CBN’s swap policy shows cash is king in Nigeria

Nigeria is moving toward a full-fledged cashless society with the Central Bank of Nigeria’s introduction of the cash swap policy.

Tag

Nigeria is moving toward a full-fledged cashless society with the Central Bank of Nigeria’s introduction of the cash swap policy.

In 2022, Nigeria’s apex bank, the Central Bank of Nigeria, announced its plans to redesign the currency.

The current cash shortage will likely lead to a drop in Nigeria’s gross domestic product (GDP) growth in the first quarter of 2023, according to analysts.

The Central Bank of Nigeria (CBN) says that one of the many reasons for naira redesign is to mop up excess liquidity in the Nigerian economy.

The cash withdrawal policy of the Central Bank of Nigeria is threatening to defeat the rationale behind point-of-sale (POS) services, Dataphyte analysis shows.

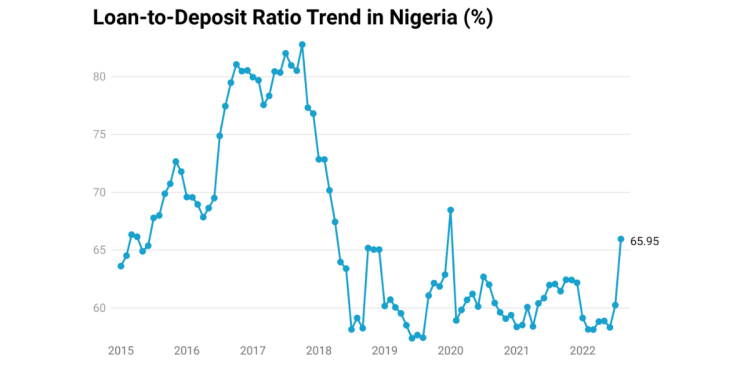

The loan-to-deposit ratio (LDR) of Nigeria’s commercial banks averaged 63.51 per cent between January to August 2022. Simply put, deposit banks in Africa’s biggest economy gave out 63.51 per cent in loans of all the deposits they received this year.

.webp)

Credit is essential for economic development. Bank credits in Nigeria are loans granted by financial institutions solely to the private sector such as businesses and households by providing capital for new investments and enabling people to buy commodities.

At the launch of the rice pyramid yesterday, at Abuja, the Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele disclosed that 2,160 metric tonnes of rice was imported into the country in 2021.

The 2019 audit report has revealed that the Central Bank of Nigeria recorded zero naira (nil) as recovered funds between 2016 and 2019.

The Central Bank of Nigeria (CBN) says it has released ₦20.18 billion to NIRSAL Microfinance as credit facilities to small businesses to cushion the effect of COVID-19.

CBN printed ₦2.86 trillion in 2020 without proprietary economic activities to match;

The Central Bank of Nigerian (CBN) has waived the guarantor requirement for the ₦50 billion COVID-19 loan applications. This was revealed in a press statement that was posted on Twitter recently. From the statement, households and SMEs applying for the ₦50 billion COVID-19 targeted credit facility would not be required to provide guarantors before they can access the credit.

The Central Bank of Nigeria (CBN) recently announced the review of its Monetary Policy Rate (MPR) from 13.5 percent to 12.5 percent. The CBN Governor disclosed this at the end of the Monetary Policy Committee (MPC) meeting in Abuja. The review was orchestrated by the impact of the COVID-19 pandemic on the economy, the increased inflationary pressure, and the restrictions in international trade.