Due to rising public debt, a large chunk of Nigeria’s revenue is used to service debt.

The Debt Management Office, in a press statement, noted that Nigeria’s debt profile could reach N77 trillion by May 2023. The agency pointed out that this is due to the addition of Ways and Means (loans sourced from the Central Bank of Nigeria) totaling N22.72 trillion.

This report examines how sustainable Nigeria’s debt servicing is.

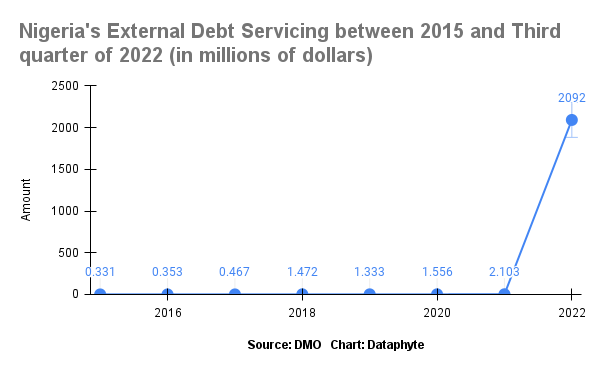

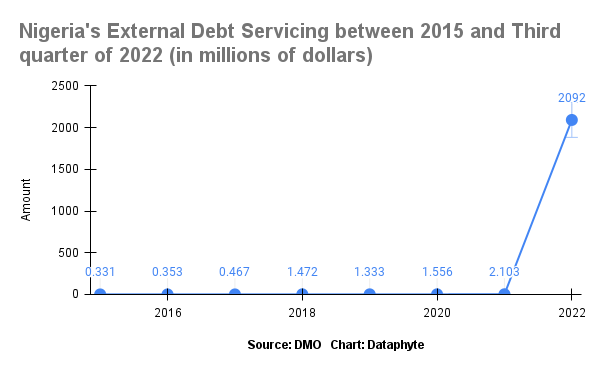

The amount Nigeria spent the highest amount on external debt servicing in 2022 alone, is the highest it has ever spent in over three decades, a review of data published by the Debt Management Office has shown.

In three quarters of 2022 alone (January to September), Nigeria spent $2.092 billion on external debt servicing, the highest it spent on external debt servicing in over three decades.

Between 2015 and the third quarter of 2022, Nigeria’s external debt servicing grew by 631,924%.

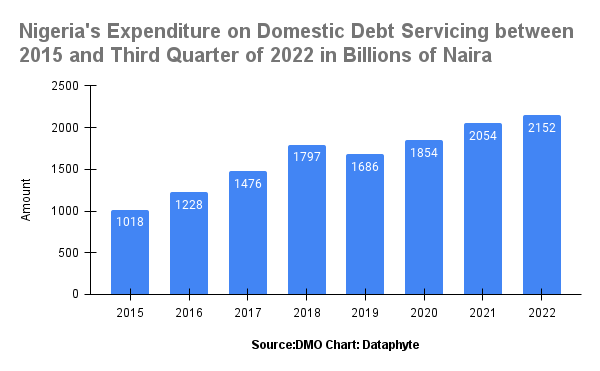

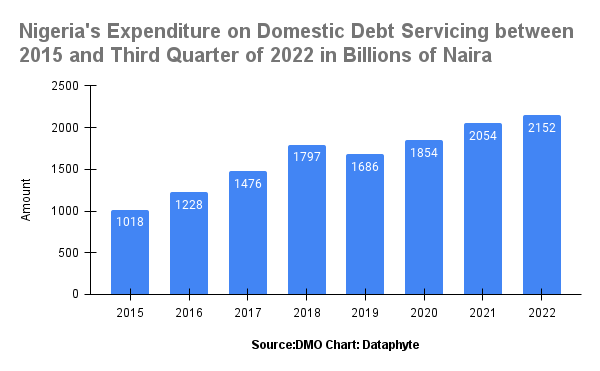

The country has also spent at least N1.018 trillion on domestic debt servicing between 2015 and 2022, with the highest amount spent in three quarters of 2022 when N2.152 trillion was spent as domestic debt servicing between January and September, 2022.

Between 2015 and the third quarter of 2022, Nigeria’s domestic debt servicing increased by 111%, growing from N1.018 trillion in 2015 to N2.152 trillion between January and September 2022.

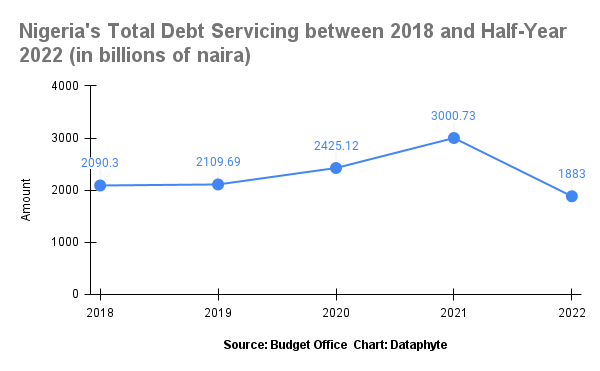

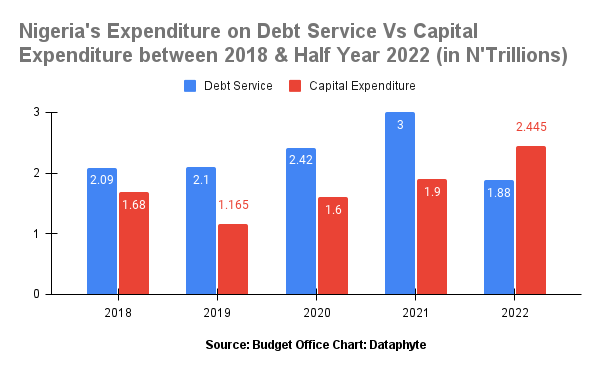

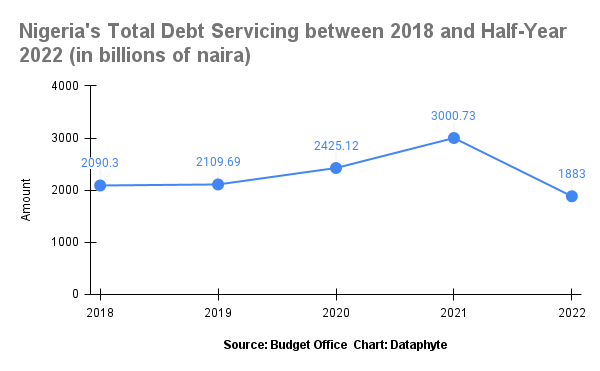

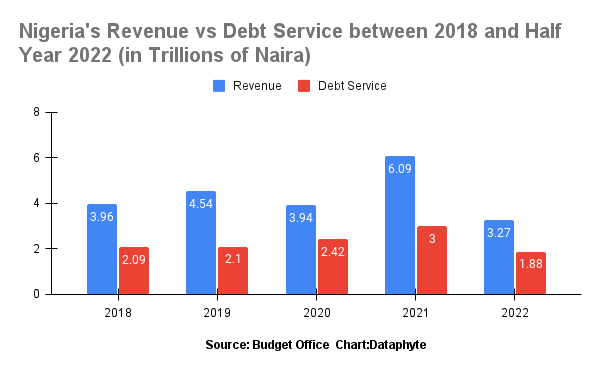

Data sourced from the budget performance reports published by the Federal Ministry of Budget and National Planning shows that between 2018 and half-year 2022 the country spent N11.508 trillion on debt servicing (Domestic and External debt service).

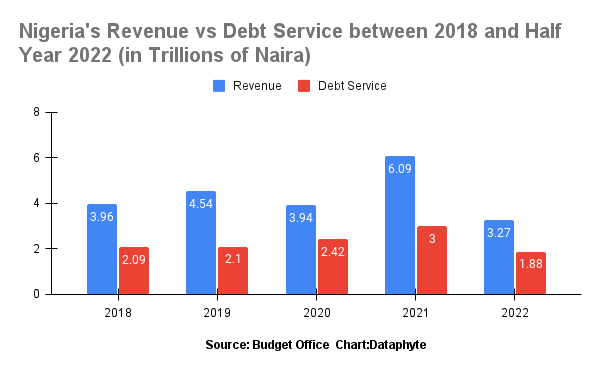

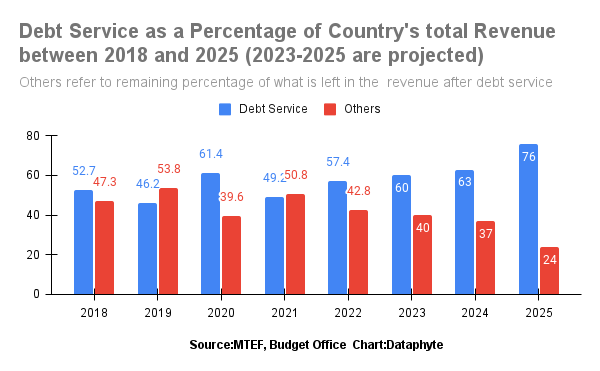

Nigeria’s heavy debt servicing obligations means that resources that should have been channelled towards developmental purposes are diverted for that purpose. A review of the debt servicing data published by the Debt Management Office (DMO) shows that Nigeria spent 52.77% of its revenue between 2018 and half year 2022 on debt servicing.

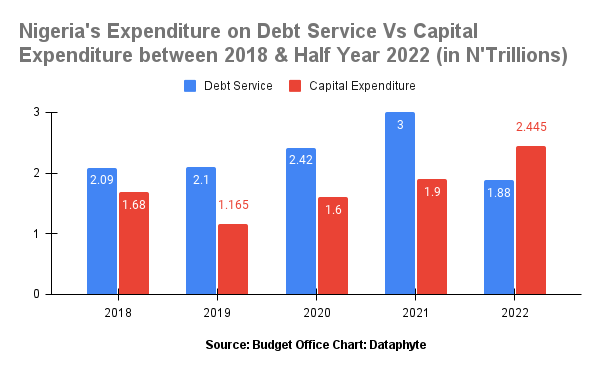

Nigeria has also spent more on debt servicing than it spent on capital expenditure that aids its development.

Between 2018 and half year 2022, the country spent N8.796 trillion on capital expenditure; this is N2.712 trillion lesser than what was spent on debt servicing in the same period under review.

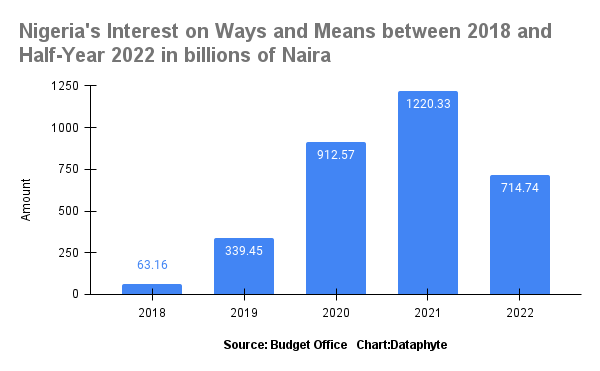

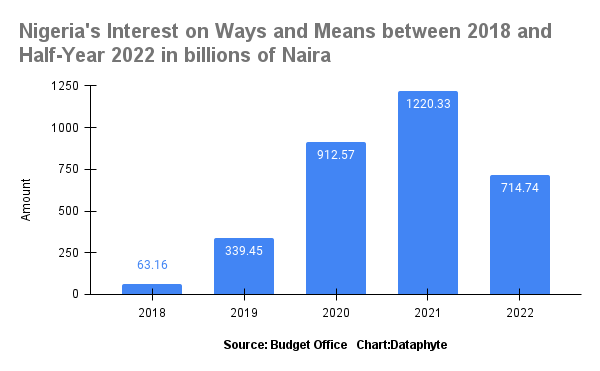

Nigeria’s expenditure on debt servicing does not include the interest it pays on Ways and Means (that is, loan sourced from the Central Bank of Nigeria). Between 2018 and the first six months of 2022, Nigeria spent N3.249 trillion on interest payments on Ways and Means loans.

In reality, if interest paid on Ways and Means are added, the country spent N14.757 trillion on servicing its debt portfolios between 2018 to the half year 2022, representing 67.9% of its revenue in the period.

This also means the country spent N5.961 trillion representing 40.39% more on debt servicing/Interest than it paid on its developmental projects.

The prioritisation of debt servicing over capital expenditure is even as the country has developmental challenges across sectors such as education, health, and other critical industries.

The 2022 multidimensional poverty index shows that 16.60 million children aged between six to fifteen, are out of school. The number of out-of-school children may point out that there would be a need for school infrastructure to enroll more persons in schools, a need that may be defeated due to the government’s resources dwindling by debt servicing.

Nigeria has deficiencies in the healthcare sector; for instance, an earlier report noted that Nigeria has 17 health facilities for 100,000 persons.

Is there any hope of better Debt Servicing to Revenue between 2023 and 2025?

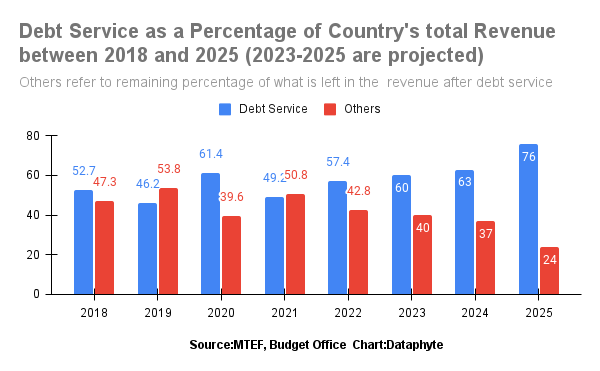

Nigeria’s projection for between 2023 and 2025, according to its medium-term expenditure framework, also creates a picture of what debt servicing to available revenue may look like for the country.

The debt service to revenue ratio is expected to hit 76% by 2025, based on the MTEF projections.

Given the projections, Nigeria plans to use more money to service debts in the coming years.

By 2025, for every N10 made by Nigeria, N7.6 will go to loan servicing. The remaining N2.4 will be what is left for capital and recurrent expenditure.

A policy analyst, Samuel Atiku, told Dataphyte that there is a need for questioning on how the monies borrowed by the country is spent.

“In other countries’ when loans are borrowed, they are used for infrastructural development but in Nigeria, the cases are different; these loans are spent on frivolous items, if Nigeria really did spend its loan portfolio well, then we should have more development than we currently have. It is however worrisome when loans are spent on salary payment, travel expenses instead of capital needs, “ he said.

Atiku opined that Nigeria needs to reprioritise loan expenditure and also find a way to cut down the cost of governance.

“There is a need to cut down the cost of governance in the country and also restructure loans, maybe we can then pay lesser interests on these monies”.

Atiku stated that Nigeria must find a way to cut down its public debt as it is becoming a worrisome development.