issues within each target sector and proffer feasible private sector responses and public policy solutions.

The National Environmental Standards, Regulation and Enforcement Agency (NESREA) is saddled with the responsibility of protection and development of the environment, biodiversity conservation and sustainable development of Nigeria’s natural resources.

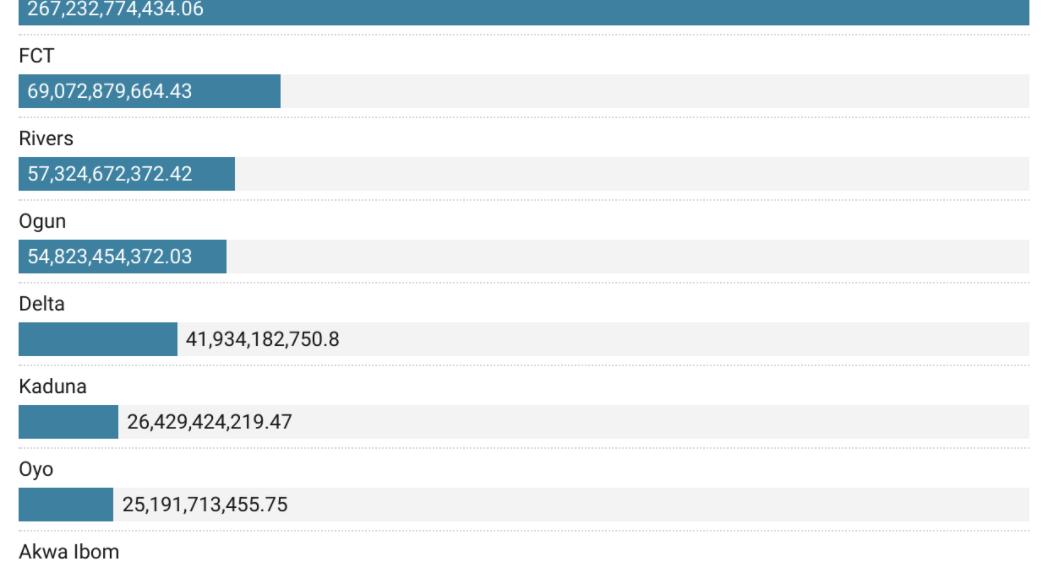

According to the 2021 half-year report by the National Bureau of Statistics (NBS), these states have the highest IGR in H1. Internally Generated Revenue (IGR) for each state is made up of road taxes, pay as you earn, direct assessment, revenue from ministries, departments and agencies, and other taxes which are made of land-related fees.

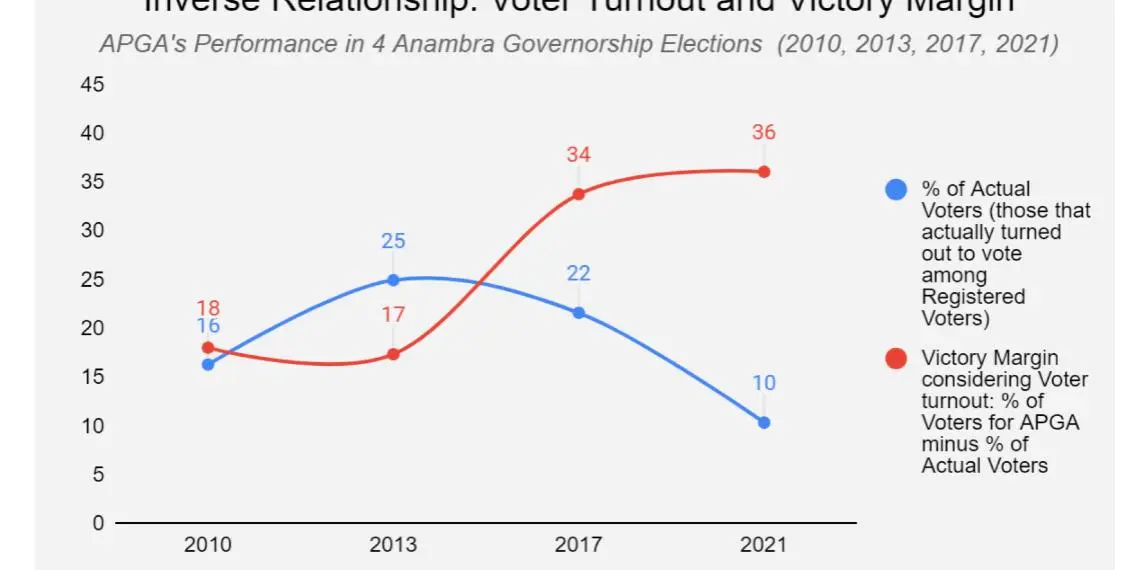

Anambra’s Antumbra and the Soludo Effect

While Reynolds Construction Company (RCC) boasts of adequate measures to prevent accidents, pollution and other adverse effects of its rock blasting activities, Dataphyte’s investigation exposes how unhealthy practices by the company and government’s sheer regulatory failure endanger the lives in Ogunmakin, a border community in Ogun State, Southwest Nigeria.